If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. Speaking of which, we noticed some great changes in cBrain's (CPH:CBRAIN) returns on capital, so let's have a look.

Return On Capital Employed (ROCE): What Is It?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for cBrain:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.23 = kr.46m ÷ (kr.251m - kr.53m) (Based on the trailing twelve months to June 2022).

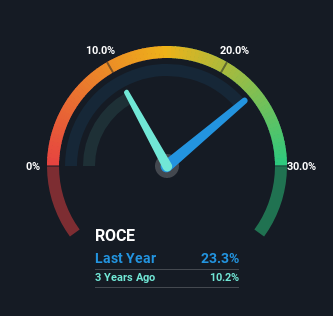

Thus, cBrain has an ROCE of 23%. That's a fantastic return and not only that, it outpaces the average of 12% earned by companies in a similar industry.

Check out our latest analysis for cBrain

In the above chart we have measured cBrain's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

What Does the ROCE Trend For cBrain Tell Us?

cBrain is displaying some positive trends. The data shows that returns on capital have increased substantially over the last five years to 23%. The amount of capital employed has increased too, by 121%. So we're very much inspired by what we're seeing at cBrain thanks to its ability to profitably reinvest capital.

For the record though, there was a noticeable increase in the company's current liabilities over the period, so we would attribute some of the ROCE growth to that. Essentially the business now has suppliers or short-term creditors funding about 21% of its operations, which isn't ideal. Keep an eye out for future increases because when the ratio of current liabilities to total assets gets particularly high, this can introduce some new risks for the business.

The Bottom Line

A company that is growing its returns on capital and can consistently reinvest in itself is a highly sought after trait, and that's what cBrain has. Since the stock has returned a staggering 314% to shareholders over the last five years, it looks like investors are recognizing these changes. In light of that, we think it's worth looking further into this stock because if cBrain can keep these trends up, it could have a bright future ahead.

Like most companies, cBrain does come with some risks, and we've found 1 warning sign that you should be aware of.

High returns are a key ingredient to strong performance, so check out our free list ofstocks earning high returns on equity with solid balance sheets.

Valuation is complex, but we're here to simplify it.

Discover if cBrain might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:CBRAIN

cBrain

A software company, provides software solutions for government, private, education, and non-profit sectors in Denmark, rest of the European Union, and internationally.

Undervalued with high growth potential and pays a dividend.

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Quanta Services (PWR): Strengthening the Backbone of the AI Power Grid.

KLA Corporation (KLAC): Engineering Yield in the Age of Chiplets and Sub-2nm Nodes.

Monolithic Power Systems (MPWR): The AI "Power Play" Facing a Transition from Scarcity to Scale.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks