- Denmark

- /

- Real Estate

- /

- CPSE:GERHSP

German High Street Properties (CPH:GERHSP) Shareholders Have Enjoyed A 60% Share Price Gain

The main point of investing for the long term is to make money. Furthermore, you'd generally like to see the share price rise faster than the market But German High Street Properties A/S (CPH:GERHSP) has fallen short of that second goal, with a share price rise of 60% over five years, which is below the market return. The last year has been disappointing, with the stock price down 6.4% in that time.

View our latest analysis for German High Street Properties

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, German High Street Properties actually saw its EPS drop 46% per year.

This means it's unlikely the market is judging the company based on earnings growth. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

On the other hand, German High Street Properties' revenue is growing nicely, at a compound rate of 3.8% over the last five years. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

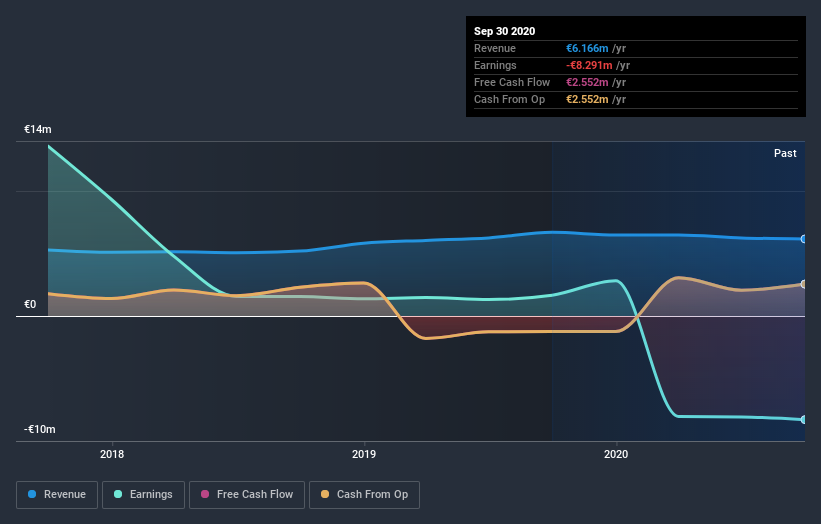

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling German High Street Properties stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

German High Street Properties shareholders are down 6.4% for the year, but the market itself is up 22%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 10%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand German High Street Properties better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with German High Street Properties (including 2 which are potentially serious) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DK exchanges.

If you decide to trade German High Street Properties, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CPSE:GERHSP

German High Street Properties

Invests in and rents retail properties in Scandinavia, Germany, Switzerland, and England.

Slight risk with imperfect balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026