Is Novo Nordisk Attractively Priced After Recent 6.6% Weekly Rally?

Reviewed by Bailey Pemberton

- Wondering if Novo Nordisk stock is trading at a bargain or set for a pullback? You are not alone. Valuation is a top focus for investors trying to spot the next opportunity.

- The share price has shown real movement recently, climbing 6.6% this past week. However, it is still down 14.1% in the last month and down a hefty 56.3% over the past year.

- Investors are weighing fresh headlines, with increased scrutiny on the competitive landscape for GLP-1 drugs and new partnerships aimed at strengthening Novo Nordisk’s pipeline. These updates impact market sentiment and partially explain why the stock’s path has been so volatile lately.

- Novo Nordisk scores a strong 5 out of 6 on key valuation checks, suggesting it passes most of the critical value tests. Before you decide if the stock is under- or overvalued, it is helpful to see how different valuation methods compare and, even better, discover a smarter way to interpret these numbers by the end of this article.

Find out why Novo Nordisk's -56.3% return over the last year is lagging behind its peers.

Approach 1: Novo Nordisk Discounted Cash Flow (DCF) Analysis

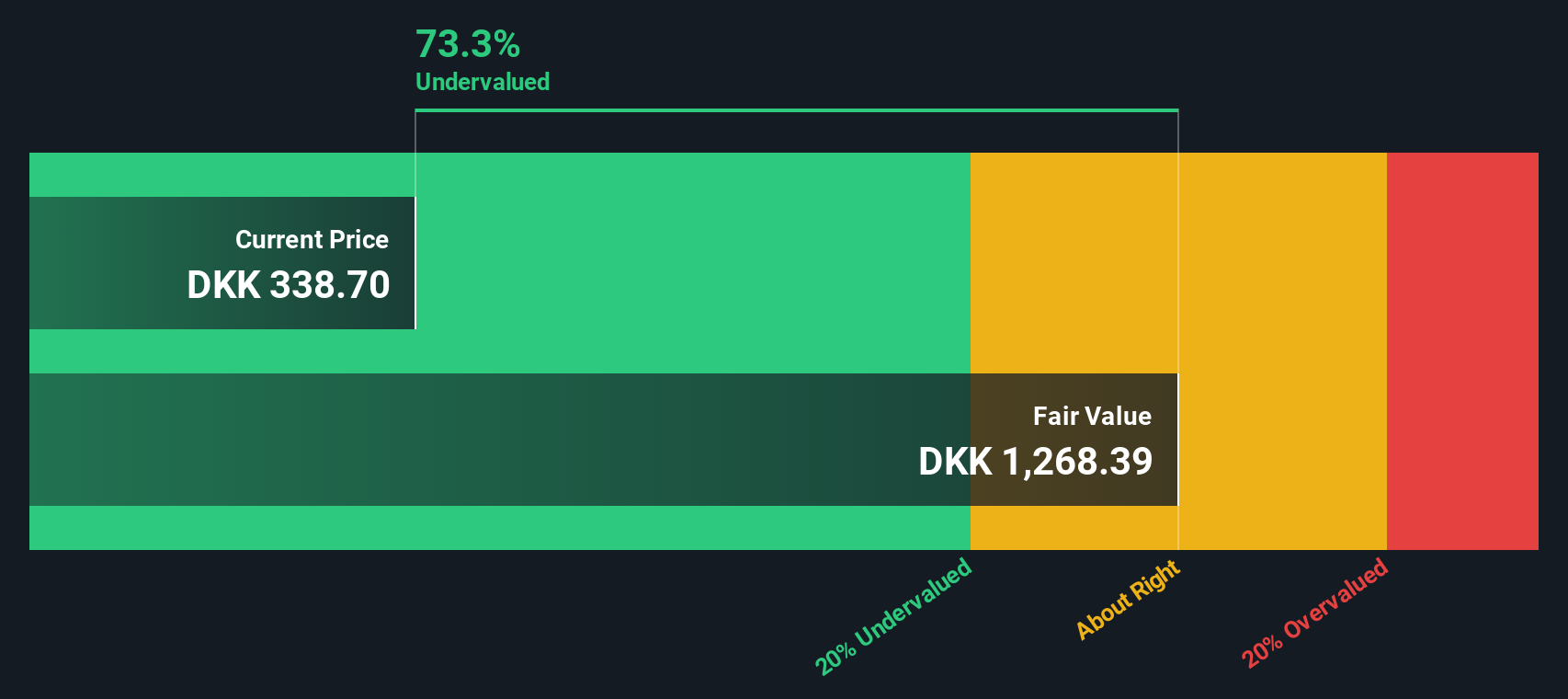

A Discounted Cash Flow (DCF) model estimates the true value of a company by projecting its future cash flows and discounting them back to present value. For Novo Nordisk, this approach uses the 2 Stage Free Cash Flow to Equity model, analyzing expected cash generation over time in Danish Krone (DKK).

Currently, Novo Nordisk’s last twelve months free cash flow is DKK 67.6 billion. Analysts forecast free cash flow growth over the next five years, with projections reaching DKK 129.5 billion by 2029. Beyond analyst coverage, Simply Wall St extrapolates further, with estimates rising to DKK 207.4 billion in 2035. These figures highlight robust cash generation and support a valuation grounded in both current performance and long-term potential.

Based on this DCF analysis, Novo Nordisk’s estimated intrinsic value is DKK 1,103.04 per share. With the DCF model suggesting the stock is trading at a 70.9% discount to its intrinsic value, the shares appear significantly undervalued at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Novo Nordisk is undervalued by 70.9%. Track this in your watchlist or portfolio, or discover 865 more undervalued stocks based on cash flows.

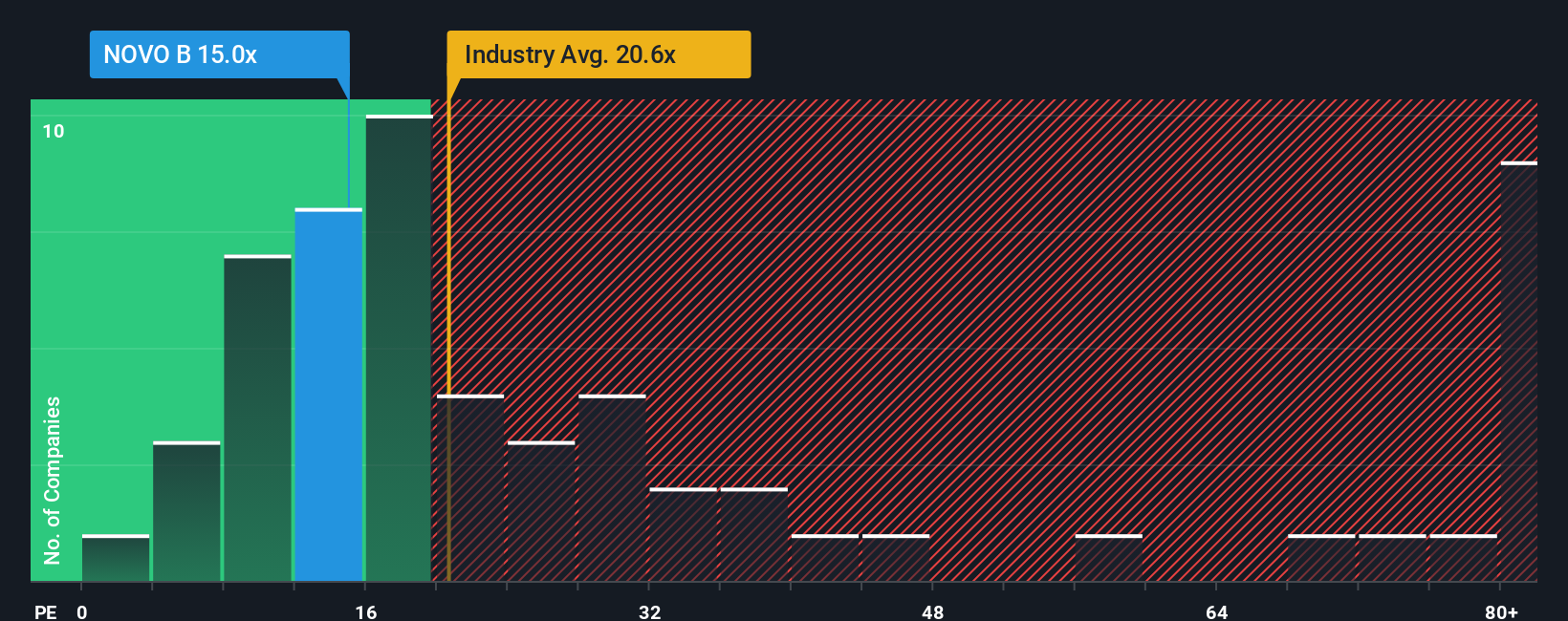

Approach 2: Novo Nordisk Price vs Earnings

The Price-to-Earnings (PE) ratio is widely used to value profitable companies like Novo Nordisk because it directly links the market price of the stock to its current earnings power. For companies that consistently generate strong profits, the PE ratio provides a quick snapshot of how much investors are willing to pay for each Danish Krone of earnings.

It is important to remember that companies with higher growth prospects or lower perceived risks typically command higher PE ratios. Those with slower growth or more uncertainty tend to trade at lower multiples. As a result, determining what counts as a “normal” or “fair” PE is not only about the company’s earnings, but also about its growth outlook, profitability, and risk profile compared to other firms in its sector.

Novo Nordisk currently trades at a PE ratio of 13.7x. This is well below both the Pharmaceuticals industry average of 24.1x and the average among comparable peers, which sits at 21.6x. However, Simply Wall St’s proprietary “Fair Ratio” metric, which adjusts for factors like Novo Nordisk’s expected earnings growth, market capitalization, risk profile, and profit margins, suggests a fair PE of 29.3x for the business.

Unlike simple comparisons with industry or peers, the Fair Ratio provides a more tailored and accurate benchmark by taking into account Novo Nordisk’s specific strengths and risks. This approach helps investors avoid misleading like-for-like comparisons and offers a more realistic assessment of value.

With Novo Nordisk’s actual PE far below its Fair Ratio, the stock appears fundamentally undervalued by this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1370 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Novo Nordisk Narrative

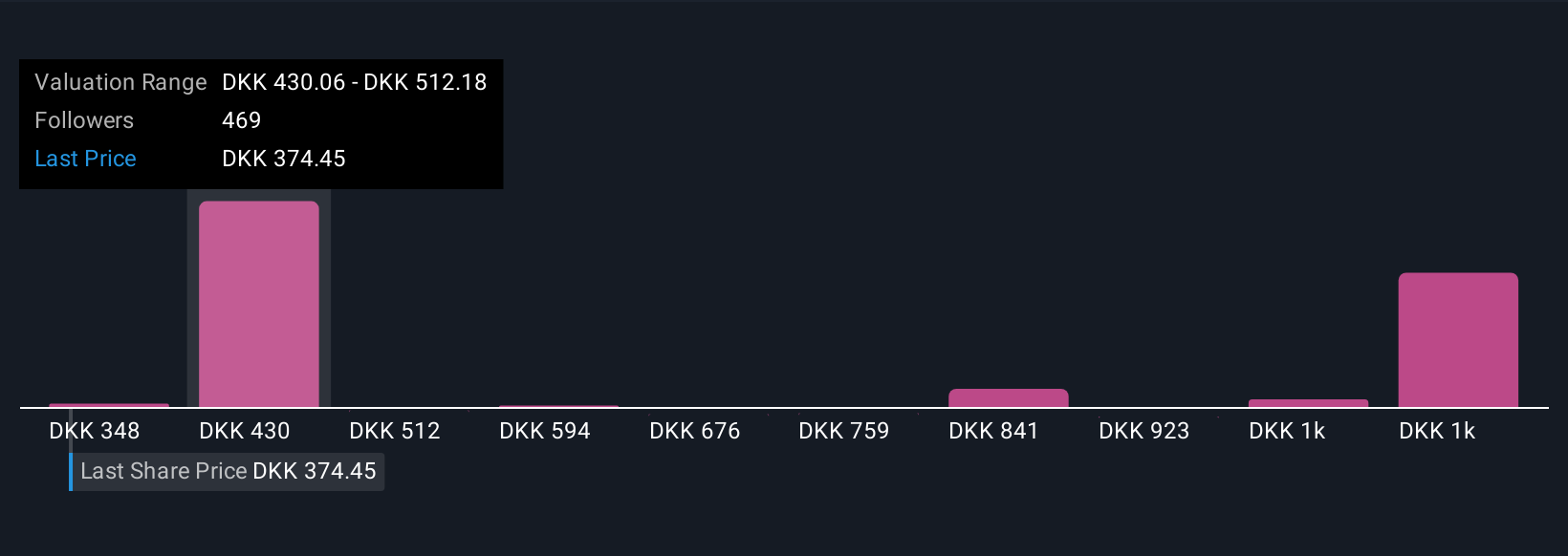

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is simply your story or perspective about a company’s future. It connects your assumptions about its growth, earnings, and margins to a forecast and fair value, bringing the numbers to life. Instead of just relying on broad industry multiples or static valuation models, Narratives let you link the company’s actual story, key events, and your personal outlook directly to the numbers that underpin your investment decision.

On Simply Wall St’s Community page, millions of investors create and update Narratives. It is an easy, accessible tool designed for every experience level. Narratives help guide buy and sell decisions by letting you compare your calculated fair value to the current share price. Because they dynamically update with new information such as earnings releases or news, your analysis always stays relevant.

For Novo Nordisk, one investor might be bullish, forecasting rapid expansion in obesity treatments and setting a fair value above DKK 1,000 per share. Another could focus on competition risks and patent expiries, concluding fair value is closer to DKK 340. Narratives make it effortless to visualize and act on these different viewpoints, empowering you to invest with conviction.

Do you think there's more to the story for Novo Nordisk? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novo Nordisk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:NOVO B

Novo Nordisk

Engages in the research and development, manufacture, and distribution of pharmaceutical products in Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, North America, and internationally.

Undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives