Assessing Lundbeck (CPSE:HLUN B) Valuation After Subtle Shift in Investor Interest

Reviewed by Simply Wall St

Most Popular Narrative: 14% Undervalued

According to the most widely followed narrative, H. Lundbeck shares appear to be trading below their estimated fair value. This is attributed to a positive outlook based on future growth opportunities and earnings potential.

Expansion of Vyepti into new international markets (with Asia filings in progress, ongoing regulatory discussions in China and Japan, and rapid uptake in Europe), along with robust real-world data support, positions Lundbeck to capture increased demand as global healthcare spending grows. This is expected to boost future revenues and improve its earnings mix.

How might a global push and strategic bets on new treatments translate into a valuation increase for Lundbeck? The foundation of this narrative is built on ambitious financial forecasts, rising profitability, and a reshaped growth profile. Interested in the specific financial projections analysts are considering? Explore further to discover the assumptions and data supporting this outlook.

Result: Fair Value of DKK48.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, the narrative faces real risks, including potential setbacks from regulatory delays or unexpected generic competition that could challenge Lundbeck’s future growth outlook.

Find out about the key risks to this H. Lundbeck narrative.Another View

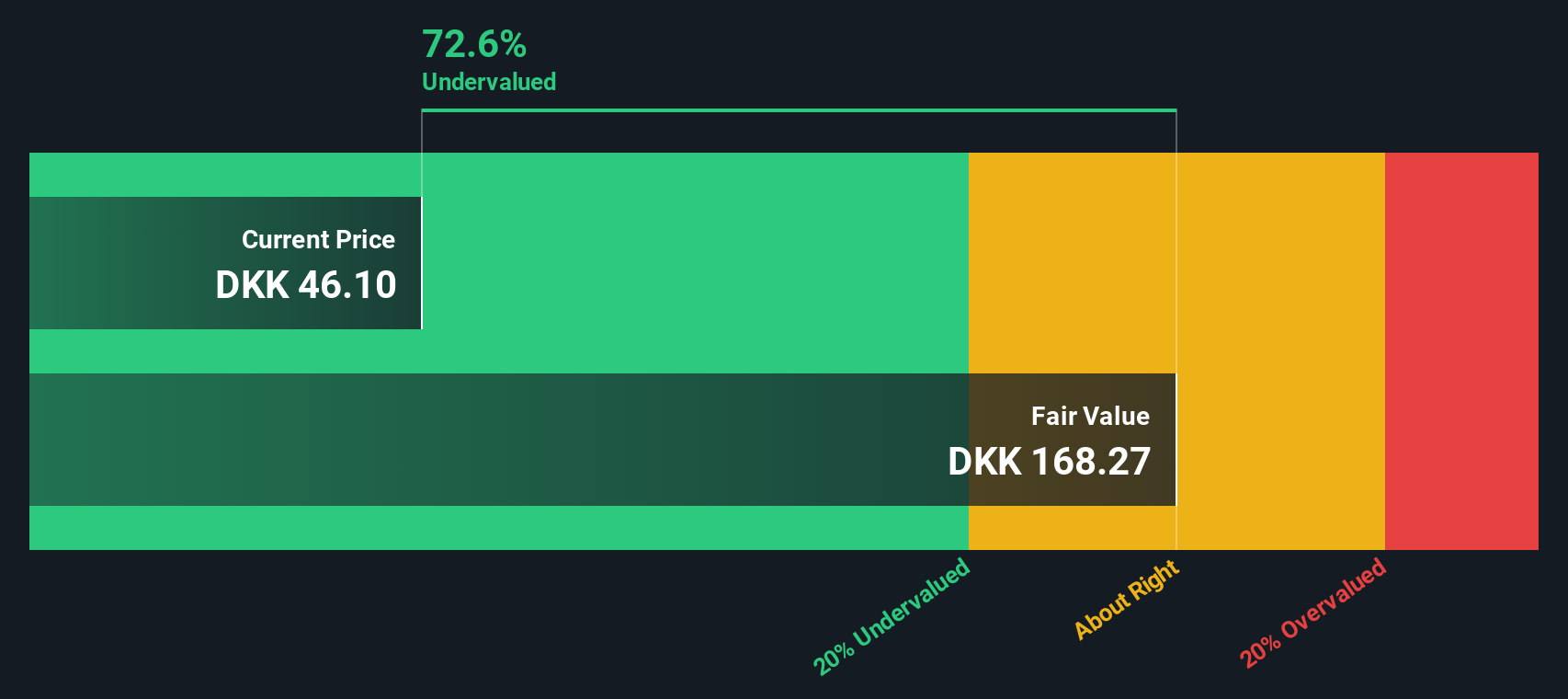

Looking at H. Lundbeck from a discounted cash flow perspective, our DCF model also suggests the stock is attractively valued based on its projected cash flows. However, are these forecasts reliable, or could market expectations shift?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own H. Lundbeck Narrative

If you would rather dig into the numbers for yourself or prefer forming your own perspective, you can craft a fresh narrative in just a few minutes. Do it your way

A great starting point for your H. Lundbeck research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Act now and find inspiration beyond H. Lundbeck. The best opportunities often go unnoticed unless you actively look for them. Be the investor who gets ahead.

- Capture value with stocks trading below their intrinsic worth by using our undervalued stocks based on cash flows, helping you spot potential bargains before the rest of the market.

- Fuel your portfolio’s growth as artificial intelligence transforms industries with access to AI penny stocks, putting tomorrow’s innovators on your radar today.

- Grow your income streams and stability by tapping into dividend stocks with yields > 3%, where you’ll find reliable companies offering strong yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if H. Lundbeck might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About CPSE:HLUN B

H. Lundbeck

Engages in the research, development, manufacturing, and commercializing pharmaceuticals for the treatment of psychiatric and neurological disorders in Europe, United States, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion