Undiscovered European Gems With Strong Fundamentals For September 2025

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index ended the week slightly lower amidst a series of monetary policy decisions, investors are keenly evaluating opportunities within Europe's diverse markets. In this environment, stocks with robust fundamentals can offer resilience and potential growth, making them attractive prospects for those seeking stability amid fluctuating economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sparta | NA | -9.54% | -15.40% | ★★★★★☆ |

| Inmocemento | 28.68% | 3.60% | 33.84% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 394.25% | 3.36% | 6.34% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Philogen (BIT:PHIL)

Simply Wall St Value Rating: ★★★★★★

Overview: Philogen S.p.A. is a biotechnology company that focuses on developing drugs for oncology and chronic inflammatory diseases in Switzerland and the European Union, with a market capitalization of €927.64 million.

Operations: Philogen generates its revenue primarily from its biotechnologies segment, amounting to €77.65 million.

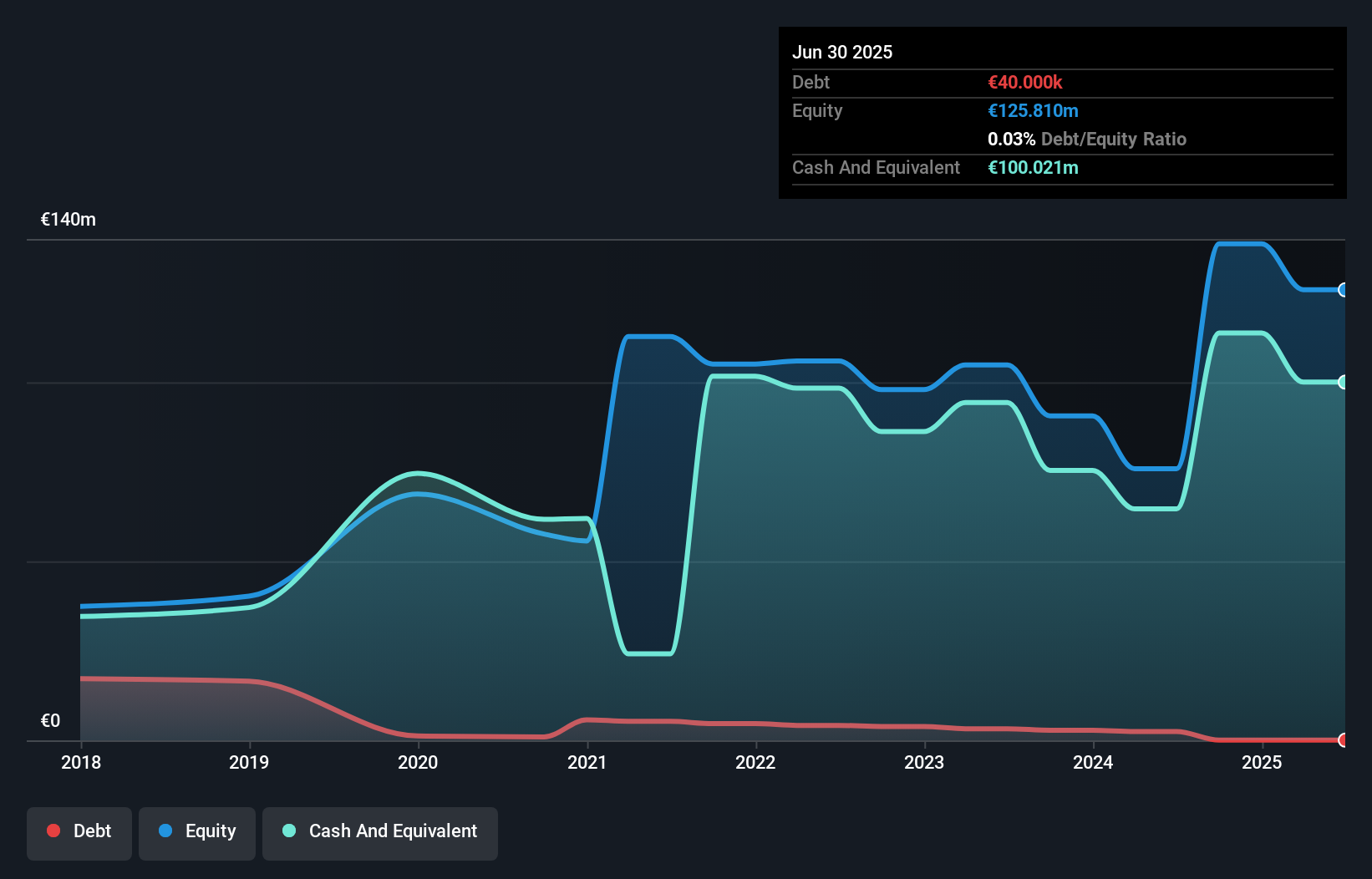

Philogen, a dynamic player in biotechnology, focuses on oncology and chronic inflammatory diseases with promising late-stage assets. The company holds a robust cash position of €110 million, supporting its research endeavors while managing dilution risks. Over the past five years, Philogen's debt to equity ratio impressively decreased from 1.7% to 0.03%, highlighting financial prudence. Despite becoming profitable recently and having high non-cash earnings quality, future earnings could face volatility due to reliance on milestone payments and regulatory challenges. Analysts foresee an annual revenue dip of 8% over three years but maintain optimism with a €28 price target reflecting long-term potential amidst current hurdles.

Gubra (CPSE:GUBRA)

Simply Wall St Value Rating: ★★★★★★

Overview: Gubra A/S is a biotech company specializing in pre-clinical contract research and peptide-based drug discovery for metabolic and fibrotic diseases across Europe, North America, and internationally, with a market cap of DKK6.83 billion.

Operations: Gubra generates revenue primarily from two segments: Contract Research Organization (CRO) services, contributing DKK218.31 million, and Discovery & Partnerships (D&P), which brings in DKK2.42 billion.

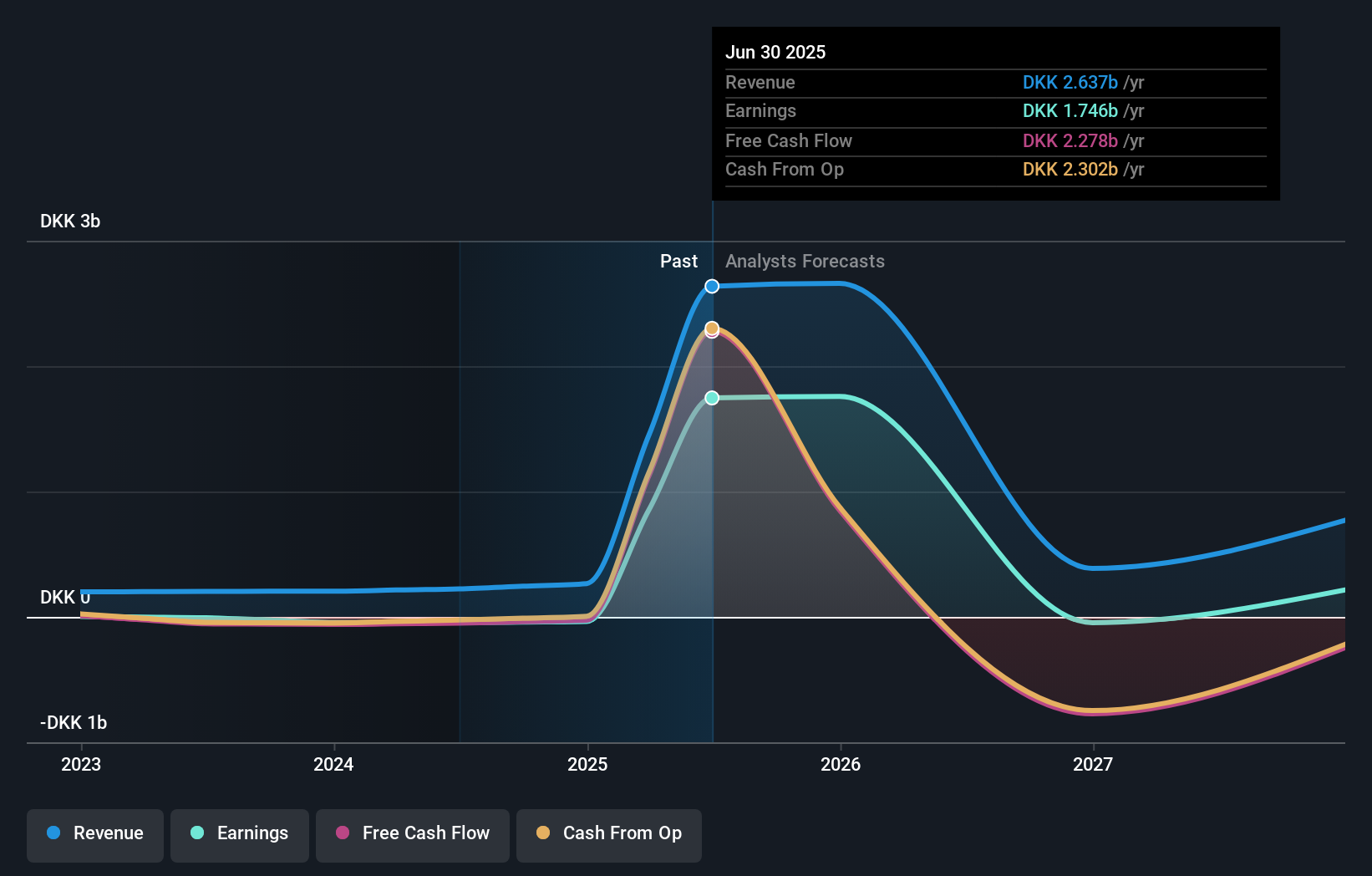

Gubra, a biotech firm focused on peptide-based drug discovery, is navigating a dynamic market landscape. Recently achieving profitability, the company reported impressive half-year sales of DKK 2.49 billion and net income of DKK 1.76 billion, compared to losses last year. Despite these gains, earnings are projected to decline by an average of 52.7% annually over the next three years due to volatile markets and concentrated revenue streams. Gubra's price-to-earnings ratio stands at an attractive 3.9x against Denmark's market average of 15x, yet future valuation challenges loom as industry competition intensifies and funding constraints persist for small biotechs like Gubra.

Newron Pharmaceuticals (SWX:NWRN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Newron Pharmaceuticals S.p.A. is a biopharmaceutical company focused on discovering and developing novel therapies for central and peripheral nervous system diseases in Italy and the United States, with a market cap of CHF207.59 million.

Operations: Newron Pharmaceuticals generates revenue through its biopharmaceutical operations, focusing on therapies for nervous system diseases. The company has a market cap of CHF207.59 million, indicating its valuation in the financial markets.

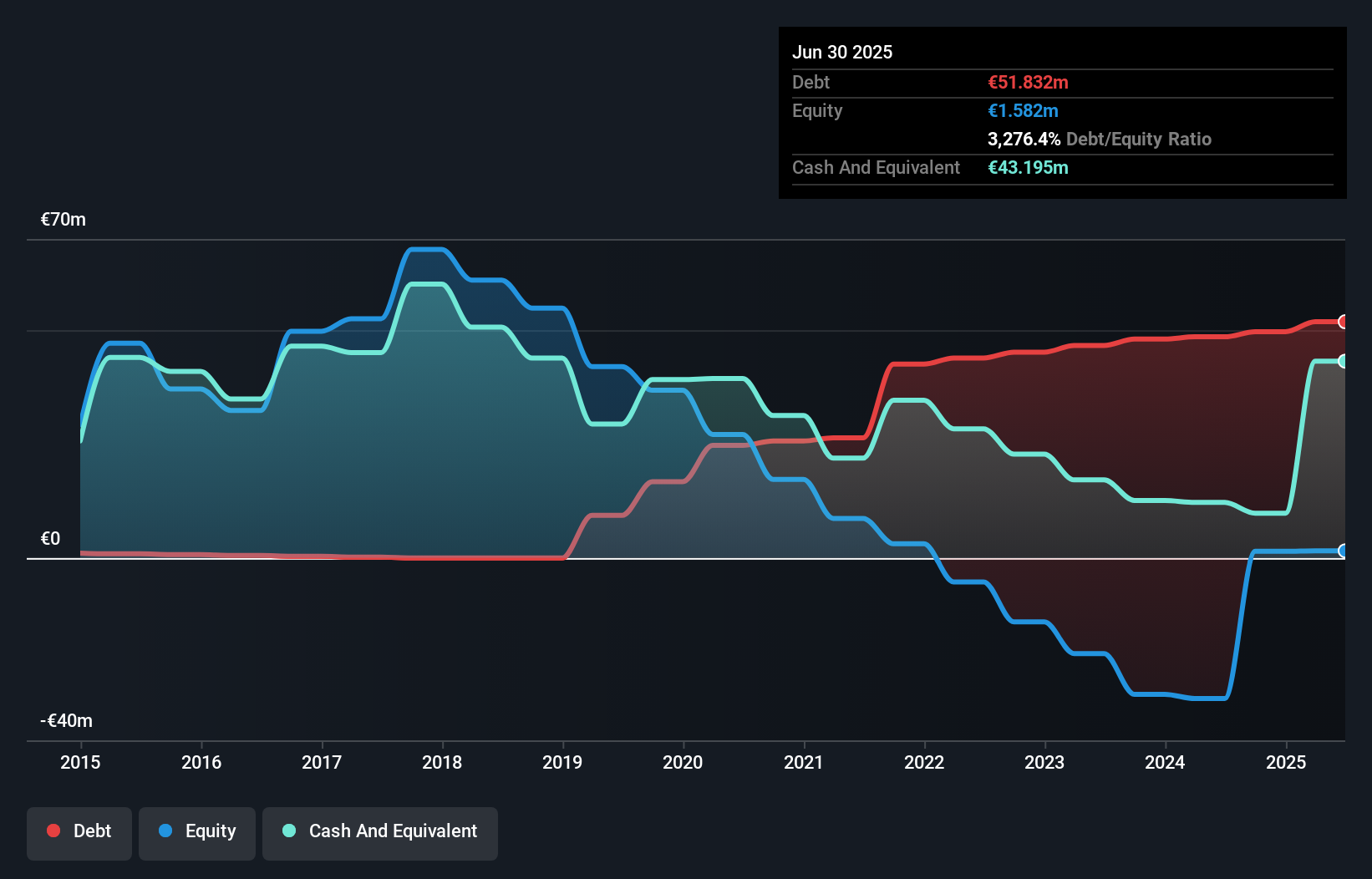

Newron Pharmaceuticals, a promising player in the biotech space, has shown remarkable revenue growth, jumping to €11.9 million from €3.41 million year-on-year. Recently becoming profitable with earnings forecasted to grow at 45% annually, Newron's financial health seems robust despite a high net debt to equity ratio of 1592%. The company’s strategic focus on evenamide as an add-on therapy for treatment-resistant schizophrenia could be transformative. With recent leadership changes and ongoing Phase III trials for evenamide showing positive results, Newron is well-positioned within the industry landscape for future success.

Turning Ideas Into Actions

- Unlock more gems! Our European Undiscovered Gems With Strong Fundamentals screener has unearthed 335 more companies for you to explore.Click here to unveil our expertly curated list of 338 European Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:PHIL

Philogen

A biotechnology company, develops drugs for oncology and chronic inflammatory diseases in Switzerland and the European Union.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives