- China

- /

- General Merchandise and Department Stores

- /

- SHSE:600814

Undiscovered Gems To Explore In February 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and a cooling labor market, small-cap stocks have shown resilience despite broader index declines. With U.S. manufacturing activity expanding for the first time in over two years, investors are increasingly looking towards undiscovered gems that demonstrate strong fundamentals and potential growth amidst these shifting economic landscapes.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Techshine ElectronicsLtd | NA | 15.38% | 17.24% | ★★★★★★ |

| Ingersoll-Rand (India) | NA | 15.75% | 28.28% | ★★★★★★ |

| AzureWave Technologies | NA | 3.00% | 29.49% | ★★★★★★ |

| All E Technologies | NA | 18.60% | 31.35% | ★★★★★★ |

| Sinotherapeutics | NA | 12.57% | 1.89% | ★★★★★★ |

| SML Isuzu | 88.08% | 26.24% | 57.97% | ★★★★☆☆ |

| Pizu Group Holdings | 48.10% | -4.86% | -19.23% | ★★★★☆☆ |

| Shandong Longquan Pipe IndustryLtd | 34.82% | 2.24% | -22.15% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

ChemoMetec (CPSE:CHEMM)

Simply Wall St Value Rating: ★★★★★★

Overview: ChemoMetec A/S develops, produces, and sells analytical equipment for cell counting and analysis across the United States, Canada, Europe, and internationally with a market capitalization of DKK9.80 billion.

Operations: ChemoMetec generates revenue primarily from the sale of consumables (DKK208.76 million), instruments (DKK142.83 million), and services (DKK103.43 million).

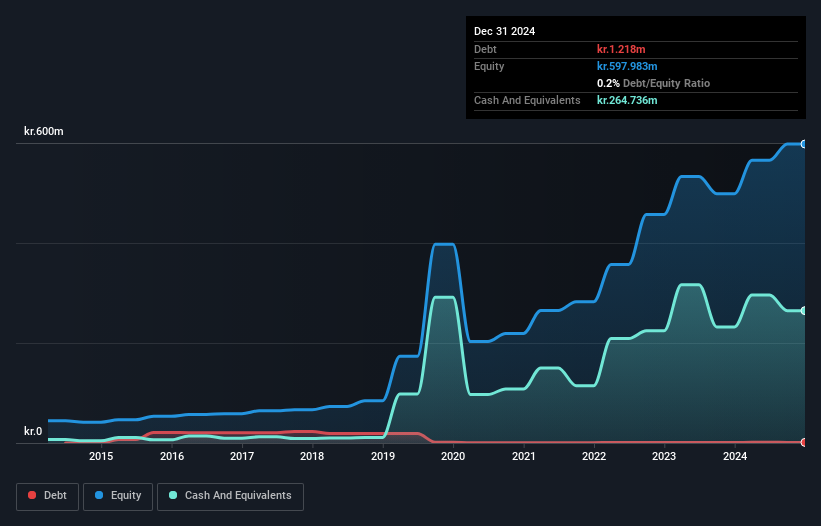

ChemoMetec, a nimble player in the life sciences sector, has shown promising financial health with earnings growing 17.6% over the past year, outpacing its industry peers. The company's debt to equity ratio improved from 0.4% to 0.2% in five years, indicating prudent financial management. Recent earnings for H1 2025 revealed sales of DKK 251 million and net income of DKK 103 million, both up significantly from last year. Despite a volatile share price recently, ChemoMetec's robust cash position and high-quality earnings suggest resilience and potential for continued growth in the coming years.

- Unlock comprehensive insights into our analysis of ChemoMetec stock in this health report.

Gain insights into ChemoMetec's past trends and performance with our Past report.

Hangzhou Jiebai Group (SHSE:600814)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hangzhou Jiebai Group Co., Limited operates department stores and shopping malls in China with a market capitalization of CN¥5.29 billion.

Operations: The company generates revenue primarily through its department stores and shopping malls in China. Its net profit margin has shown variability over recent periods, reflecting changes in operational efficiency and cost management.

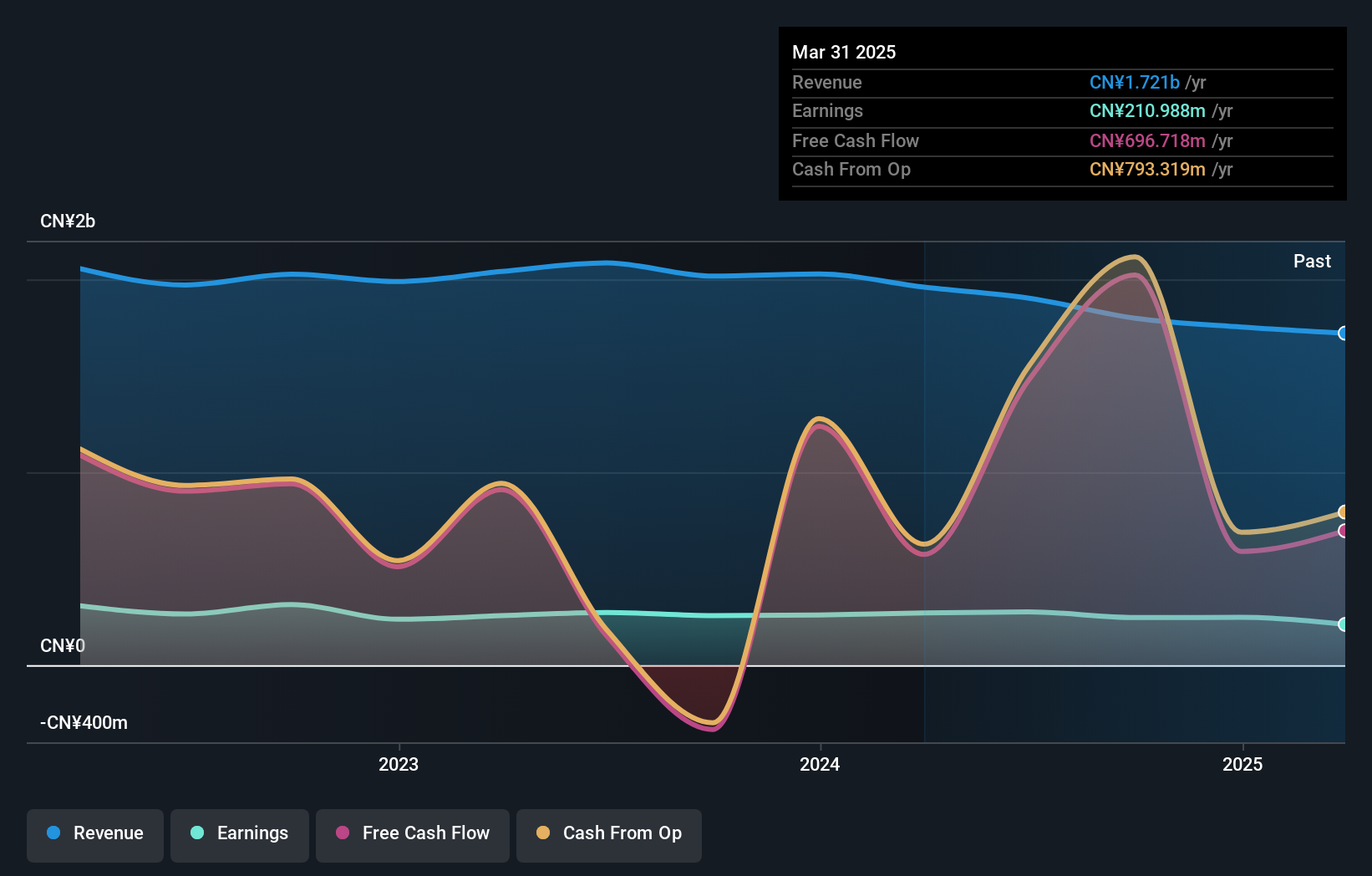

Hangzhou Jiebai Group, a relatively small player in the retail sector, presents an intriguing case with its current valuation at 93.6% below fair value estimates. Despite negative earnings growth of 3.8% over the past year, which is slightly better than the industry average of 5.3%, it maintains high-quality earnings and positive free cash flow. The company has more cash than total debt and earns sufficient interest to cover payments comfortably, suggesting financial stability. Over five years, its debt-to-equity ratio increased to 1.6%, indicating some leverage but not overly concerning given its profitability and liquidity position in US$.

Macrolink Culturaltainment Development (SZSE:000620)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Macrolink Culturaltainment Development Co., Ltd. operates in the cultural and entertainment sectors with a market capitalization of CN¥10.80 billion.

Operations: Macrolink Culturaltainment Development generates revenue primarily from its cultural and entertainment sectors. The company's net profit margin has shown fluctuations over recent periods, reflecting changes in operational efficiency and cost management.

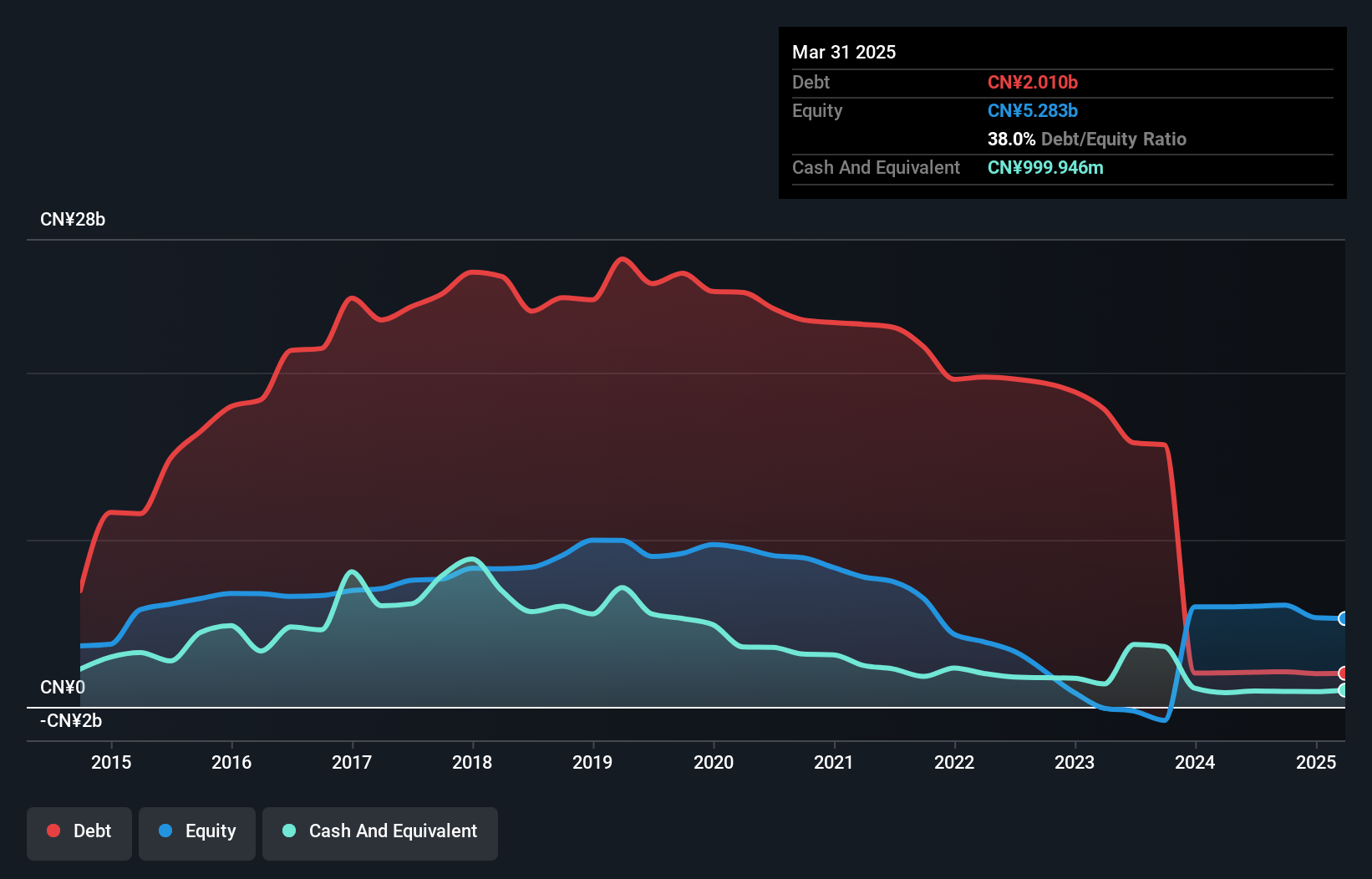

Macrolink Culturaltainment Development, a relatively small player in its field, has recently turned profitable, which is notable given the broader Real Estate industry's 38.4% earnings drop. Its price-to-earnings ratio stands at a modest 5.2x, significantly undercutting the CN market average of 36.3x, suggesting potential undervaluation. The company has managed to reduce its debt-to-equity ratio from a hefty 282.4% to a more manageable 34.5% over five years, indicating improved financial health despite recent shareholder dilution and volatile share prices over the past three months likely impacting investor sentiment negatively.

Key Takeaways

- Discover the full array of 4721 Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Jiebai Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600814

Hangzhou Jiebai Group

Engages in the department store and shopping mall business in China.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives