As the European markets navigate a complex landscape of interest rate policies and trade tensions, the pan-European STOXX Europe 600 Index has remained relatively stable, while major stock indexes in Italy, Germany, France, and the UK have shown modest gains. In this environment of cautious optimism and selective growth across sectors, identifying promising stocks involves looking at companies with strong fundamentals that can thrive amid fluctuating economic indicators.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Dekpol | 64.28% | 9.75% | 13.77% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Freetrailer Group | 0.01% | 22.96% | 31.56% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

ChemoMetec (CPSE:CHEMM)

Simply Wall St Value Rating: ★★★★★☆

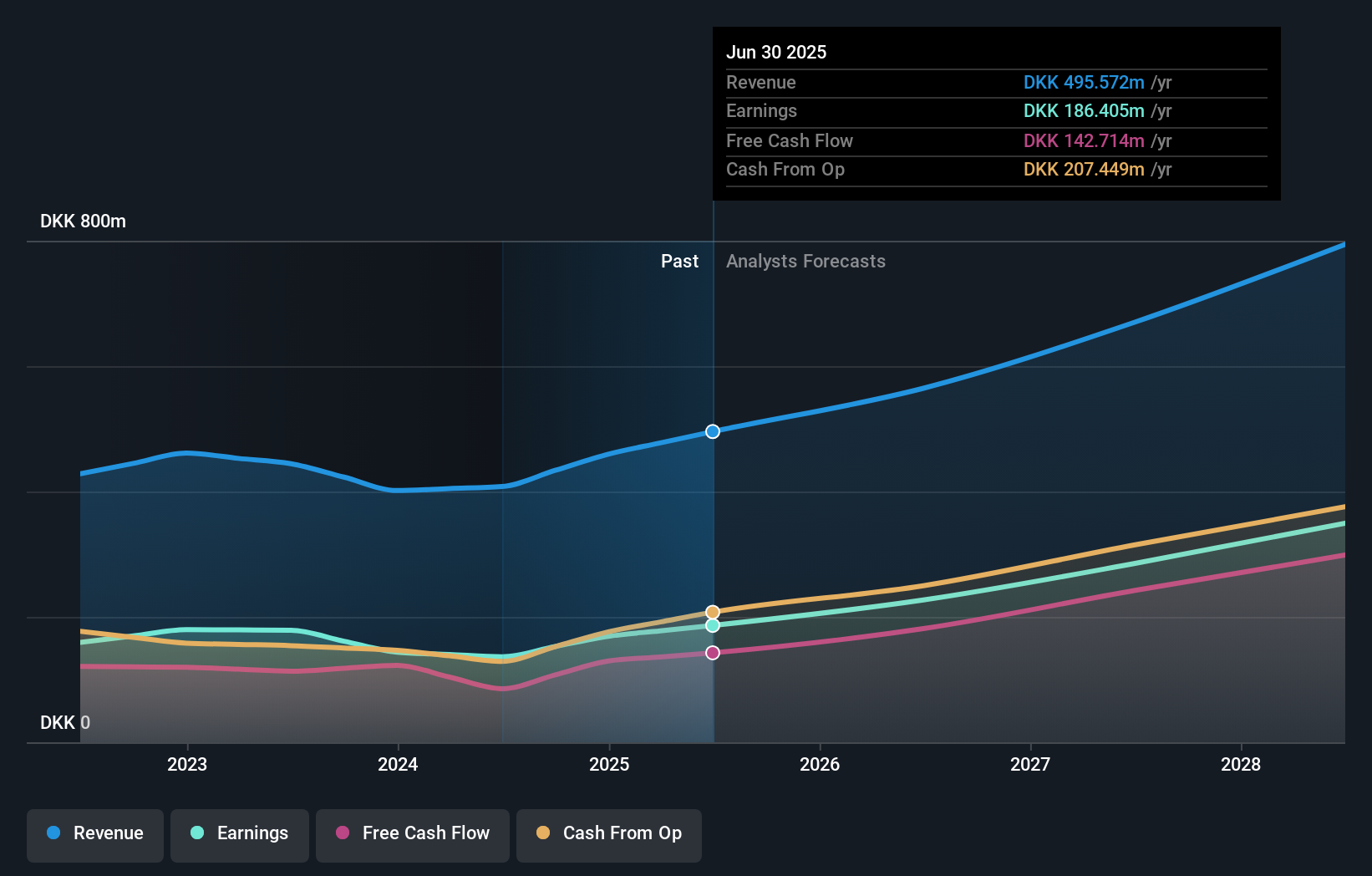

Overview: ChemoMetec A/S develops, produces, and sells analytical equipment for cell counting and analysis across the United States, Canada, Europe, and internationally with a market capitalization of DKK11.29 billion.

Operations: ChemoMetec generates revenue primarily from consumables, instruments, and services, with consumables contributing DKK230.79 million and instruments bringing in DKK143.34 million. The company operates with a market capitalization of approximately DKK11.29 billion.

ChemoMetec, a nimble player in the life sciences sector, reported impressive earnings growth of 36.8% over the past year, outpacing its industry peers at 18.2%. With sales reaching DKK 495.57 million and net income climbing to DKK 186.41 million for the fiscal year ending June 2025, the company is demonstrating robust financial health. It boasts more cash than total debt and maintains positive free cash flow, highlighting financial stability and operational efficiency. Looking ahead, ChemoMetec anticipates revenue between DKK 545 million and DKK 565 million for the next fiscal year, suggesting continued momentum in its growth trajectory.

- Navigate through the intricacies of ChemoMetec with our comprehensive health report here.

Assess ChemoMetec's past performance with our detailed historical performance reports.

Deceuninck (ENXTBR:DECB)

Simply Wall St Value Rating: ★★★★★★

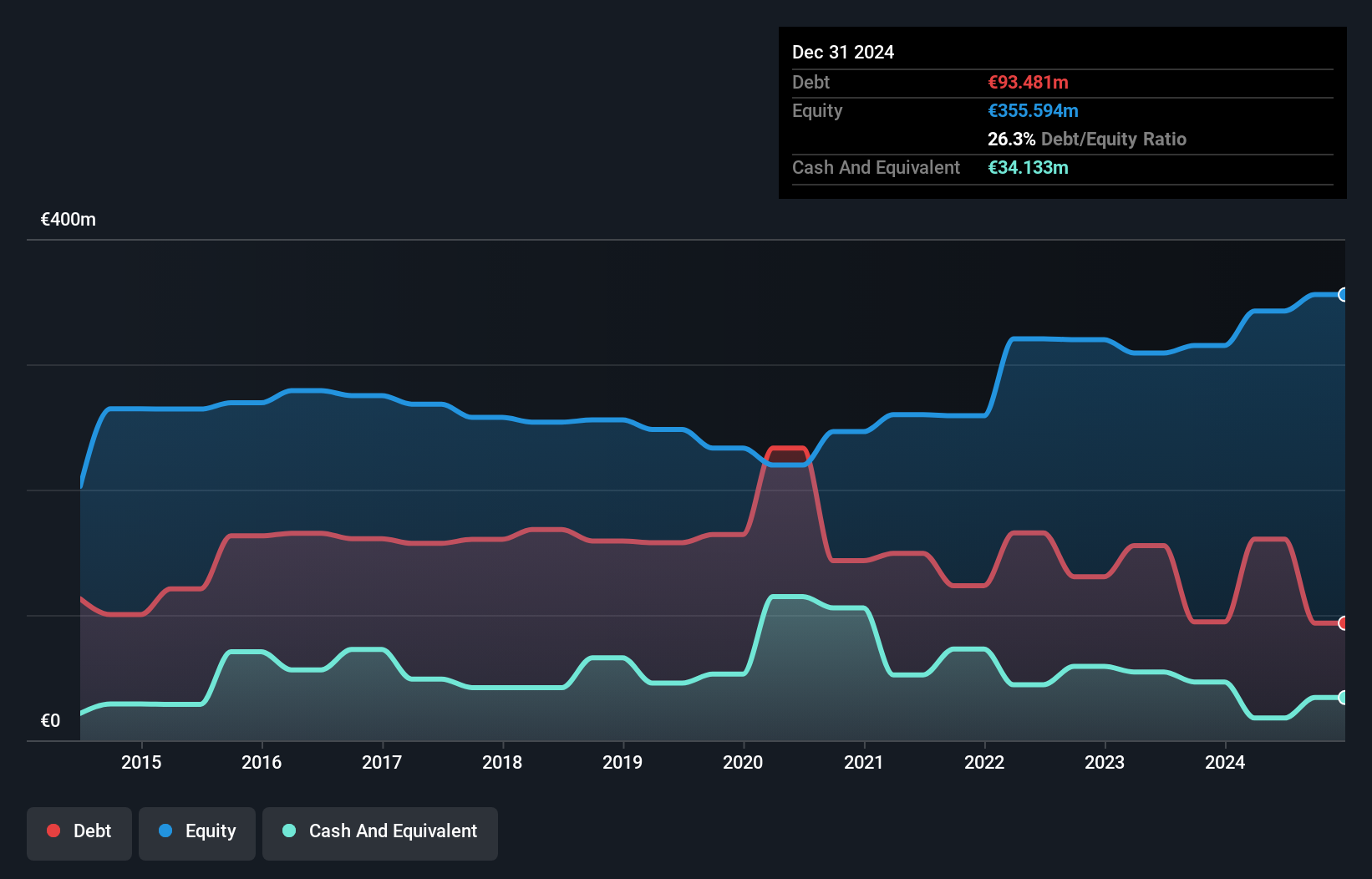

Overview: Deceuninck NV is involved in the design, manufacture, recycling, and distribution of multi-material window, door, and building solutions across Europe, North America, Turkey, and other international markets with a market cap of €304.09 million.

Operations: Deceuninck NV generates revenue primarily from its Window and Door Systems segment, which accounts for €724.41 million, followed by Home Protection at €38.30 million, and Outdoor Living at €26.26 million.

This Belgian company is making waves with its impressive financial turnaround. Deceuninck's earnings surged by 811% over the past year, outpacing the building industry's -2.2%. The debt to equity ratio has improved significantly from 106% to a more manageable 44% over five years. Trading at nearly 24% below fair value, it offers an attractive entry point for investors seeking value in smaller European stocks. Recent results show sales of €383 million for the half-year ended June 2025, while net income rose to €11 million from €8 million a year prior, highlighting its potential for future growth and resilience in challenging markets.

engcon (OM:ENGCON B)

Simply Wall St Value Rating: ★★★★★☆

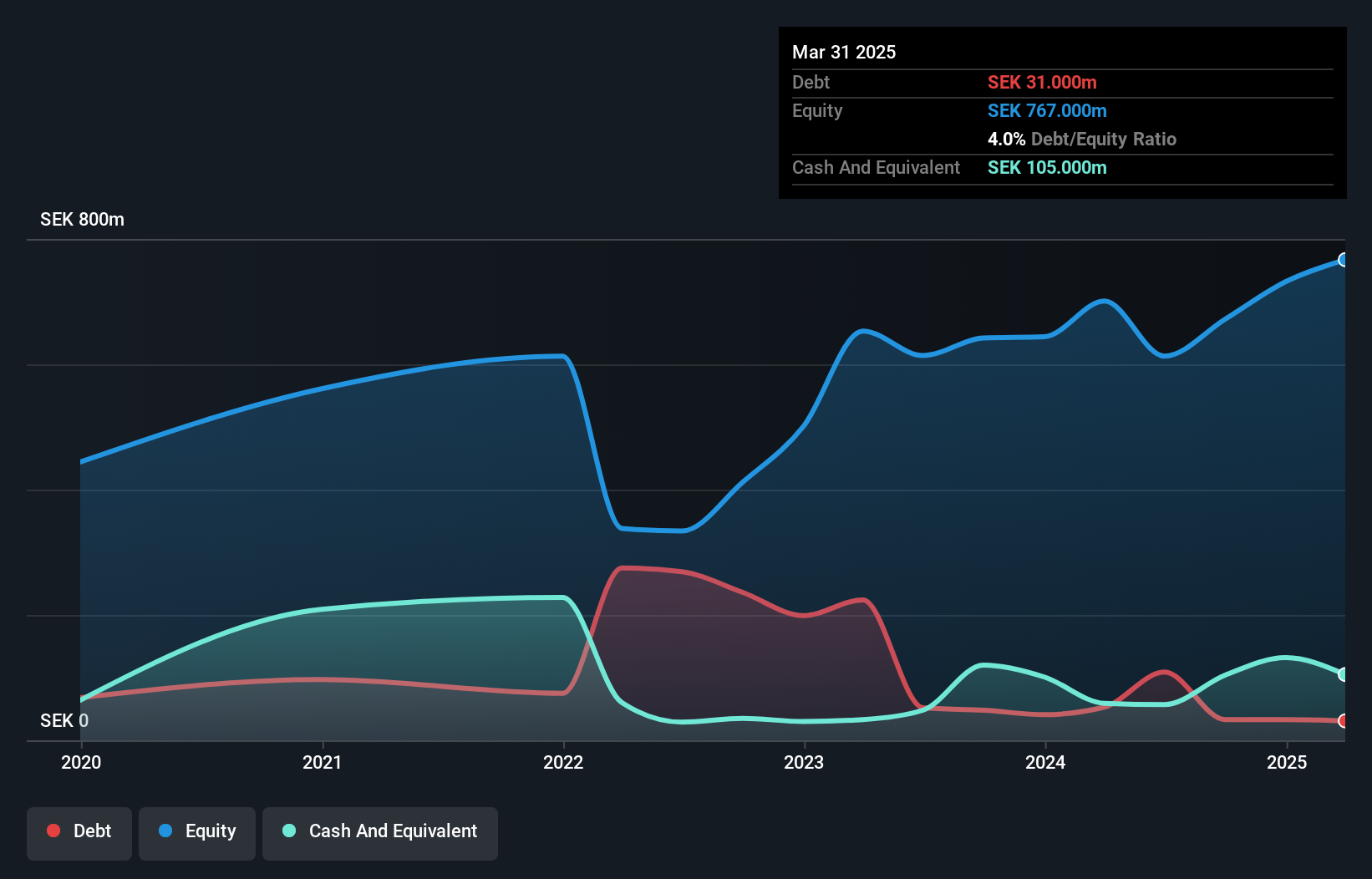

Overview: Engcon AB (publ) is involved in the design, production, and sale of excavator tools across various international markets including Europe, the Americas, Asia-Pacific, and more, with a market cap of SEK11.71 billion.

Operations: Engcon AB generates revenue primarily from its Construction Machinery & Equipment segment, amounting to SEK1.78 billion. The company's financial performance is influenced by its ability to manage production costs and optimize profit margins.

Engcon, a notable player in the machinery industry, has shown robust financial performance with earnings growing 53% over the past year and a satisfactory net debt to equity ratio of 12%. The company's EBIT covers interest payments 27 times over, indicating strong financial health. Recent agreements with Hitachi Construction Machinery (Europe) NV aim to boost tiltrotator adoption across Europe. However, legal challenges regarding patent disputes could pose risks. Engcon's sales increased to SEK 530 million in Q2 2025 from SEK 450 million last year, while net income rose to SEK 69 million from SEK 55 million.

Key Takeaways

- Gain an insight into the universe of 329 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:DECB

Deceuninck

Engages in the design, manufacture, recycling, and distribution of multi-material window, door, and building solutions in Europe, North America, Turkey, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives