A Look at ALK-Abelló’s (CPSE:ALK B) Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for ALK-Abelló.

While ALK-Abelló’s recent share price strength has turned heads, the bigger story is its sustained momentum, with a year-to-date share price return of nearly 27% and an impressive 29% total shareholder return over the past year. With buyers rewarding improving fundamentals, optimism appears to be building around the company’s outlook.

If you’re watching the sector for where momentum meets opportunity, now is a great chance to discover fast growing stocks with high insider ownership

But with ALK-Abelló’s share price now near analyst targets and much of its recent growth story already well known, the key question is whether there is still upside left for new investors or if the market has already factored in future gains.

Most Popular Narrative: 5% Overvalued

With ALK-Abelló closing at DKK 206.2, slightly above the narrative’s fair value of DKK 196, the consensus suggests the recent run-up may have outpaced projected fundamentals. Expectations for double-digit growth, rising margins, and commercial wins underpin this viewpoint. Here is what the narrative highlights as a major catalyst.

The rapid expansion of ALK's dedicated pediatric sales force in North America and strategic partnerships (e.g., ARS Pharma) are improving commercial reach and penetration, which, combined with broadening approval for pediatric use, should accelerate new patient growth and increase the volume of high-margin tablet sales.

Wondering what aggressive growth and margin projections are driving this valuation? The narrative hinges on remarkable top-line expansion and bullish future earnings assumptions. The full story behind these ambitious numbers might surprise you.

Result: Fair Value of DKK196 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in new product launches or slower uptake in key international markets could quickly dampen ALK-Abelló’s current growth trajectory and valuation optimism.

Find out about the key risks to this ALK-Abelló narrative.

Another View: Discounted Cash Flow Points to Opportunity

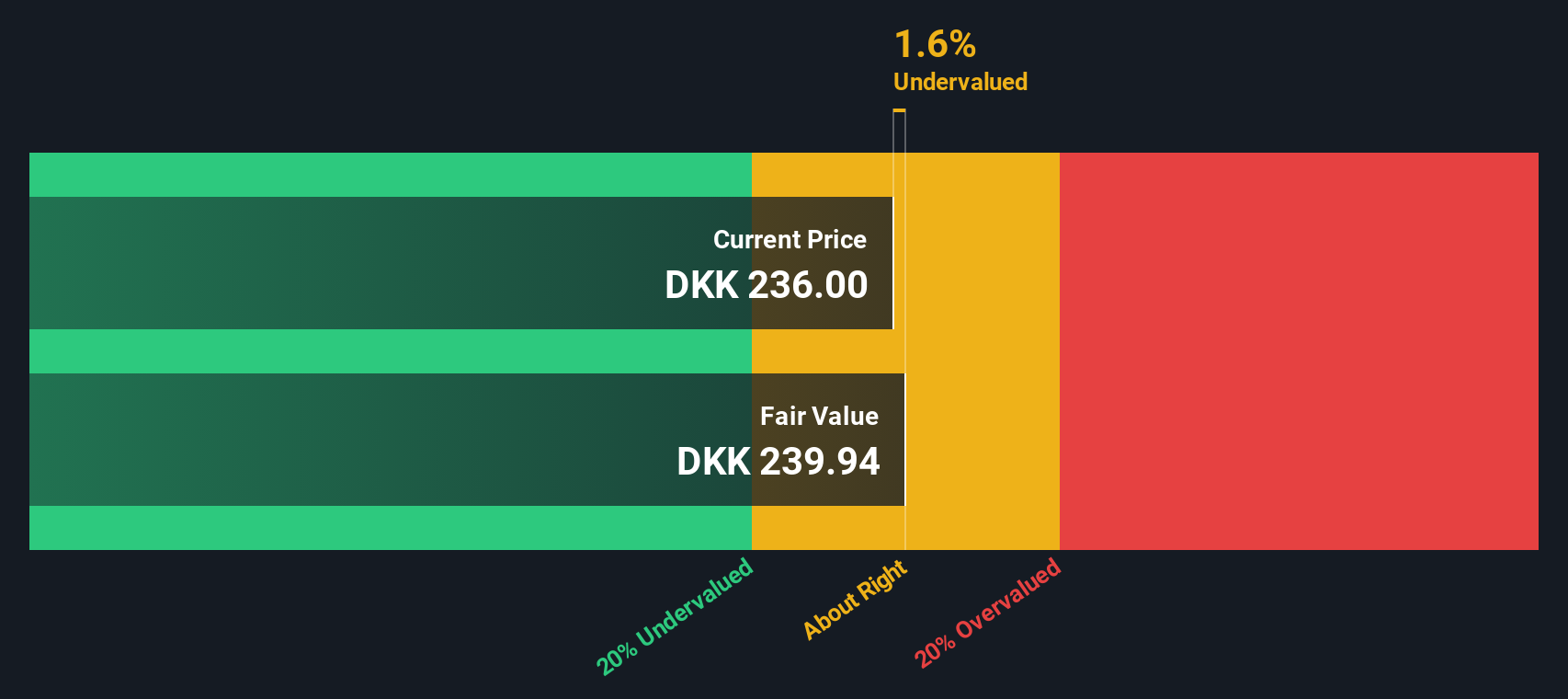

Taking a step back from the consensus price target, our SWS DCF model offers a different angle and estimates ALK-Abelló's fair value at DKK 218.88, which is about 6% above its current price. This suggests a possible undervaluation if future growth holds up as forecast. Could the market be underestimating longer-term potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ALK-Abelló for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ALK-Abelló Narrative

If you think there’s more to ALK-Abelló’s story, or want to draw your own conclusions from the numbers, you can easily create your own perspective in just minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding ALK-Abelló.

Looking for More Investment Ideas?

Smart investors never stop at just one opportunity. Take your portfolio further by acting now and tapping into hand-picked ideas making waves beyond ALK-Abelló.

- Catch the momentum in high-yield income by tapping into these 14 dividend stocks with yields > 3% with stable payouts and the potential to enhance your returns.

- Ride the AI revolution and position yourself for tomorrow's breakthroughs with these 25 AI penny stocks that are powering innovation across industries.

- Seize undervalued gems before they are gone by using these 865 undervalued stocks based on cash flows, which are identified by robust fundamentals and strong cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:ALK B

ALK-Abelló

Operates as an allergy solutions company in Europe, North America, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives