Unveiling Three Undiscovered Gems in Europe with Strong Potential

Reviewed by Simply Wall St

As European markets navigate a landscape marked by geopolitical tensions and economic uncertainties, the pan-European STOXX Europe 600 Index has recently experienced a decline, reflecting broader concerns. Amidst this backdrop, identifying stocks with strong fundamentals and resilience becomes crucial for investors seeking opportunities; in this article, we explore three such undiscovered gems in Europe that exhibit promising potential.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Sparta | NA | -9.54% | -15.40% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

SP Group (CPSE:SPG)

Simply Wall St Value Rating: ★★★★★★

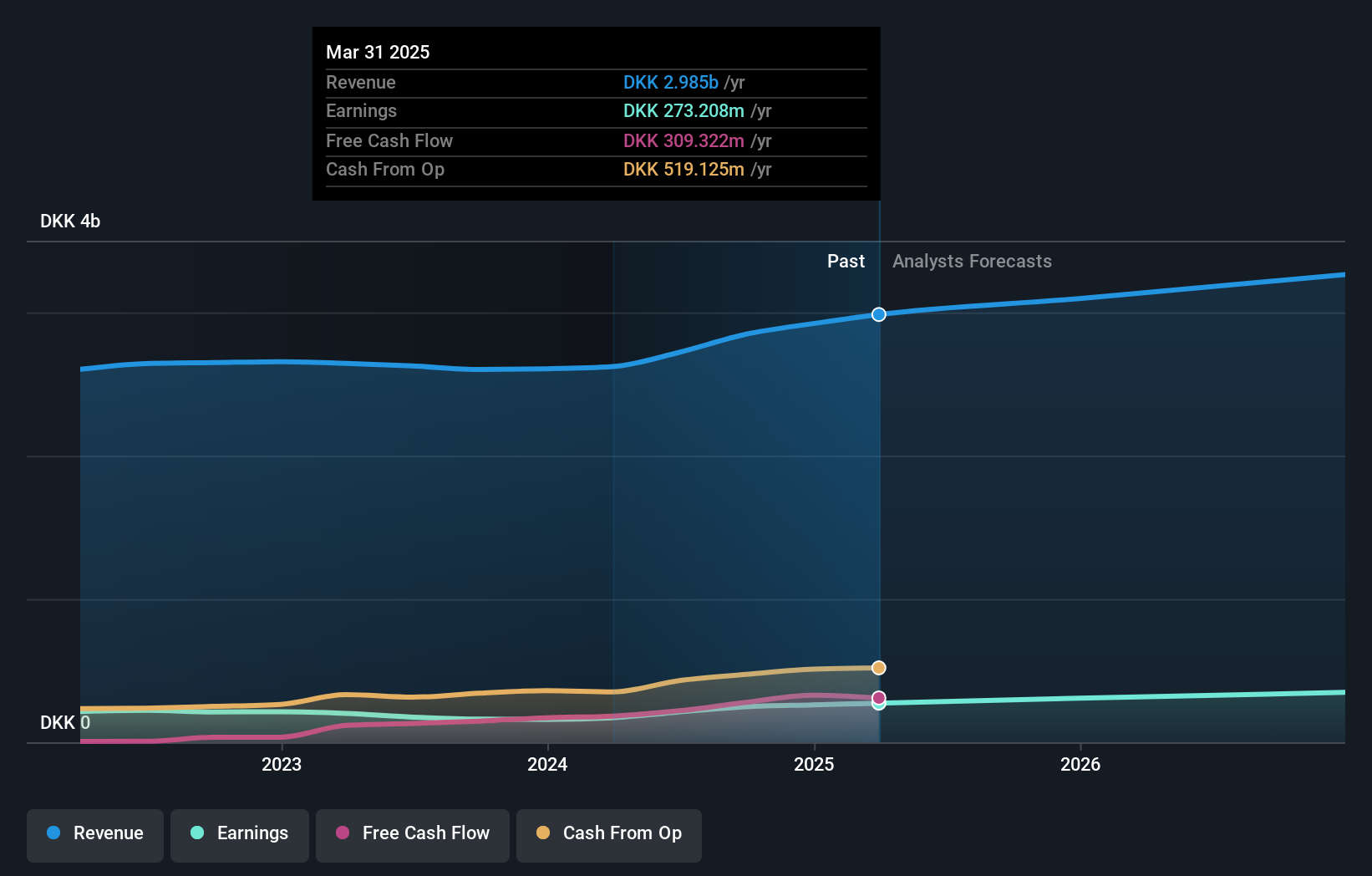

Overview: SP Group A/S, with a market cap of DKK3.75 billion, is engaged in the manufacturing and sale of moulded plastic and composite components across various regions including Denmark, Europe, the Americas, Asia, the Middle East, Australia, and Africa.

Operations: SP Group generates its revenue primarily from the Plastics & Rubber segment, which accounts for DKK2.99 billion.

SP Group, a notable player in the European market, has shown impressive growth with its earnings surging 59.7% over the past year, outpacing the industry average of 9.5%. Trading at 76.6% below its fair value estimate suggests potential for upside. The company’s net debt to equity ratio stands satisfactorily at 11.1%, indicating prudent financial management as it reduced from 79.7% over five years. Recent earnings results show sales reaching DKK 786 million in Q1 2025 compared to DKK 723 million a year prior, while net income rose to DKK 78 million from DKK 66 million, reflecting robust operational performance amidst strategic expansions and sustainability initiatives.

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative (ENXTPA:CRBP2)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative offers diverse banking and financial services to various customer segments in France, with a market capitalization of approximately €1.22 billion.

Operations: Crédit Agricole Brie Picardie generates revenue primarily through its retail banking segment, which accounts for €624.79 million. The company's market capitalization stands at approximately €1.22 billion.

CRBP2, with assets totaling €41.0B and equity of €5.4B, offers an intriguing profile in the banking sector. It has a sufficient allowance for bad loans at 110% and maintains an appropriate level of non-performing loans at 1.4%, showcasing prudent risk management. Despite earnings growth lagging behind industry averages, its earnings have increased by 7.2% annually over the past five years, indicating potential stability in performance. Trading at 41.7% below estimated fair value suggests it might be undervalued relative to its intrinsic worth, with high-quality past earnings further reinforcing this perspective.

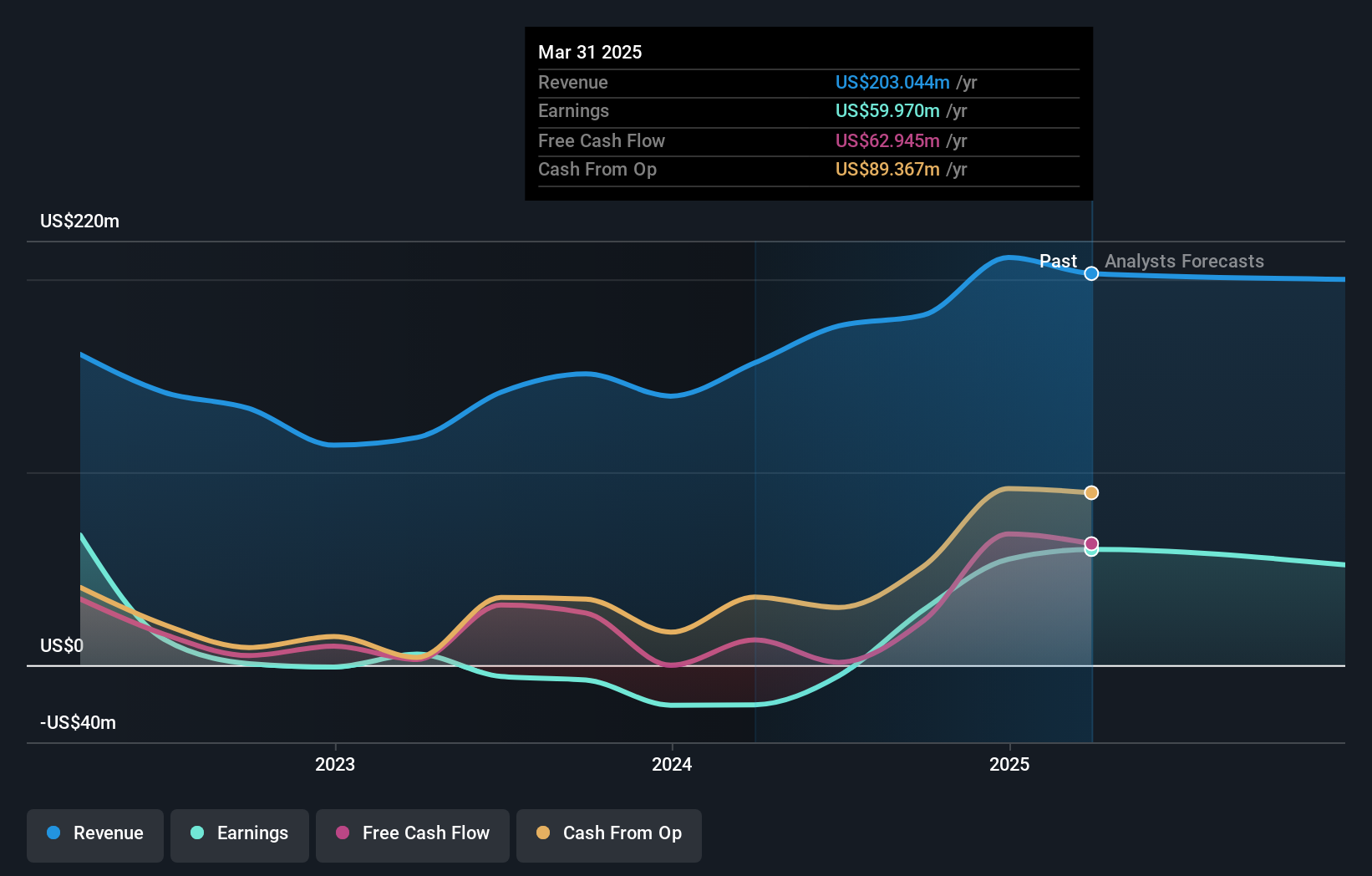

IMC (WSE:IMC)

Simply Wall St Value Rating: ★★★★★★

Overview: IMC S.A. operates as an integrated agricultural company in Ukraine and internationally, with a market capitalization of PLN1.07 billion.

Operations: IMC generates revenue primarily from its Crop Farming segment, which contributed $204.17 million, while the Elevators and Warehouses segment added $3.74 million.

IMC has recently turned profitable, reporting a net income of US$54.89 million for 2024 compared to a loss of US$20.82 million the previous year, with earnings per share from continuing operations at US$1.55. Despite this positive turnaround, its earnings have dropped by an average of 14.7% annually over the past five years, and its share price remains highly volatile in recent months. The company holds more cash than total debt and has significantly lowered its debt-to-equity ratio from 50% to 12.1% over five years, indicating prudent financial management amidst market challenges.

- Click to explore a detailed breakdown of our findings in IMC's health report.

Review our historical performance report to gain insights into IMC's's past performance.

Taking Advantage

- Investigate our full lineup of 332 European Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:SPG

SP Group

Manufactures and sells moulded plastic and composite components in Denmark, rest of Europe, the Americas, Asia, the Middle East, Australia, and Africa.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives