Undiscovered European Gems with Strong Potential This October 2025

Reviewed by Simply Wall St

As European markets continue to show resilience, with the pan-European STOXX Europe 600 Index climbing 1.68% and major indices like Germany's DAX and the UK's FTSE 100 posting gains, investors are increasingly eyeing opportunities in small-cap stocks that could benefit from this positive momentum. In such an environment, identifying stocks with strong fundamentals and growth potential can be crucial for those looking to capitalize on Europe's dynamic economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Dn Agrar Group | 63.27% | 15.46% | 33.00% | ★★★★☆☆ |

| Alantra Partners | 11.48% | -5.76% | -30.16% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

SP Group (CPSE:SPG)

Simply Wall St Value Rating: ★★★★☆☆

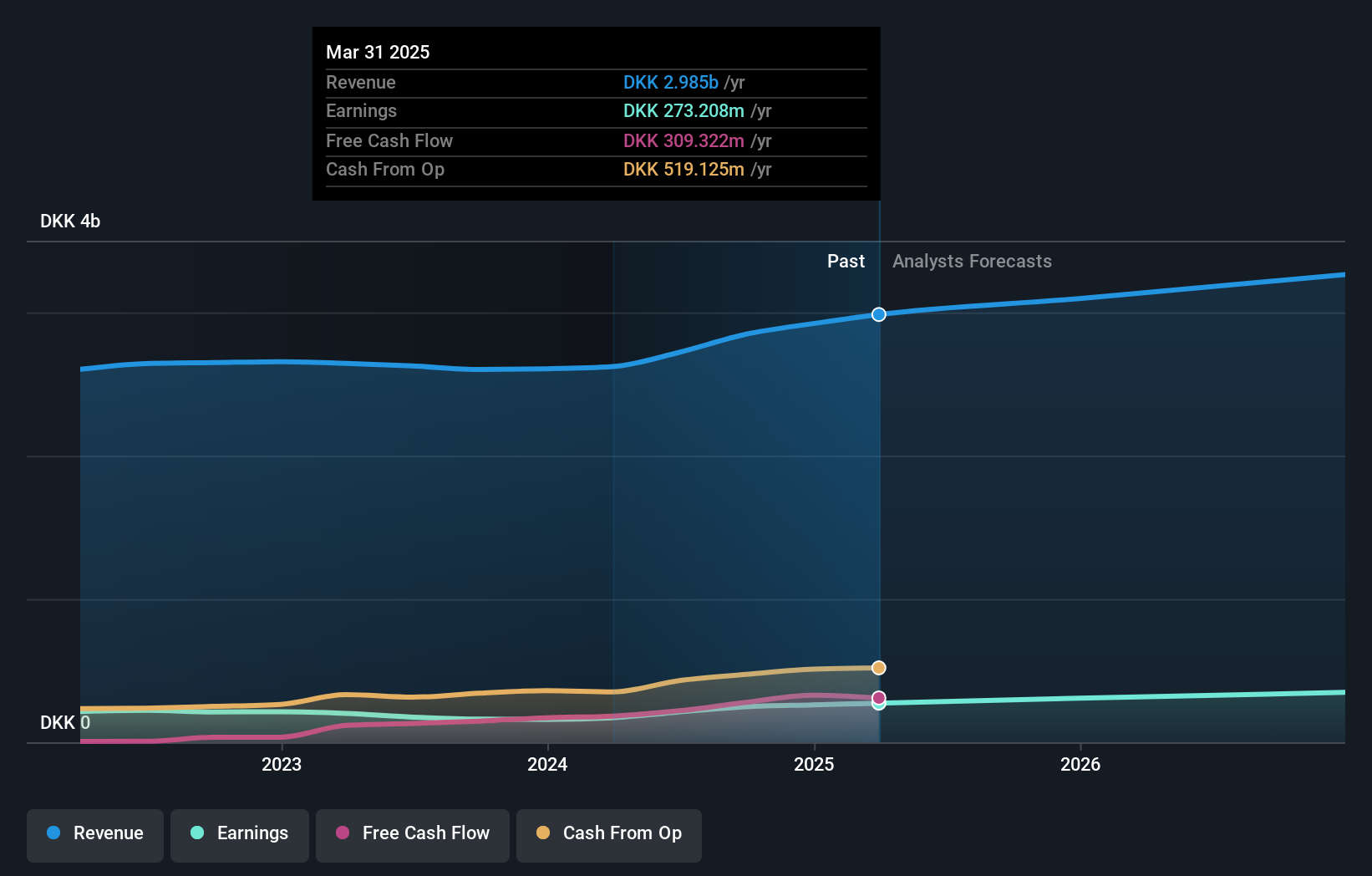

Overview: SP Group A/S is a company that produces and distributes moulded plastic and composite components across various global markets, with a market cap of DKK3.49 billion.

Operations: SP Group generates revenue primarily from the Plastics & Rubber segment, amounting to DKK2.90 billion.

SP Group, a promising player in the chemicals sector, is navigating both opportunities and challenges. With earnings growth of 18.7% over the past year, it outpaced the industry average of 10%, reflecting its high-quality earnings. However, its net debt to equity ratio stands at a concerning 52.9%, indicating significant leverage. Despite this, interest payments are well-covered at 6.6 times by EBIT, showcasing financial resilience. The company trades at good value—51% below estimated fair value—and has repurchased shares worth DKK 40 million recently, signaling confidence in its future prospects despite recent revenue guidance adjustments and competition from sustainable alternatives.

SpareBank 1 Helgeland (OB:HELG)

Simply Wall St Value Rating: ★★★★★☆

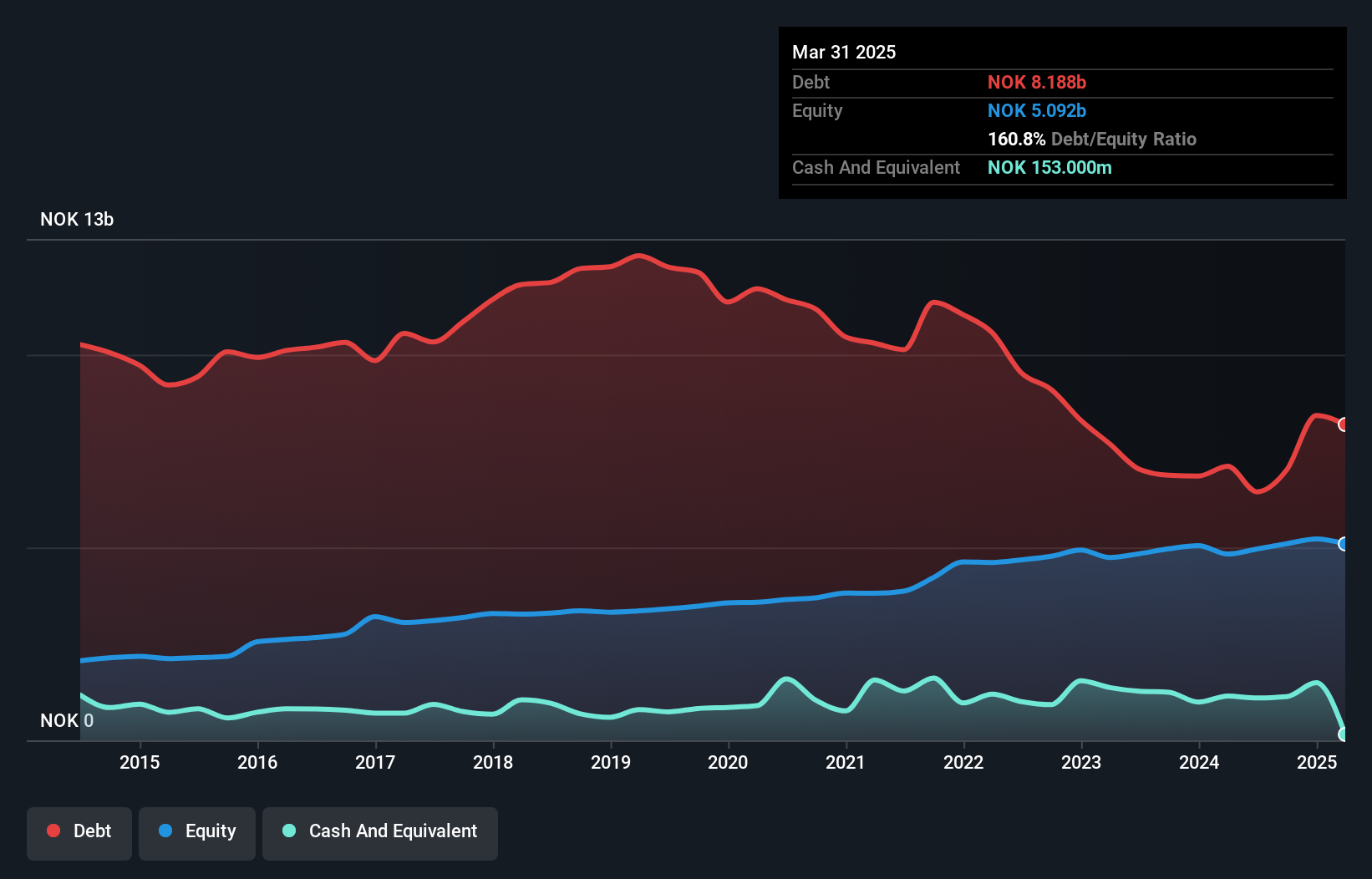

Overview: SpareBank 1 Helgeland offers a range of banking products and services to individuals, SMEs, municipalities, and institutions in Norway, with a market cap of NOK4.93 billion.

Operations: The bank generates revenue primarily through interest income and fees from its diverse client base, including individuals, SMEs, municipalities, and institutions. It reported a net profit margin of 25% in the latest period.

SpareBank 1 Helgeland, with assets totaling NOK40.7 billion and equity of NOK5.2 billion, stands out for its robust financial health. The bank's reliance on customer deposits, which make up 73% of liabilities, provides a stable funding base. It reported net income of NOK136 million for Q2 2025 and NOK290 million for the first half of the year, reflecting consistent performance compared to last year. With total loans at NOK32.1 billion and deposits at NOK26 billion, it maintains an appropriate bad loan ratio of 1.9%. Trading at a discount to its estimated fair value enhances its appeal in the market.

NOTE (OM:NOTE)

Simply Wall St Value Rating: ★★★★★☆

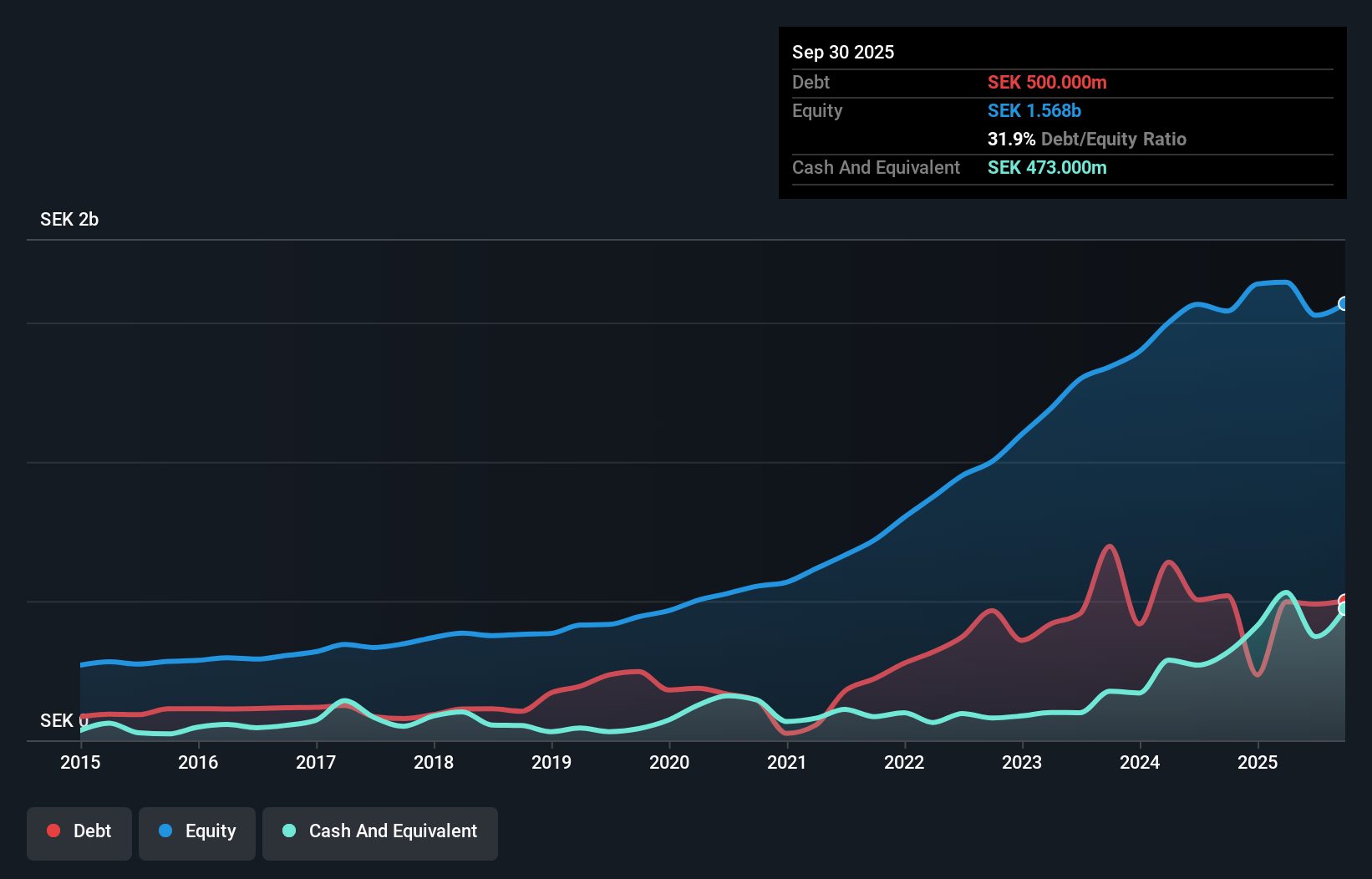

Overview: NOTE AB (publ) offers electronics manufacturing services across Sweden, Finland, the United Kingdom, Bulgaria, Estonia, China, and other international markets with a market cap of SEK5.38 billion.

Operations: Revenue primarily comes from Western Europe, contributing SEK2.89 billion, followed by the Rest of World segment at SEK995.31 million.

NOTE appears to be strategically positioning itself for growth, with recent earnings showing a net income rise to SEK 54 million in Q3 from SEK 43 million the previous year. The company is trading at a notable discount of 23.9% below its estimated fair value, suggesting potential upside. Their debt management seems prudent, with a net debt to equity ratio of just 1.7%, while EBIT covers interest payments by an impressive 18.8 times. Plans to shift production from China to Europe could mitigate tariff costs and bolster margins, though macroeconomic factors like salary inflation pose risks.

Where To Now?

- Take a closer look at our European Undiscovered Gems With Strong Fundamentals list of 328 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:HELG

SpareBank 1 Helgeland

Provides various banking products and services to private customers, small and medium-sized enterprises, municipalities, and institutions in Norway.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives