Does the Chr. Hansen Integration Make Novozymes More Attractive After Recent Share Price Decline?

Reviewed by Bailey Pemberton

- Curious if Novozymes is worth a closer look, whether you are already holding shares or just valuation-savvy? Let’s get straight to what matters for investors weighing the company’s true worth.

- The share price has slipped by 2.5% over the past week and is down 9.2% in the past year, hinting at shifting sentiment and fresh questions around growth potential.

- Recent headlines around Novozymes' strategic initiatives in sustainable bio-solutions and its ongoing integration efforts with Chr. Hansen have kept the stock in focus. Market reactions suggest ongoing debate about how these changes might impact future returns and risks.

- On our scale, Novozymes scores 3 out of 6 valuation checks for being undervalued. Next, we will break down standard valuation models. Stick around for a smarter way to interpret these numbers by the end of the article.

Approach 1: Novozymes Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is really worth by projecting its future cash flows and discounting them back to their present value. For Novozymes, this approach begins with the current Free Cash Flow (FCF) of €490 million and looks at analyst estimates for the coming years. Analyst forecasts cover up to five years, after which future projections are extrapolated.

Analysts expect Novozymes’ FCF to rise from €841 million in 2026 to €1.28 billion in 2029. Simply Wall St’s DCF model projects further growth beyond that, with FCF reaching about €1.8 billion by 2035. All values are in euros to reflect the company’s reporting currency, even if its share price is listed in Danish kroner.

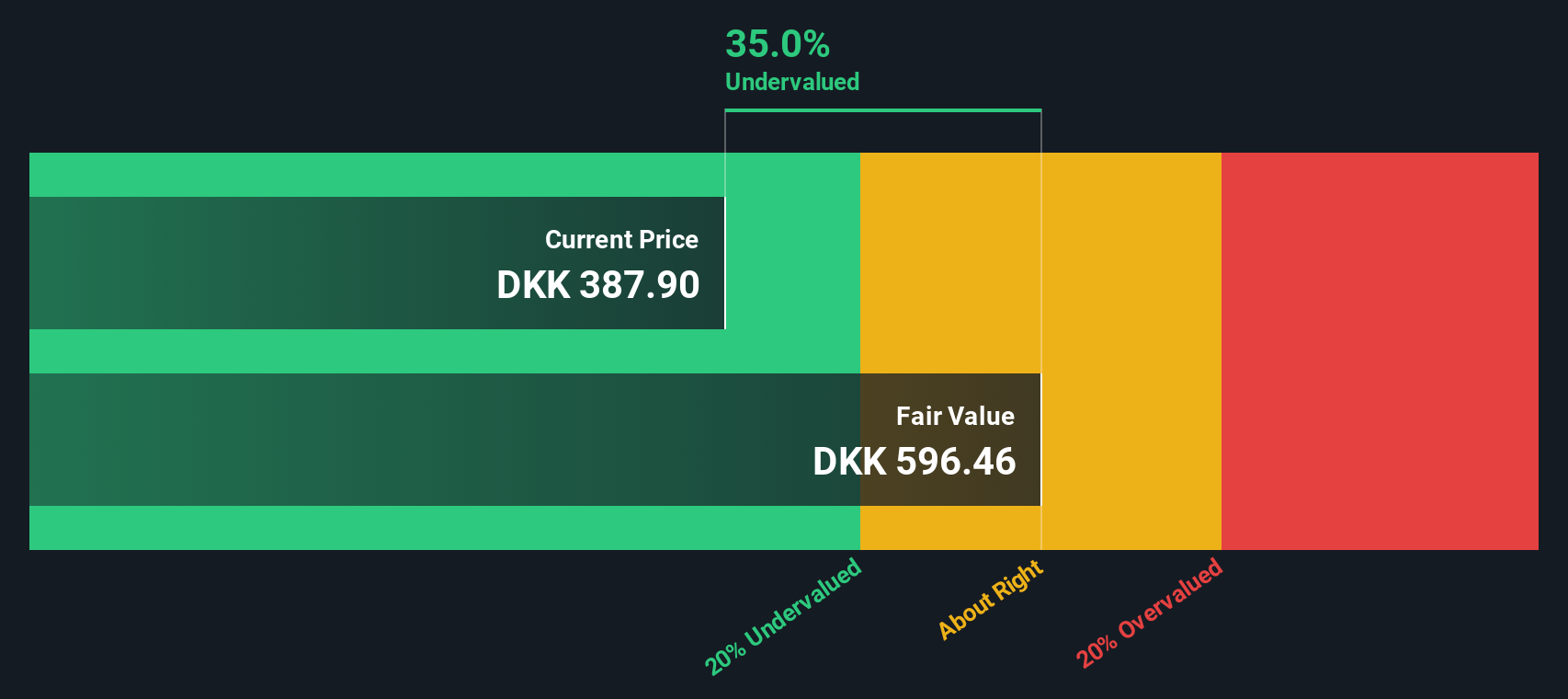

Based on this cash flow extrapolation, Novozymes’ estimated intrinsic value is €595.2 per share. This suggests the stock is trading at a 35.8% discount to its calculated fair value, which may indicate undervaluation at recent prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Novozymes is undervalued by 35.8%. Track this in your watchlist or portfolio, or discover 844 more undervalued stocks based on cash flows.

Approach 2: Novozymes Price vs Earnings

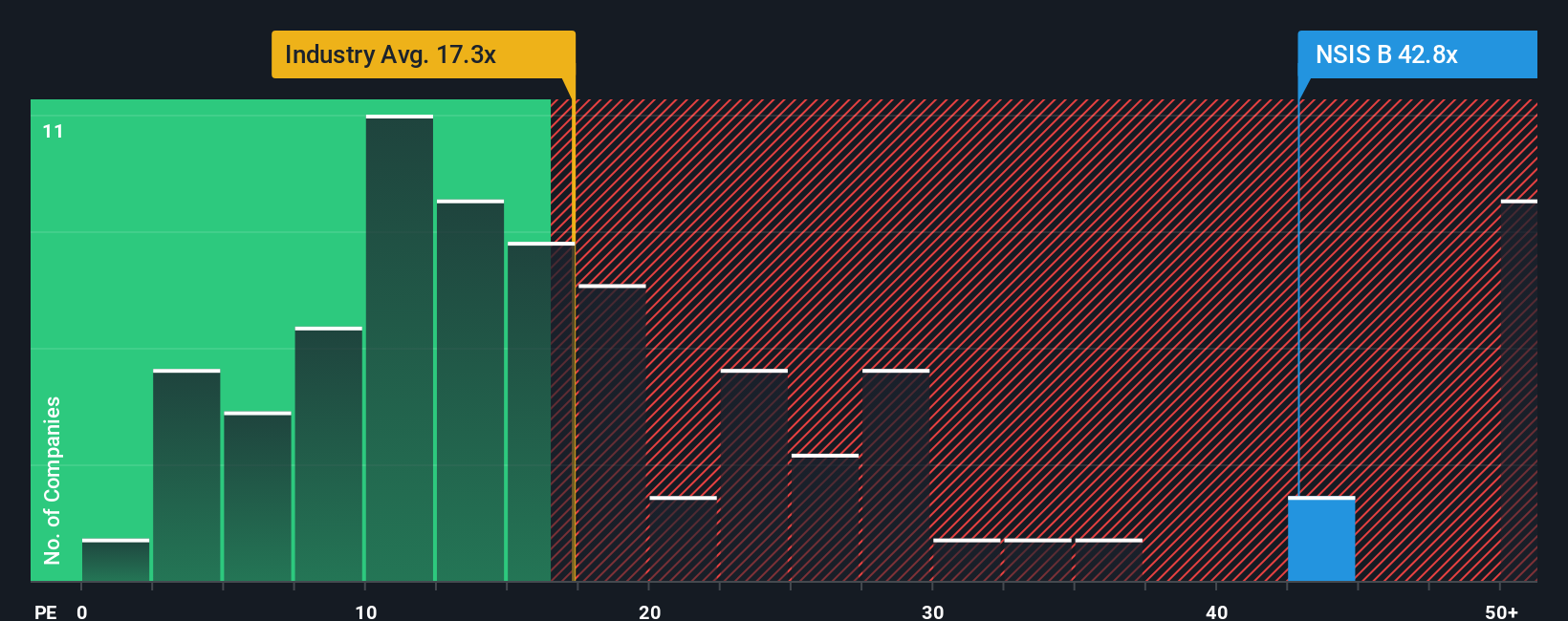

The Price-to-Earnings (PE) ratio is often the go-to valuation tool for profitable companies like Novozymes. This multiple reflects what investors are willing to pay for each euro of earnings, making it highly relevant when the business generates steady profits.

What counts as a fair or normal PE ratio varies. Businesses with higher future growth or lower risk typically deserve a higher PE multiple, while slower-growing or riskier companies usually trade at lower ones.

Currently, Novozymes trades at a PE ratio of 42.2x. This is well above both the Chemicals industry average of 21.9x and the average for similar peers at 32.1x. At first glance, this premium might suggest the stock is expensive, but context matters.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio, calculated at 28.9x for Novozymes, considers the company’s growth outlook, profit margins, risk factors, industry trends, and market capitalization. It provides a tailored benchmark rather than a simple comparison to industry or peer averages, setting a smarter baseline that adjusts for what makes Novozymes unique.

Comparing Novozymes’ actual PE of 42.2x to its Fair Ratio of 28.9x, the stock currently looks overvalued on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Novozymes Narrative

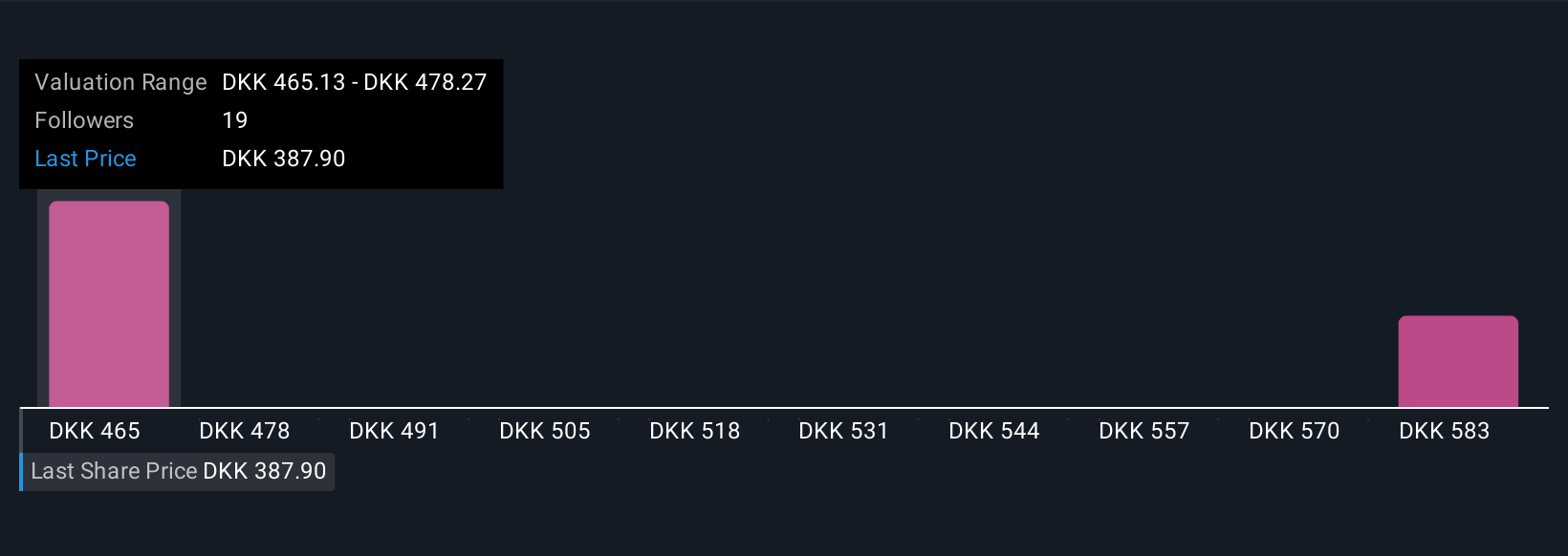

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your own story and expectations about a company, built from your view on how much it should be worth and what it could achieve in the future. Instead of focusing only on formulas or ratios, Narratives connect what a business does and where it is heading to the numbers that drive its financial forecast and fair value.

Narratives are easy to use, available right within the Simply Wall St Community page, and are relied on by millions of investors. They help you make decisions with confidence by letting you see how your Fair Value stacks up against Novozymes’ current share price, so you can decide when the stock is a buy or a hold for you, rather than just following the market. These Narratives update in real time when news, earnings, or major events hit, keeping your outlook always relevant.

For example, some investors see Novozymes’ future as bright and value it much higher, while others are more cautious, arriving at a much lower fair value. Narratives make it simple to compare, choose, and act based on the latest insights and your personal perspective.

Do you think there's more to the story for Novozymes? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Novozymes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:NSIS B

Novozymes

Produces and sells industrial enzymes, functional proteins, and microorganisms in Denmark, rest of Europe, North America, the Asia Pacific, the Middle East, Africa, Latin America, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion