- United Kingdom

- /

- Professional Services

- /

- LSE:STEM

European Undervalued Small Caps With Insider Action For May 2025

Reviewed by Simply Wall St

In recent weeks, European markets have faced pressures from proposed U.S. tariffs, leading to a decline in major stock indexes such as the STOXX Europe 600, which ended a streak of gains. Amidst this backdrop of economic uncertainty and shifting trade policies, identifying small-cap stocks with potential value can be challenging yet rewarding for investors who focus on strong fundamentals and market resilience.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 12.1x | 0.6x | 34.06% | ★★★★★☆ |

| Savills | 24.4x | 0.5x | 41.41% | ★★★★☆☆ |

| FRP Advisory Group | 11.6x | 2.1x | 18.80% | ★★★★☆☆ |

| Tristel | 28.8x | 4.1x | 7.84% | ★★★★☆☆ |

| AKVA group | 15.8x | 0.7x | 46.16% | ★★★★☆☆ |

| Absolent Air Care Group | 22.7x | 1.8x | 48.43% | ★★★☆☆☆ |

| Italmobiliare | 11.9x | 1.6x | -216.86% | ★★★☆☆☆ |

| SmartCraft | 40.9x | 7.3x | 35.45% | ★★★☆☆☆ |

| Close Brothers Group | NA | 0.6x | 0.21% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.4x | 44.17% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

H+H International (CPSE:HH)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: H+H International is a company that specializes in the production of construction materials, with a market capitalization of approximately DKK 2.78 billion.

Operations: The company's revenue primarily comes from the construction materials segment, amounting to DKK 2.78 billion. Over recent periods, the gross profit margin has shown variability, reaching as high as 31.86% in early 2020 before declining to around 22.17% by early 2025. Operating expenses include significant allocations for general and administrative purposes, sales and marketing, and depreciation and amortization. The company experienced fluctuations in net income margins over time with a notable negative trend in recent quarters before a positive turnaround by early 2025.

PE: 34.3x

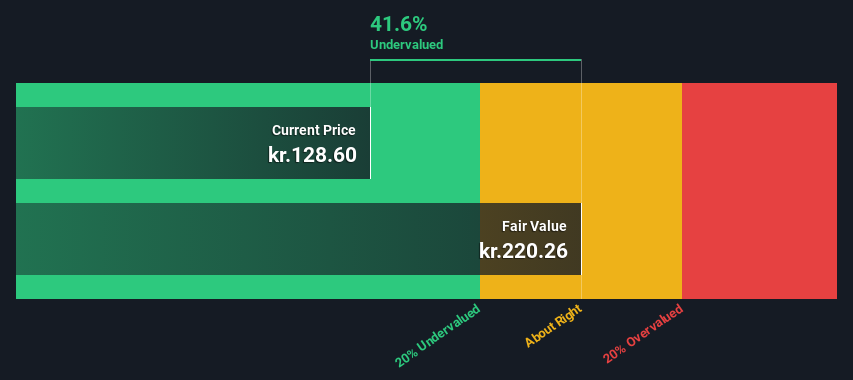

H+H International, a smaller player in the European market, shows potential as an undervalued opportunity. Recently, insider confidence was demonstrated when Jorg Brinkmann purchased 4,000 shares for approximately DKK 433K in March 2025. Despite recent volatility and reliance on higher-risk external funding, the company has improved its financial position with a net loss reduction to DKK 12 million from DKK 129 million year-on-year in Q1 2025. Looking ahead, they maintain guidance for organic revenue growth of up to 10% this year.

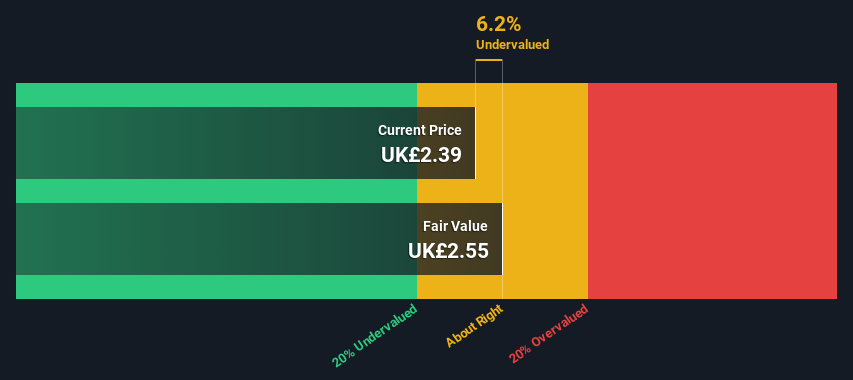

SThree (LSE:STEM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: SThree is a recruitment company specializing in STEM (Science, Technology, Engineering, and Mathematics) sectors with operations across the USA, DACH region, Rest of Europe, Middle East & Asia, and Netherlands including Spain.

Operations: SThree's revenue is primarily derived from its operations across regions such as the USA, DACH, Rest of Europe, Middle East & Asia, and the Netherlands (including Spain). Over time, net income margin has shown variability with a recent figure of 3.33%. The company's cost structure includes significant general and administrative expenses alongside non-operating expenses.

PE: 5.9x

SThree, a key player in the STEM workforce consultancy sector, recently experienced a drop from major indices like FTSE 250 and FTSE 350 in March 2025. Despite this, insider confidence is evident with share purchases made within the past year. The company faces an anticipated earnings decline of 18% annually over three years. A recent board addition of Paula Coughlan as an Independent Non-Executive Director could bring strategic insights to navigate these challenges amidst its reliance on external borrowing for funding.

- Unlock comprehensive insights into our analysis of SThree stock in this valuation report.

Explore historical data to track SThree's performance over time in our Past section.

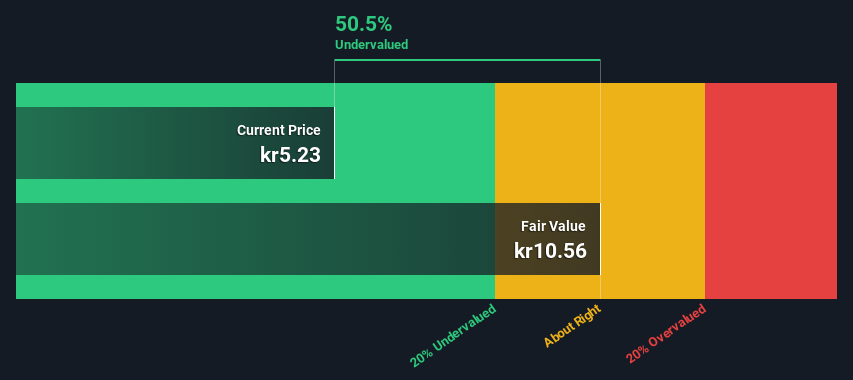

Nyab (OM:NYAB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nyab operates in the heavy construction industry with a focus on large-scale infrastructure projects and has a market cap of €393.48 million.

Operations: The company generates its revenue primarily from heavy construction, with the latest reported revenue at €393.48 million. Over recent periods, the gross profit margin has shown variability, reaching 24.64% in September 2023 before adjusting to 22.87% by March 2025. Operating expenses and cost of goods sold are significant components impacting profitability.

PE: 22.2x

Nyab, a European small-cap company, is gaining traction with significant projects and insider confidence. Recent contracts include a SEK 409 million road reconstruction in Sweden and a SEK 144 million railway project. Despite reporting a net loss of €0.35 million in Q1 2025, sales surged to €106.71 million from €59.17 million the previous year. The company's five-year extension with Aker BP ASA highlights its strategic partnerships in energy sectors, while earnings are forecasted to grow annually by over 19%.

- Click here and access our complete valuation analysis report to understand the dynamics of Nyab.

Understand Nyab's track record by examining our Past report.

Seize The Opportunity

- Reveal the 73 hidden gems among our Undervalued European Small Caps With Insider Buying screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:STEM

SThree

Provides specialist recruitment services in the sciences, technology, engineering, and mathematics markets in the United Kingdom, Austria, Germany, Switzerland, Netherlands, Spain, Belgium, France, the United States, Dubai, Japan, and the United Arab Emirates.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives