- Denmark

- /

- Medical Equipment

- /

- CPSE:EMBLA

Should Embla Medical hf’s Major Ukraine Initiative With Iceland Shift the Outlook for CPSE:EMBLA Investors?

Reviewed by Sasha Jovanovic

- Embla Medical has opened a new prosthetic clinic in Kyiv and, at the opening, announced a three-year partnership with the Government of Iceland to deliver prosthetic care and rehabilitation to up to 1,000 Ukrainian amputees, with a total program value of US$11 million co-financed by both parties and supported by Future for Ukraine.

- This initiative directly addresses Ukraine’s unprecedented need for advanced prosthetic support following the war, highlighting Embla Medical’s commitment to expanding access and infrastructure in a growing humanitarian market.

- We'll explore how Embla's government-backed expansion in Ukraine could impact its investment narrative and long-term international growth potential.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Embla Medical hf Investment Narrative Recap

For investors in Embla Medical hf, the core belief rests on the company’s ability to leverage its advanced prosthetics technologies and partnerships to drive international expansion and capture new markets, all while sustaining leadership in the Prosthetics and Neuro Orthotics segment. The Kyiv clinic and Icelandic partnership may enhance Embla’s humanitarian profile and open new international channels, but the announcement does not materially alter the most important short-term catalyst: the pace of product innovation and new reimbursement approvals in the US and Europe. The largest risk remains the company's reliance on its core prosthetics segment for both revenue and earnings stability, should this engine lose momentum, overall growth could suffer. Among recent announcements, the ongoing share buyback program is especially relevant. The company acquired 50,692 shares between November 3 and 7, 2025, taking total treasury shares held to over 2.5 million. This capital management initiative aims to optimize Embla’s balance sheet and may support shareholder value, but it does not address the need for sustained diversification outside the core neuro-orthotics and prosthetics markets. In contrast, investors should be aware of the business concentration risk if core segment growth unexpectedly slows and…

Read the full narrative on Embla Medical hf (it's free!)

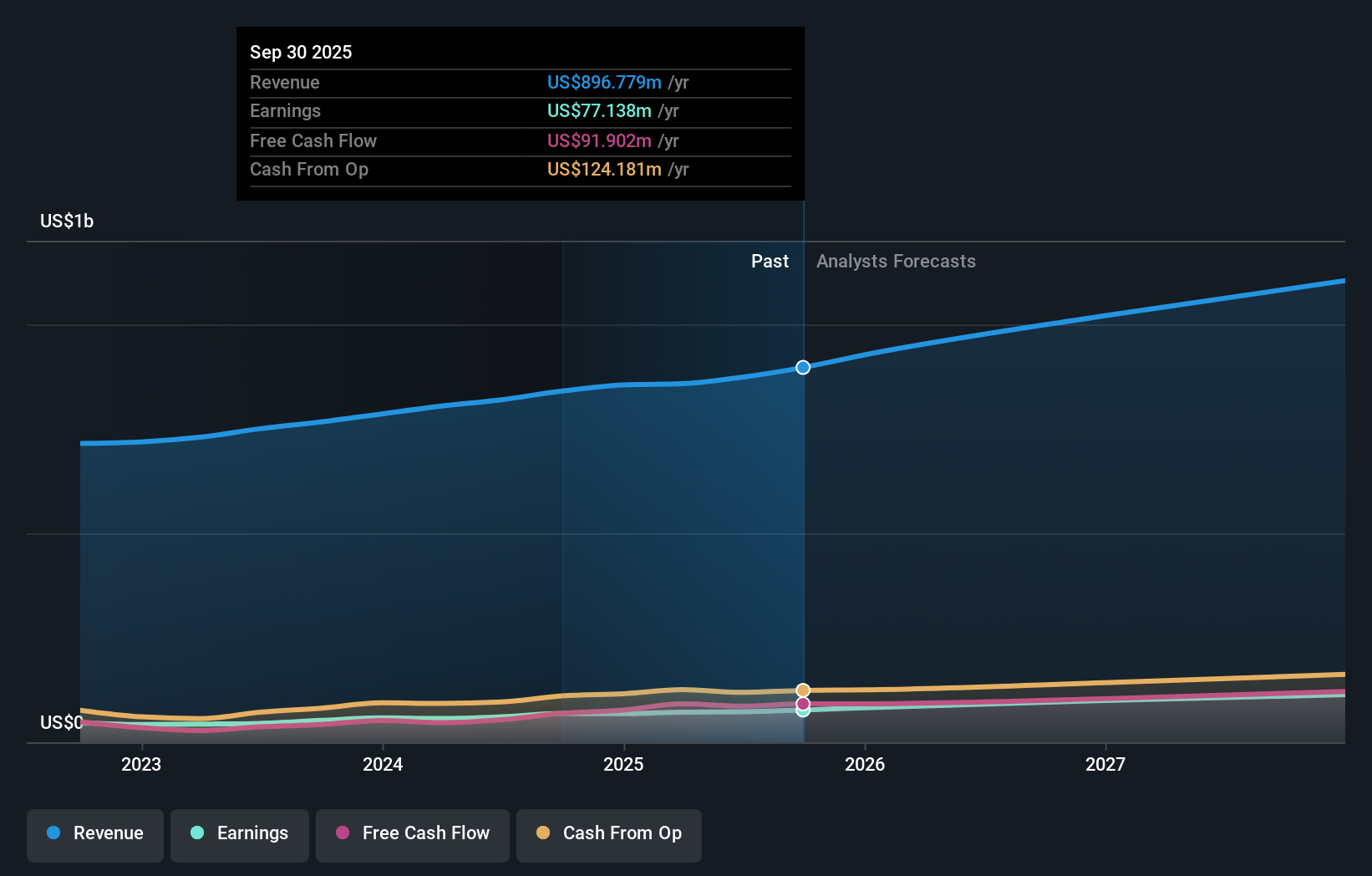

Embla Medical hf's outlook anticipates $1.1 billion in revenue and $112.8 million in earnings by 2028. Achieving this would mean annual revenue growth of 9.0% and a $39.7 million earnings increase from the current $73.1 million.

Uncover how Embla Medical hf's forecasts yield a DKK37.40 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Only one fair value estimate from the Simply Wall St Community pegs Embla Medical at DKK 37.4, suggesting limited diversity of retail opinion. Meanwhile, as Embla focuses on international expansion, its high reliance on a single segment continues to pose challenges for long-term stability.

Explore another fair value estimate on Embla Medical hf - why the stock might be worth just DKK37.40!

Build Your Own Embla Medical hf Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Embla Medical hf research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Embla Medical hf research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Embla Medical hf's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Embla Medical hf might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:EMBLA

Embla Medical hf

Provides non-invasive orthopedic products in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives