- Denmark

- /

- Medical Equipment

- /

- CPSE:EMBLA

0.7% earnings growth over 5 years has not materialized into gains for Embla Medical hf (CPH:EMBLA) shareholders over that period

While it may not be enough for some shareholders, we think it is good to see the Embla Medical hf. (CPH:EMBLA) share price up 20% in a single quarter. But over the last half decade, the stock has not performed well. In fact, the share price is down 28%, which falls well short of the return you could get by buying an index fund.

If the past week is anything to go by, investor sentiment for Embla Medical hf isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

While the share price declined over five years, Embla Medical hf actually managed to increase EPS by an average of 3.7% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

Based on these numbers, we'd venture that the market may have been over-optimistic about forecast growth, half a decade ago. Having said that, we might get a better idea of what's going on with the stock by looking at other metrics.

Revenue is actually up 6.0% over the time period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

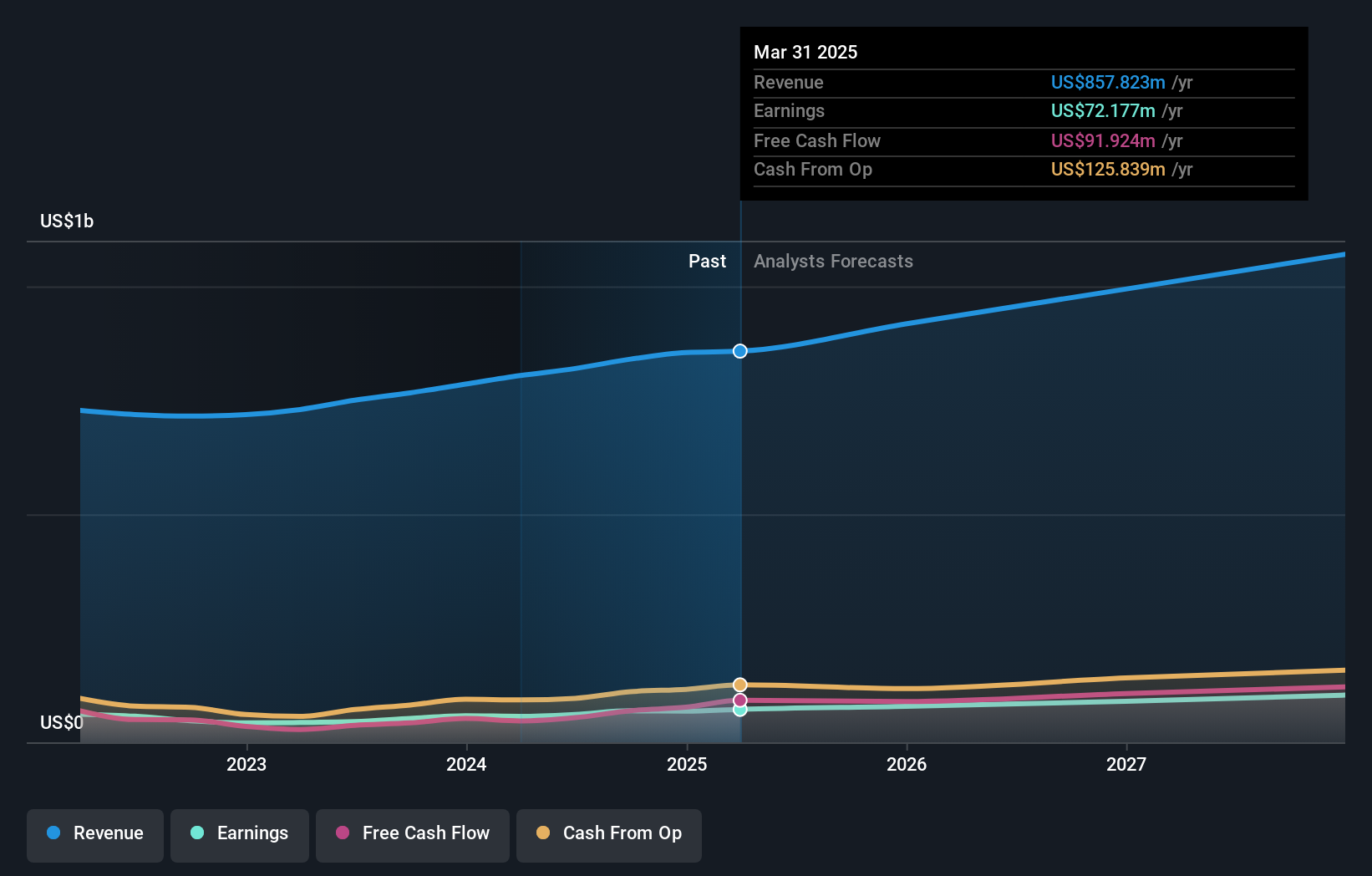

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think Embla Medical hf will earn in the future (free profit forecasts).

A Different Perspective

It's nice to see that Embla Medical hf shareholders have received a total shareholder return of 16% over the last year. Notably the five-year annualised TSR loss of 5% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for Embla Medical hf that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Danish exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Embla Medical hf might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:EMBLA

Embla Medical hf

Provides non-invasive orthopedic products in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives