European Value Stocks Offering Estimated Discount Opportunities

Reviewed by Simply Wall St

As European markets navigate a landscape of mixed performance, with the STOXX Europe 600 Index ending slightly lower amid varied national index results, investors are closely evaluating monetary policy decisions and their potential impacts. In this environment, identifying undervalued stocks becomes crucial as these opportunities may offer significant potential for growth when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK42.30 | SEK82.19 | 48.5% |

| Trifork Group (CPSE:TRIFOR) | DKK87.60 | DKK171.39 | 48.9% |

| Talenom Oyj (HLSE:TNOM) | €3.70 | €7.19 | 48.5% |

| Stille (OM:STIL) | SEK206.00 | SEK403.06 | 48.9% |

| Prosegur Cash (BME:CASH) | €0.716 | €1.39 | 48.4% |

| Noratis (XTRA:NUVA) | €0.785 | €1.56 | 49.6% |

| E-Globe (BIT:EGB) | €0.68 | €1.32 | 48.4% |

| ATON Green Storage (BIT:ATON) | €2.11 | €4.09 | 48.5% |

| Atea (OB:ATEA) | NOK143.20 | NOK280.41 | 48.9% |

| adidas (XTRA:ADS) | €184.75 | €369.09 | 49.9% |

Let's uncover some gems from our specialized screener.

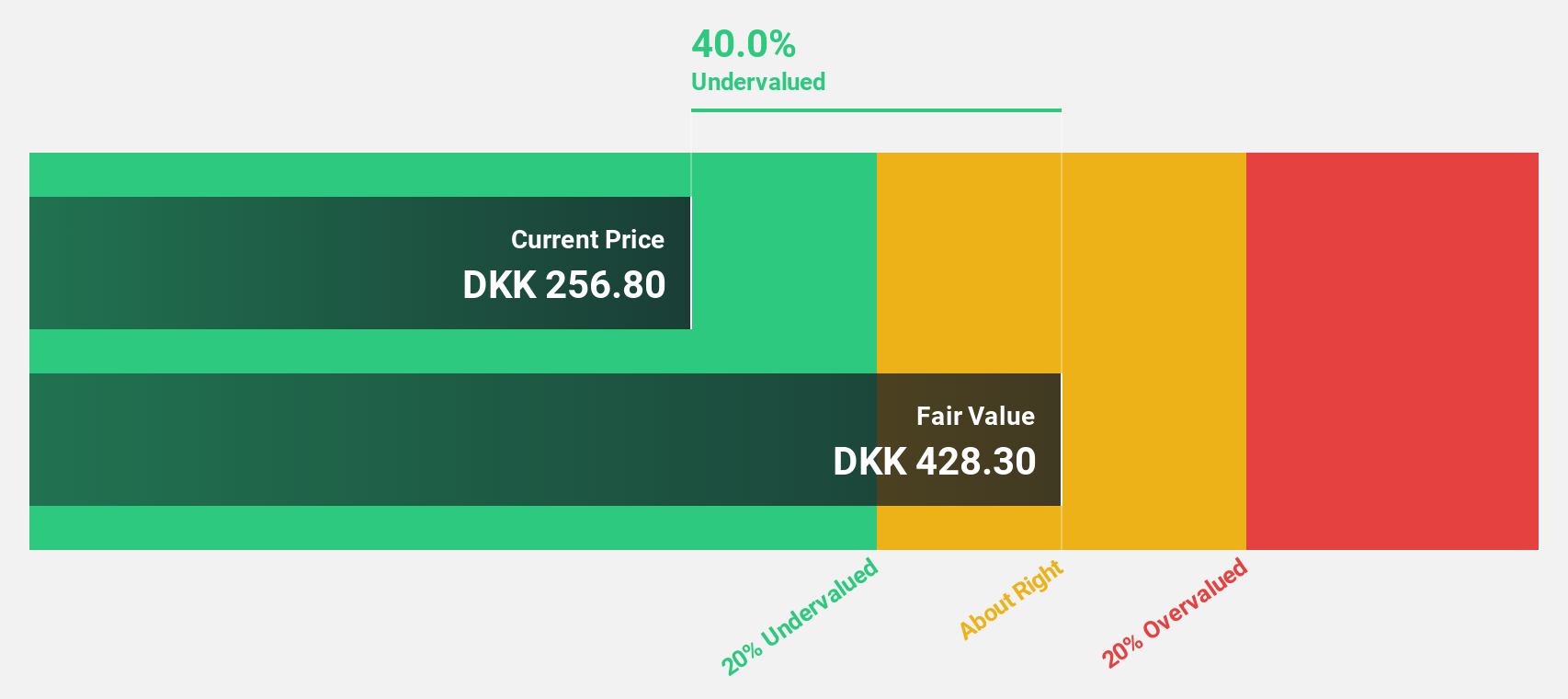

Demant (CPSE:DEMANT)

Overview: Demant A/S is a hearing healthcare company with operations across Europe, North America, Asia, the Pacific region, and internationally, boasting a market cap of DKK50.61 billion.

Operations: The company generates revenue primarily from its Hearing Healthcare segment, which amounts to DKK22.59 billion.

Estimated Discount To Fair Value: 45.2%

Demant is trading at DKK237.6, significantly below its estimated fair value of DKK433.43, suggesting it may be undervalued based on cash flows. The company's earnings are forecast to grow at 11.4% annually, outpacing the Danish market average of 3.8%. However, Demant faces challenges with high debt levels and recently lowered its earnings guidance for 2025. Despite these hurdles, analysts expect a stock price increase of approximately 23.4%.

- The analysis detailed in our Demant growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Demant.

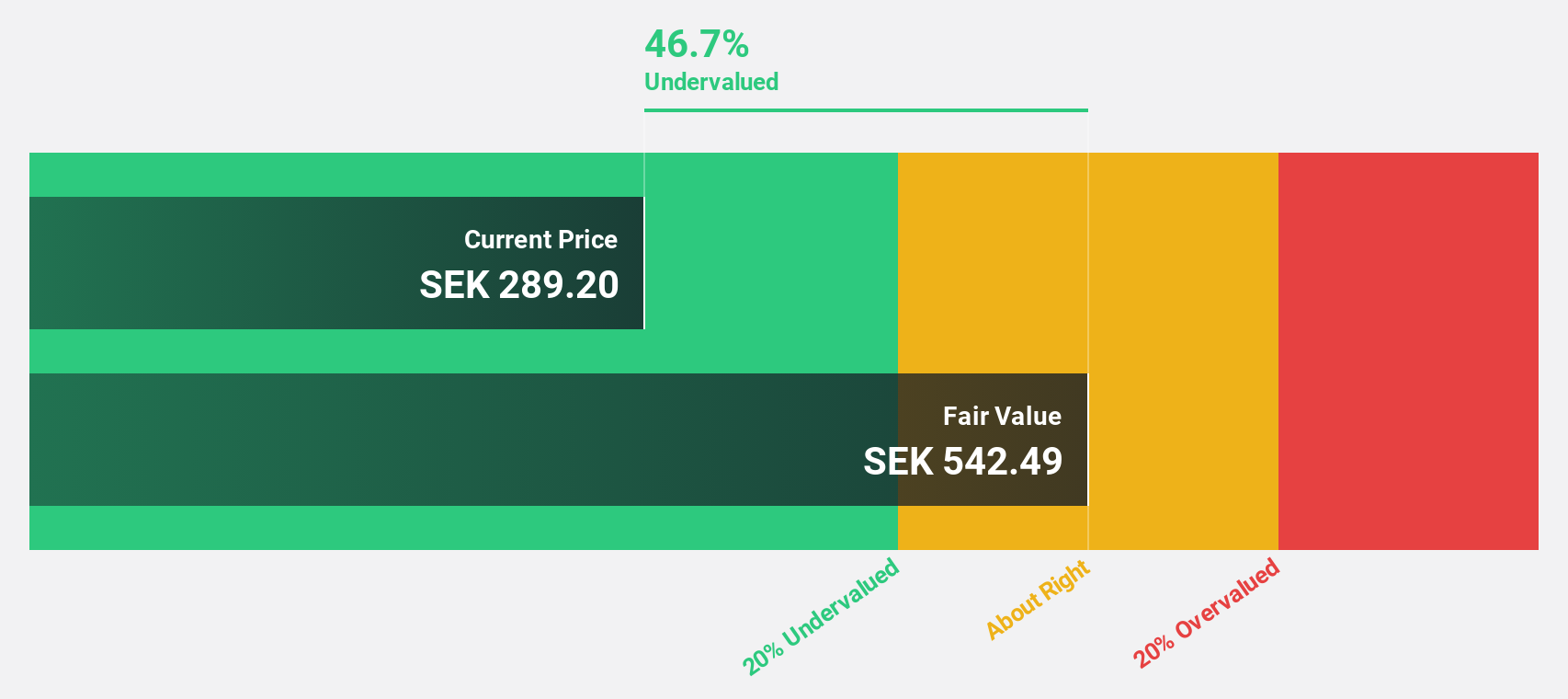

Bonesupport Holding (OM:BONEX)

Overview: Bonesupport Holding AB is an orthobiologics company that develops and sells injectable bio-ceramic bone graft substitutes across Europe, North America, and internationally, with a market cap of SEK19.77 billion.

Operations: The company generates revenue from its pharmaceuticals segment, totaling SEK1.06 billion.

Estimated Discount To Fair Value: 35%

Bonesupport Holding is trading at SEK300.2, considerably below its estimated fair value of SEK461.71, highlighting potential undervaluation based on cash flows. The company's earnings are forecast to grow significantly at 59.4% annually, surpassing the Swedish market's average growth rate of 16.5%. Recent positive clinical study results for CERAMENT® G could enhance market confidence and support future revenue growth projections of 25.3% per year, despite a decline in profit margins from last year.

- Our comprehensive growth report raises the possibility that Bonesupport Holding is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Bonesupport Holding.

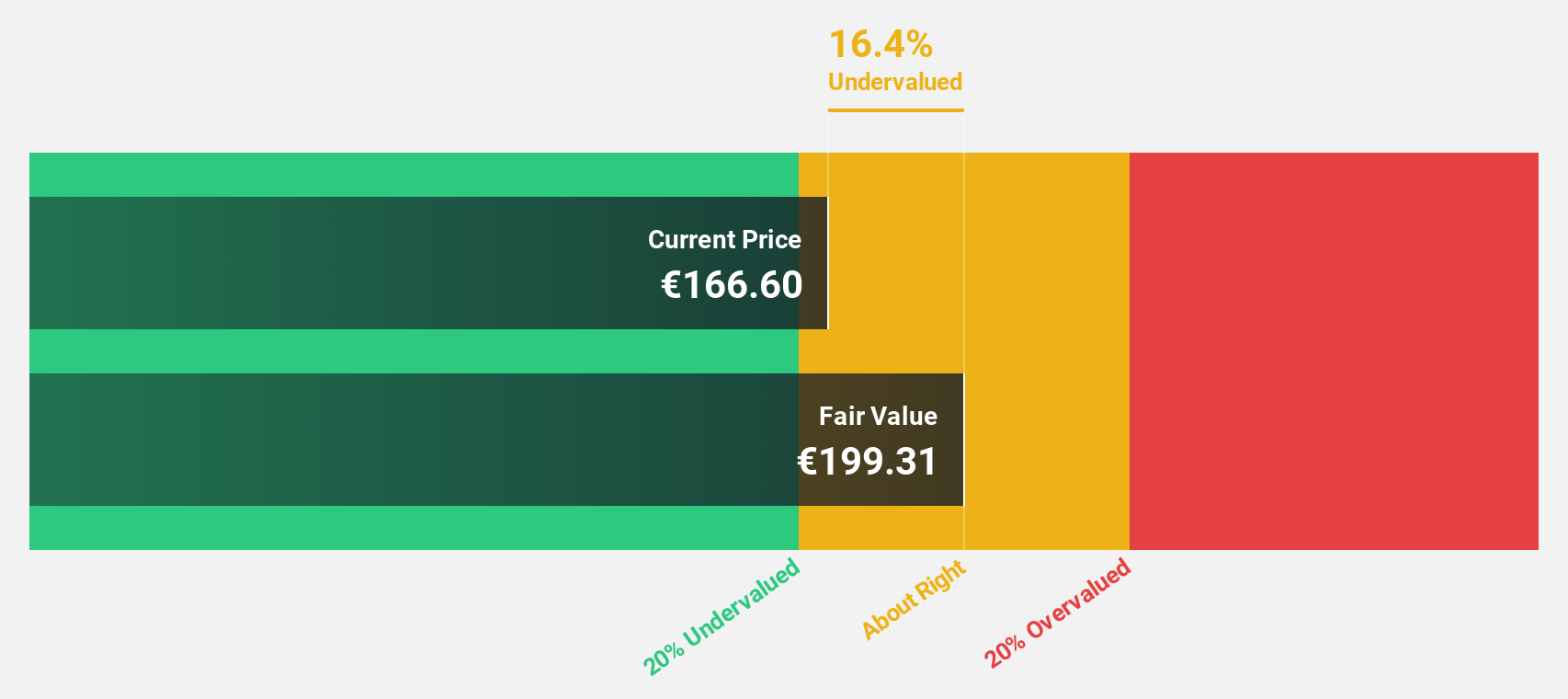

AlzChem Group (XTRA:ACT)

Overview: AlzChem Group AG, with a market cap of €1.47 billion, develops, produces, and markets a variety of chemical specialties across Germany, the European Union, the rest of Europe, Asia, the NAFTA region, and internationally.

Operations: The company generates revenue through its Specialty Chemicals segment, which accounts for €363.96 million, and its Basics & Intermediates segment, contributing €161.10 million.

Estimated Discount To Fair Value: 38.5%

AlzChem Group is trading at €145, significantly below its estimated fair value of €235.82, suggesting undervaluation based on cash flows. The company's earnings grew by 25% last year and are forecast to grow at 17.38% annually, outpacing the German market's average growth rate of 16.9%. Recent M&A activity with Staluna Trade A.S., acquiring a 9.71% stake, may influence future strategic directions and enhance shareholder value.

- The growth report we've compiled suggests that AlzChem Group's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of AlzChem Group stock in this financial health report.

Make It Happen

- Click here to access our complete index of 209 Undervalued European Stocks Based On Cash Flows.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ACT

AlzChem Group

Develops, produces, and markets a range of chemical specialties in Germany, European Union, rest of Europe, Asia, NAFTA region, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives