Earnings Update: Royal Unibrew A/S Beat Earnings And Now Analysts Have New Forecasts For This Year

Royal Unibrew A/S (CPH:RBREW) investors will be delighted, with the company turning in some strong numbers with its latest results. Results were good overall, with revenues beating analyst predictions by 5.9% to hit kr.3.2b. Statutory earnings per share (EPS) came in at kr.2.00, some 6.7% above whatthe analysts had expected. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

Check out our latest analysis for Royal Unibrew

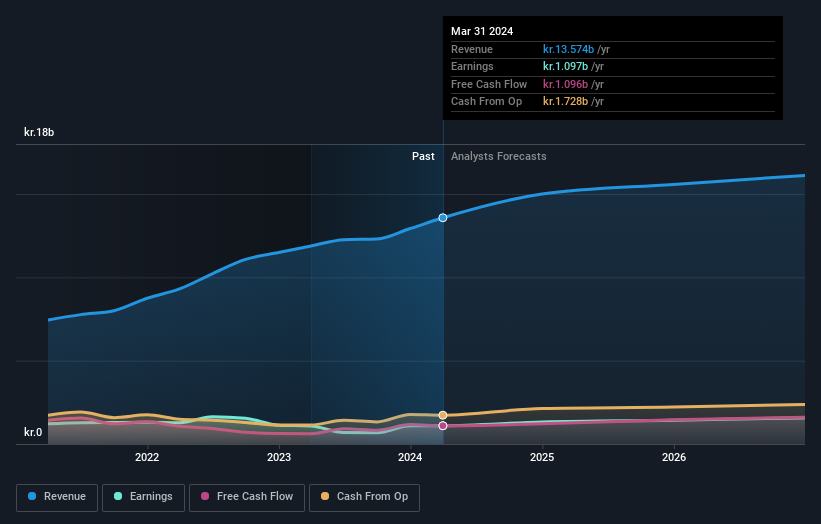

Taking into account the latest results, the most recent consensus for Royal Unibrew from nine analysts is for revenues of kr.15.0b in 2024. If met, it would imply a notable 10% increase on its revenue over the past 12 months. Statutory earnings per share are predicted to soar 21% to kr.26.52. In the lead-up to this report, the analysts had been modelling revenues of kr.14.9b and earnings per share (EPS) of kr.24.86 in 2024. The analysts seems to have become more bullish on the business, judging by their new earnings per share estimates.

There's been no major changes to the consensus price target of kr.513, suggesting that the improved earnings per share outlook is not enough to have a long-term positive impact on the stock's valuation. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values Royal Unibrew at kr.655 per share, while the most bearish prices it at kr.350. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await Royal Unibrew shareholders.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. We can infer from the latest estimates that forecasts expect a continuation of Royal Unibrew'shistorical trends, as the 14% annualised revenue growth to the end of 2024 is roughly in line with the 14% annual growth over the past five years. Compare this with the broader industry, which analyst estimates (in aggregate) suggest will see revenues grow 4.6% annually. So although Royal Unibrew is expected to maintain its revenue growth rate, it's definitely expected to grow faster than the wider industry.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Royal Unibrew following these results. Happily, there were no major changes to revenue forecasts, with the business still expected to grow faster than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that in mind, we wouldn't be too quick to come to a conclusion on Royal Unibrew. Long-term earnings power is much more important than next year's profits. We have forecasts for Royal Unibrew going out to 2026, and you can see them free on our platform here.

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Royal Unibrew , and understanding them should be part of your investment process.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:RBREW

Royal Unibrew

Provides beer, soft drinks, malt beverages, energy drinks, cider/ready to drink, juice, water, and wine and spirits.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success