- Denmark

- /

- Hospitality

- /

- CPSE:AAB

There Are Some Holes In Aalborg Boldspilklub's (CPH:AAB) Solid Earnings Release

Aalborg Boldspilklub A/S (CPH:AAB) posted some decent earnings, but shareholders didn't react strongly. We think that they might be concerned about some underlying details that our analysis found.

View our latest analysis for Aalborg Boldspilklub

A Closer Look At Aalborg Boldspilklub's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

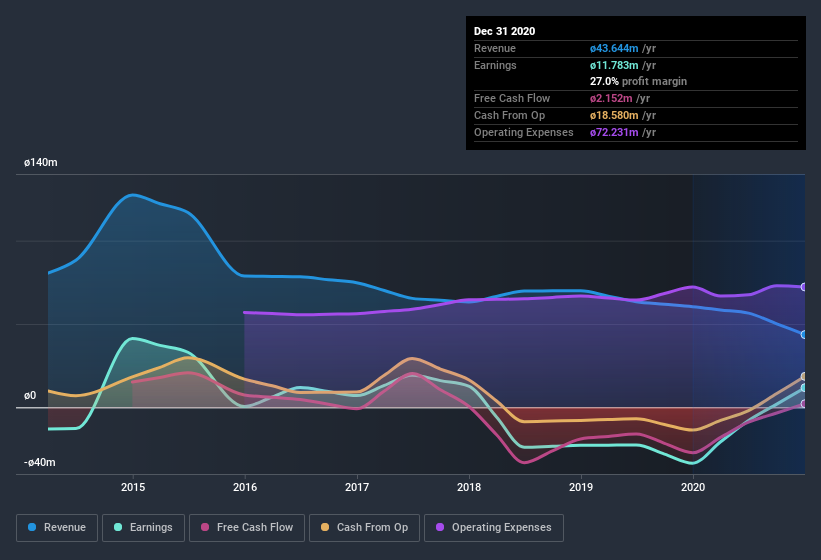

Aalborg Boldspilklub has an accrual ratio of 0.23 for the year to December 2020. Unfortunately, that means its free cash flow fell significantly short of its reported profits. In fact, it had free cash flow of kr.2.2m in the last year, which was a lot less than its statutory profit of kr.11.8m. Notably, Aalborg Boldspilklub had negative free cash flow last year, so the kr.2.2m it produced this year was a welcome improvement. However, that's not the end of the story. We can look at how unusual items in the profit and loss statement impacted its accrual ratio, as well as explore how dilution is impacting shareholders negatively. The good news for shareholders is that Aalborg Boldspilklub's accrual ratio was much better last year, so this year's poor reading might simply be a case of a short term mismatch between profit and FCF. As a result, some shareholders may be looking for stronger cash conversion in the current year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Aalborg Boldspilklub.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. As it happens, Aalborg Boldspilklub issued 191% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. Check out Aalborg Boldspilklub's historical EPS growth by clicking on this link.

A Look At The Impact Of Aalborg Boldspilklub's Dilution on Its Earnings Per Share (EPS).

As it happens, we don't know how much the company made or lost three years ago, because we don't have the data. And even focusing only on the last twelve months, we don't have a meaningful growth rate because it made a loss a year ago, too. But mathematics aside, it is always good to see when a formerly unprofitable business come good (though we accept profit would have been higher if dilution had not been required). Therefore, one can observe that the dilution is having a fairly profound effect on shareholder returns.

If Aalborg Boldspilklub's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

How Do Unusual Items Influence Profit?

Given the accrual ratio, it's not overly surprising that Aalborg Boldspilklub's profit was boosted by unusual items worth kr.22m in the last twelve months. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And, after all, that's exactly what the accounting terminology implies. We can see that Aalborg Boldspilklub's positive unusual items were quite significant relative to its profit in the year to December 2020. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On Aalborg Boldspilklub's Profit Performance

In conclusion, Aalborg Boldspilklub's weak accrual ratio suggested its statutory earnings have been inflated by the unusual items. Meanwhile, the new shares issued mean that shareholders now own less of the company, unless they tipped in more cash themselves. On reflection, the above-mentioned factors give us the strong impression that Aalborg Boldspilklub'sunderlying earnings power is not as good as it might seem, based on the statutory profit numbers. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. Case in point: We've spotted 3 warning signs for Aalborg Boldspilklub you should be aware of.

Our examination of Aalborg Boldspilklub has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Aalborg Boldspilklub, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CPSE:AAB

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives