- Denmark

- /

- Electrical

- /

- CPSE:VWS

A Fresh German Order for Vestas (CPSE:VWS): What the Latest Pipeline Boost Means for Valuation

Reviewed by Simply Wall St

Vestas Wind Systems (CPSE:VWS) just landed a fresh order that is bound to catch the eye of investors weighing their next move. The company announced a deal with Energiekontor AG in Germany, supplying 13 of its V162-7.2MW turbines and committing to a long-term, 20-year service agreement. While this order itself may not shift the industry's foundations, the combination of scale and a substantial service window signals ongoing appetite for Vestas’ solutions in the key EMEA region. This can be seen as an encouraging indicator for future growth prospects.

This news arrives as Vestas continues to rebuild momentum. After a challenging year, with shares still down 15% over the past 12 months, the stock has shown signs of recovery, climbing 14% in the past 3 months and up 20% year to date. Recent quarterly results also showed annual revenue and net income growth, hinting at gradually improving fundamentals beneath the surface. For investors keeping score, the latest order adds another pillar to Vestas’ project backlog and helps reinforce the story of a company regaining its stride in a complex energy market.

With shares still below highs and new contracts flowing in, is Vestas now trading at a discount, or has the market already factored in a return to growth?

Most Popular Narrative: 10.6% Undervalued

The most widely followed narrative currently contends that Vestas Wind Systems is trading below its estimated fair value, with a calculated discount of 10.6%. This view is based on analyst projections of multi-year growth, margin recovery, and global industry support. Using a discount rate of 7.1%, the narrative points to long-term catalysts and future earnings potential as key drivers behind the valuation.

Global prioritization of energy security and sustainability, with many governments accelerating grid investments and permitting reforms (for example, Germany, UK, and EU-wide alignment), is expanding Vestas' addressable market and could materially increase order volume and top-line growth.

Want to know what ambitious assumptions power this bullish outlook? The valuation narrative leans on expectations of a step-change in earnings and margin growth. Curious about the specific financial milestones analysts believe Vestas can hit? Keep reading, because the full story behind this valuation hinges on forecasts you may find surprising.

Result: Fair Value of DKK140.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, order intake volatility and steep offshore ramp-up costs remain significant headwinds. These factors remind investors that Vestas’s recovery path is not without challenges.

Find out about the key risks to this Vestas Wind Systems narrative.Another View: Discounted Cash Flow Perspective

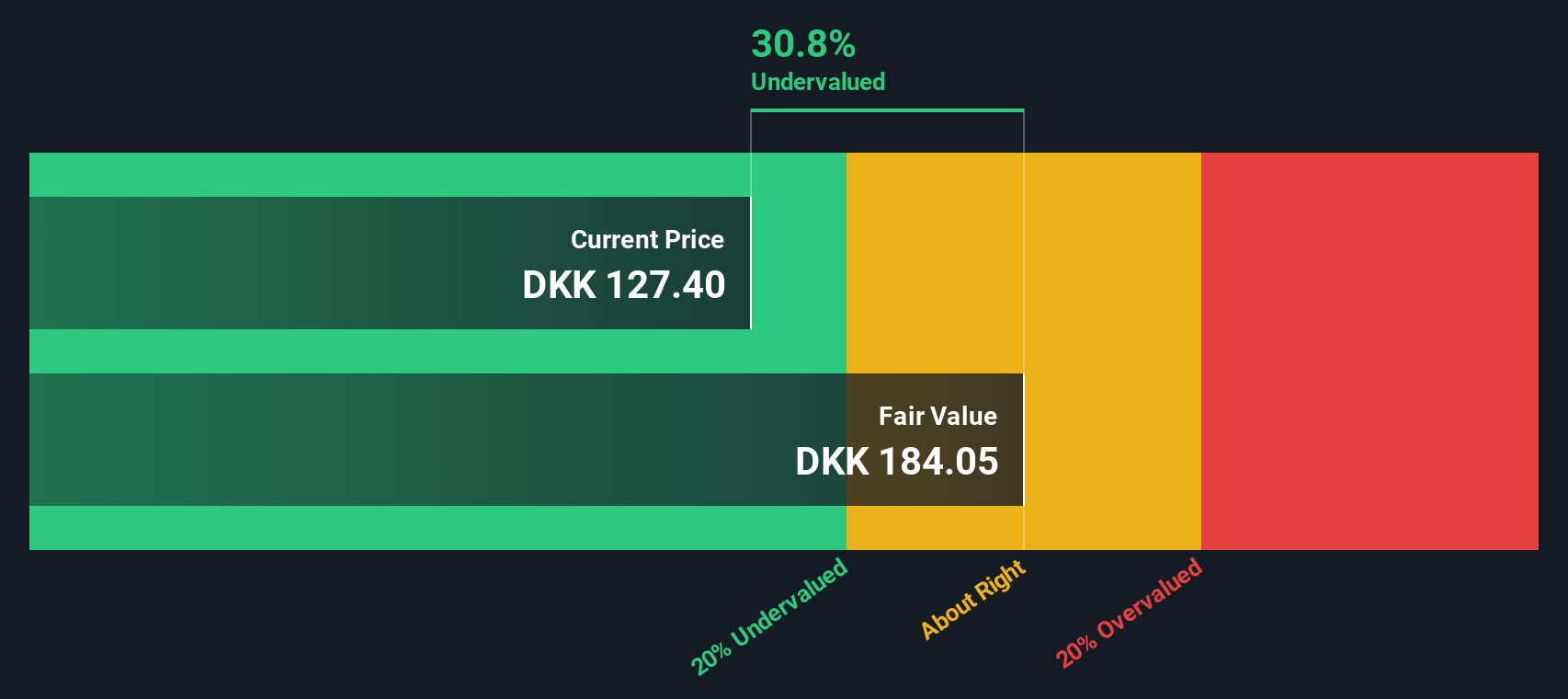

Looking through the lens of our SWS DCF model, Vestas appears undervalued by a notable margin. This alternative approach examines future cash flows instead of current earnings multiples. However, can two positive signals really tell the whole story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Vestas Wind Systems Narrative

If you have your own perspective or wish to dig into the numbers yourself, you can easily craft your own analysis in just a few minutes. Do it your way

A great starting point for your Vestas Wind Systems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Thousands of active investors are already unlocking fresh opportunities with our screeners. Don’t sit on the sidelines. Find your next portfolio star before everyone else.

- Catch companies building the future of medicine and technology with our healthcare AI showcase: healthcare AI stocks

- Start earning more with reliable payouts by checking out stocks that boast yields above 3 percent: dividend stocks with yields > 3%

- Spot emerging tech breakthroughs in quantum computing that most are missing: quantum computing stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About CPSE:VWS

Vestas Wind Systems

Engages in the design, manufacture, installation, and services of wind turbines the United States, Denmark, and internationally.

Outstanding track record and good value.

Similar Companies

Market Insights

Community Narratives