3 European Stocks That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

As European markets experience a notable upswing, with the STOXX Europe 600 Index and major national indices showing gains, investors are increasingly attentive to opportunities that may arise from these favorable conditions. In this context, identifying stocks that might be priced below their estimated value becomes particularly relevant, as they could offer potential for growth in a strengthening market environment.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Pandora (CPSE:PNDORA) | DKK889.40 | DKK1746.81 | 49.1% |

| Nordisk Bergteknik (OM:NORB B) | SEK11.80 | SEK23.59 | 50% |

| Lingotes Especiales (BME:LGT) | €5.60 | €11.03 | 49.2% |

| Hanza (OM:HANZA) | SEK130.80 | SEK258.42 | 49.4% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.36 | €0.71 | 49% |

| Cicor Technologies (SWX:CICN) | CHF194.50 | CHF385.42 | 49.5% |

| Axfood (OM:AXFO) | SEK263.20 | SEK516.03 | 49% |

| Atea (OB:ATEA) | NOK151.00 | NOK297.80 | 49.3% |

| ArcticZymes Technologies (OB:AZT) | NOK30.00 | NOK59.57 | 49.6% |

| Absolent Air Care Group (OM:ABSO) | SEK238.00 | SEK472.18 | 49.6% |

Let's take a closer look at a couple of our picks from the screened companies.

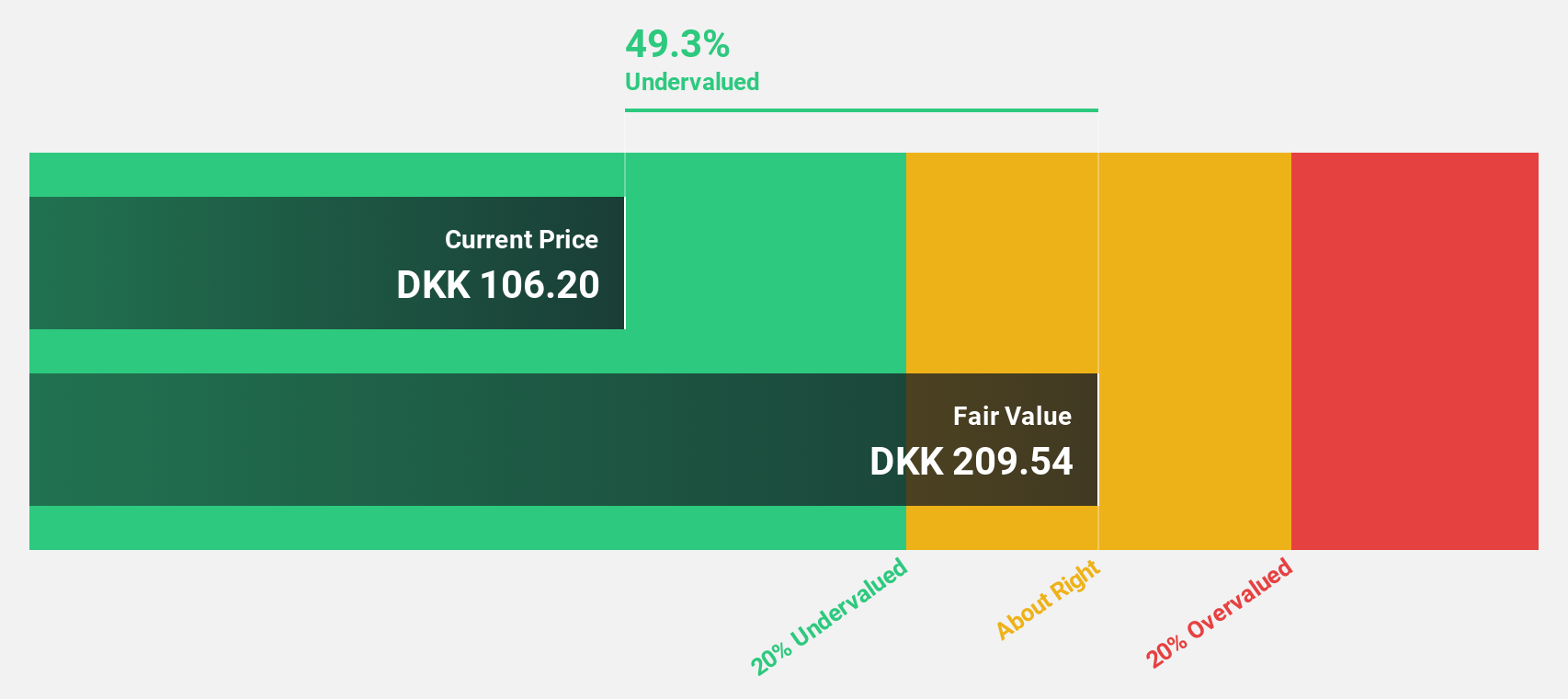

Vestas Wind Systems (CPSE:VWS)

Overview: Vestas Wind Systems A/S is involved in the design, manufacture, installation, and servicing of wind turbines across the United States, Denmark, and internationally with a market cap of DKK124.92 billion.

Operations: Vestas generates revenue through its Service segment, which accounts for €3.99 billion, and its Power Solutions segment, contributing €14.54 billion.

Estimated Discount To Fair Value: 31.5%

Vestas Wind Systems is trading at a significant discount, over 31% below its estimated fair value of DKK182.6, driven by robust cash flow projections. The company recently turned profitable and forecasts suggest revenue growth will outpace the Danish market. However, recent share price volatility may concern some investors. Vestas has secured multiple wind energy orders across Europe and North America, highlighting its strong market position and ability to deliver advanced turbine technology solutions.

- Upon reviewing our latest growth report, Vestas Wind Systems' projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Vestas Wind Systems.

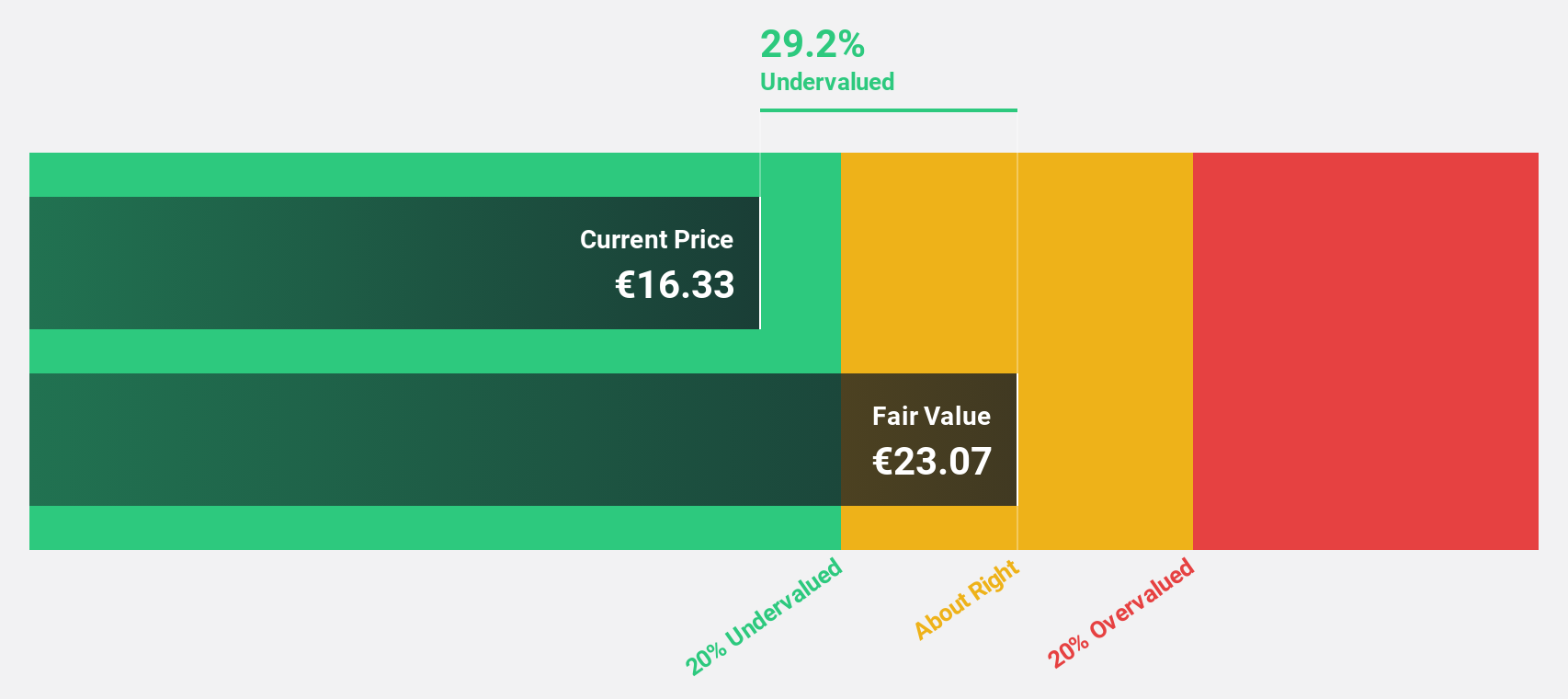

CVC Capital Partners (ENXTAM:CVC)

Overview: CVC Capital Partners plc is a private equity and venture capital firm focusing on middle market secondaries, infrastructure, credit, management buyouts, leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales and spinouts with a market cap of €15.96 billion.

Operations: The company's revenue segments consist of Credit (€197.65 million), Secondaries (€124.38 million), and Private Equity (€951.11 million).

Estimated Discount To Fair Value: 14.9%

CVC Capital Partners is trading at a 14.9% discount to its estimated fair value of €17.64, with earnings expected to grow faster than the Dutch market at 15.2% annually. Despite high debt levels, CVC's revenue growth forecast of 9.1% per year surpasses the broader Dutch market. Recent earnings showed significant improvement, with net income rising from €44.79 million to €573.73 million year-on-year, underscoring strong cash flow potential amidst ongoing M&A activities and strategic exits.

- Our expertly prepared growth report on CVC Capital Partners implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of CVC Capital Partners with our comprehensive financial health report here.

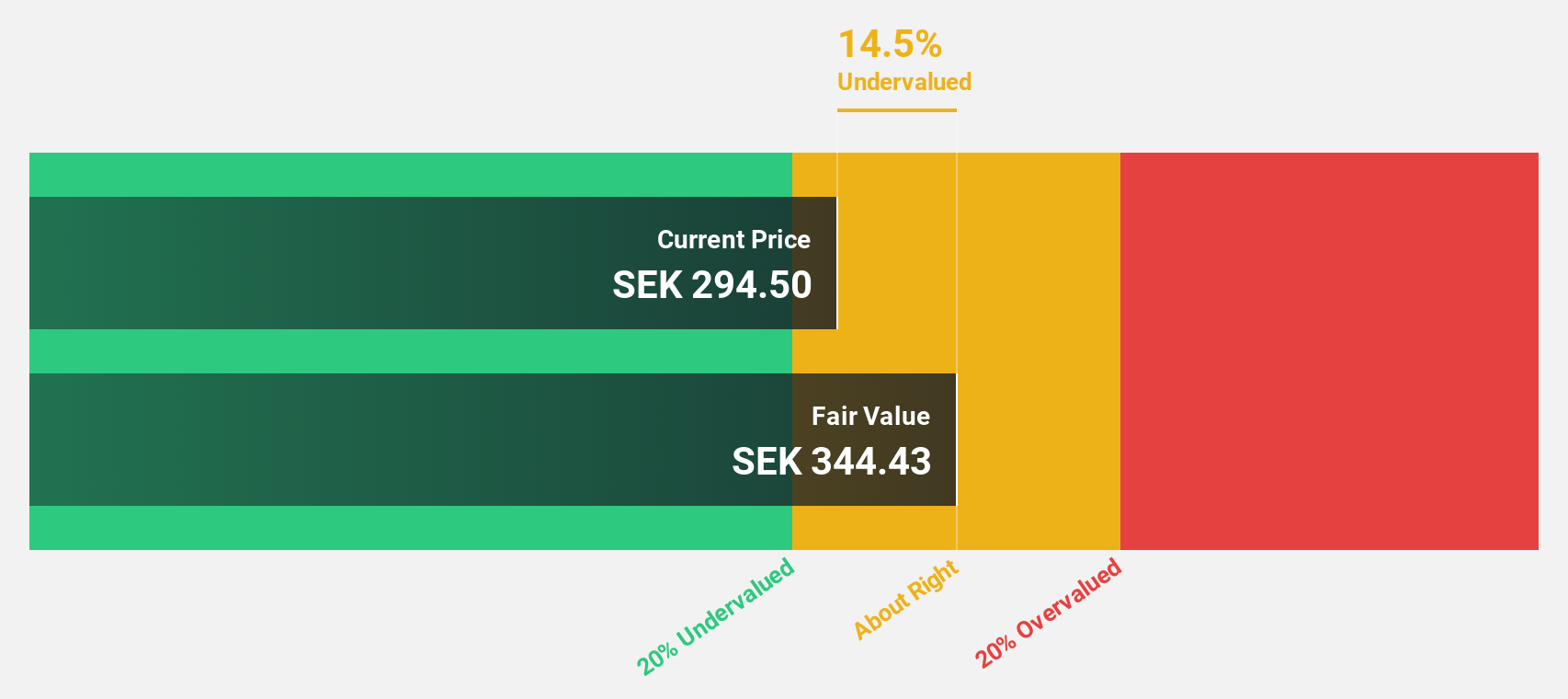

Beijer Alma (OM:BEIA B)

Overview: Beijer Alma AB (publ) operates in component manufacturing and industrial trading across Sweden, the Nordic Region, Europe, North America, Asia, and internationally with a market cap of SEK16.60 billion.

Operations: Beijer Alma generates revenue through its component manufacturing and industrial trading activities across Sweden, the Nordic Region, Europe, North America, Asia, and other international markets.

Estimated Discount To Fair Value: 15.9%

Beijer Alma is trading at a 15.9% discount to its fair value of SEK 327.73, despite forecasts of significant earnings growth at 22.6% annually, outpacing the Swedish market. However, recent earnings results showed a decline in net income and profit margins compared to last year, with Q3 net income dropping from SEK 303 million to SEK 176 million. While revenue growth is expected above market rates, high debt levels remain a concern for investors.

- Our comprehensive growth report raises the possibility that Beijer Alma is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Beijer Alma's balance sheet health report.

Where To Now?

- Dive into all 216 of the Undervalued European Stocks Based On Cash Flows we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijer Alma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BEIA B

Beijer Alma

Engages in component manufacturing and industrial trading businesses in Sweden, rest of Nordic Region, rest of Europe, North America, Asia, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives