- Denmark

- /

- Trade Distributors

- /

- CPSE:SOLAR B

Solar A/S (CPH:SOLAR B) Stock Rockets 28% As Investors Are Less Pessimistic Than Expected

Solar A/S (CPH:SOLAR B) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 12% over that time.

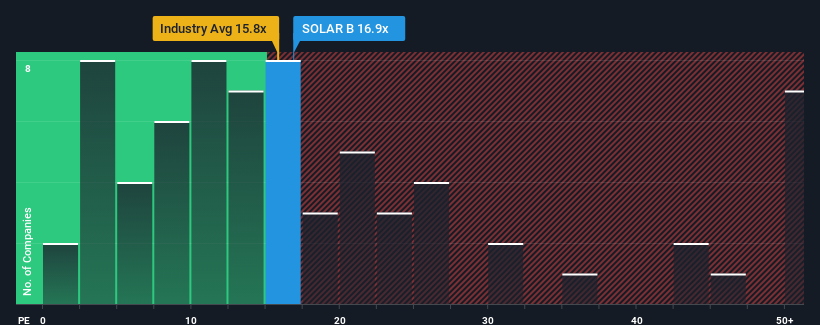

In spite of the firm bounce in price, it's still not a stretch to say that Solar's price-to-earnings (or "P/E") ratio of 16.9x right now seems quite "middle-of-the-road" compared to the market in Denmark, where the median P/E ratio is around 15x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Our free stock report includes 4 warning signs investors should be aware of before investing in Solar. Read for free now.While the market has experienced earnings growth lately, Solar's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Solar

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Solar's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 34% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 78% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the only analyst covering the company suggest earnings growth is heading into negative territory, declining 24% over the next year. That's not great when the rest of the market is expected to grow by 9.6%.

In light of this, it's somewhat alarming that Solar's P/E sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

What We Can Learn From Solar's P/E?

Its shares have lifted substantially and now Solar's P/E is also back up to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Solar currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Plus, you should also learn about these 4 warning signs we've spotted with Solar.

If these risks are making you reconsider your opinion on Solar, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:SOLAR B

Solar

Operates as a sourcing and services company in electrical, heating and plumbing, ventilation, and climate and energy solutions in the Danish, Swedish, Norwegian, and Dutch markets.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives