- Denmark

- /

- Construction

- /

- CPSE:MTHH

Announcing: MT Højgaard Holding (CPH:MTHH) Stock Increased An Energizing 113% In The Last Year

When you buy shares in a company, there is always a risk that the price drops to zero. But if you pick the right business to buy shares in, you can make more than you can lose. Take, for example MT Højgaard Holding A/S (CPH:MTHH). Its share price is already up an impressive 113% in the last twelve months. Also pleasing for shareholders was the 41% gain in the last three months. The longer term returns have not been as good, with the stock price only 0.9% higher than it was three years ago.

View our latest analysis for MT Højgaard Holding

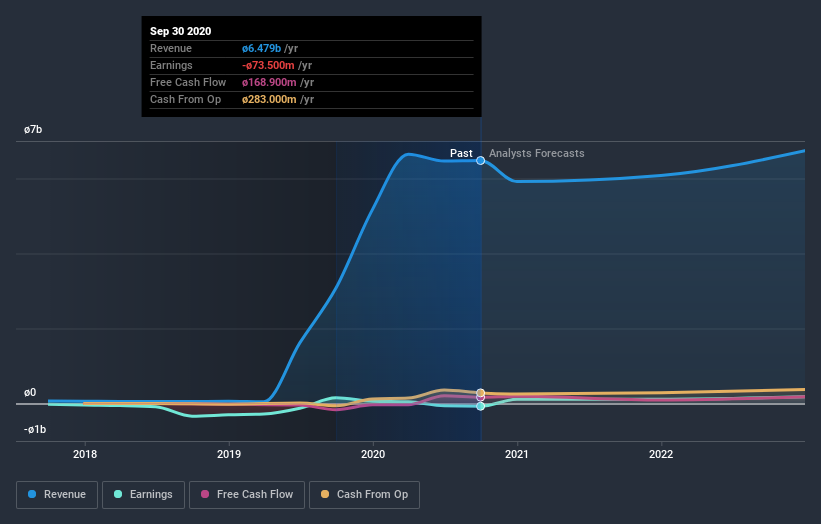

Because MT Højgaard Holding made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last twelve months, MT Højgaard Holding's revenue grew by 109%. That's a head and shoulders above most loss-making companies. And the share price has responded, gaining 113% as we previously mentioned. It's great to see strong revenue growth, but the question is whether it can be sustained. The strong share price rise indicates optimism, so there may be a better opportunity for buyers as the hype fades a bit.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at MT Højgaard Holding's financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that MT Højgaard Holding shareholders have received a total shareholder return of 113% over one year. Notably the five-year annualised TSR loss of 9% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that MT Højgaard Holding is showing 1 warning sign in our investment analysis , you should know about...

Of course MT Højgaard Holding may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DK exchanges.

If you decide to trade MT Højgaard Holding, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CPSE:MTHH

MT Højgaard Holding

Engages in the provision of construction, civil engineering, and infrastructure services for private and public customers in Denmark and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026