Is FLSmidth Still Attractive After 39% Share Price Surge and Project Wins?

Reviewed by Bailey Pemberton

- Thinking about whether FLSmidth stock is a bargain, or perhaps getting a bit pricey? Let’s take a closer look at what’s really going on beneath the surface.

- Over the last year, FLSmidth’s share price has surged 39.4%, and it’s up a remarkable 34.5% year-to-date, even after a recent dip of 5.2% in the last week.

- One driver for these moves has been ongoing sector consolidation news and recent project wins, fueling optimism around future growth and improved margins. In the same period, market sentiment has also grown stronger as sustainable technology and mining demand continue to headline industry developments.

- Currently, FLSmidth scores 1 out of 6 for undervaluation checks, so it may not look like a screaming buy on the surface, but traditional methods only tell part of the story. In the following sections, we will look more closely at these methods and consider additional ways to uncover value.

FLSmidth scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: FLSmidth Discounted Cash Flow (DCF) Analysis

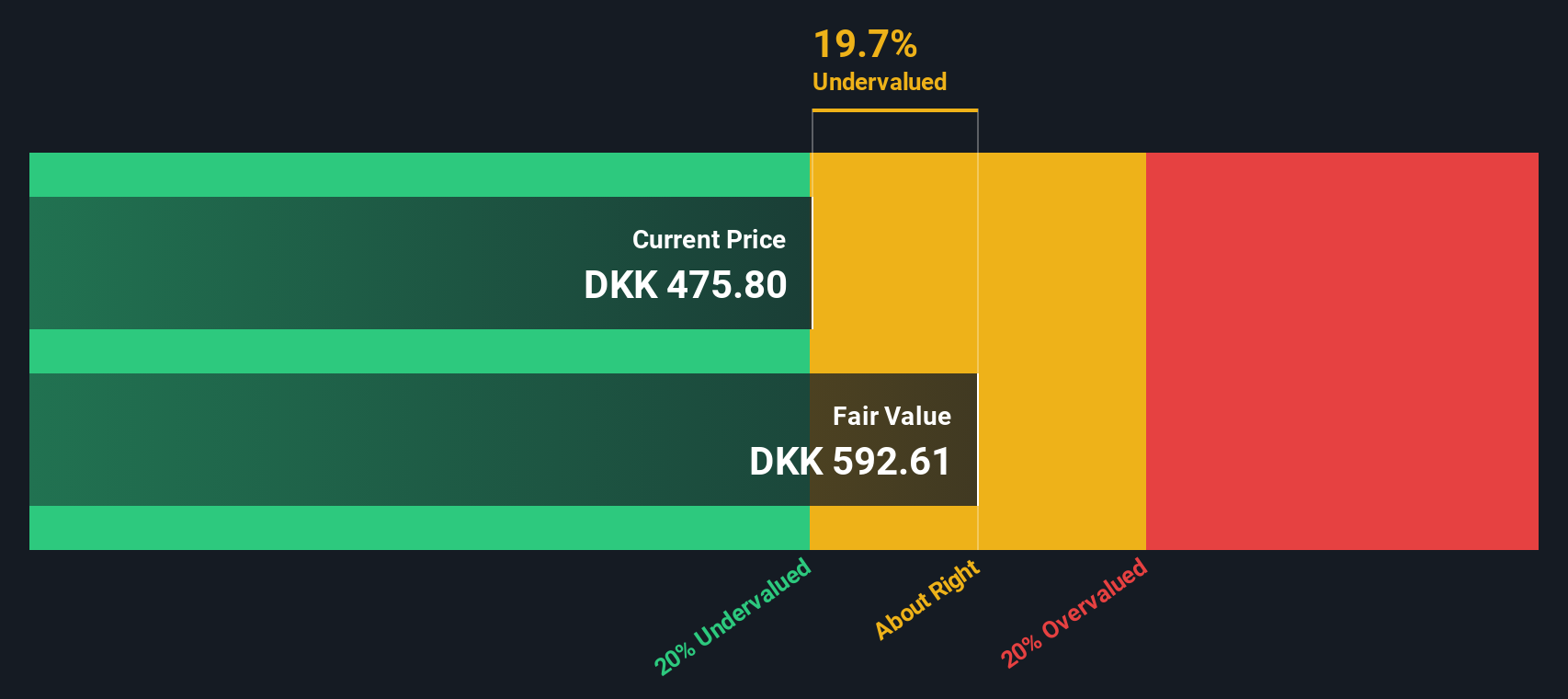

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. This process helps investors judge whether shares are undervalued or overvalued compared to the current market price.

For FLSmidth, the current trailing twelve months Free Cash Flow stands at DKK 937 million. Over the next several years, analysts expect this number to gradually increase, with projections of DKK 1,082 million in 2026 and DKK 1,617 million by 2029. Beyond analyst forecasts, Simply Wall St extrapolates cash flows and estimates DKK 1,857 million in 2035, signaling healthy and sustained growth potential in the company's core operations.

Based on these cash flow projections and the 2 Stage Free Cash Flow to Equity DCF model, FLSmidth’s intrinsic value is estimated at DKK 599 per share. This suggests the stock is currently trading at a 19.1% discount to its fair value, indicating it may be undervalued by the market right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests FLSmidth is undervalued by 19.1%. Track this in your watchlist or portfolio, or discover 839 more undervalued stocks based on cash flows.

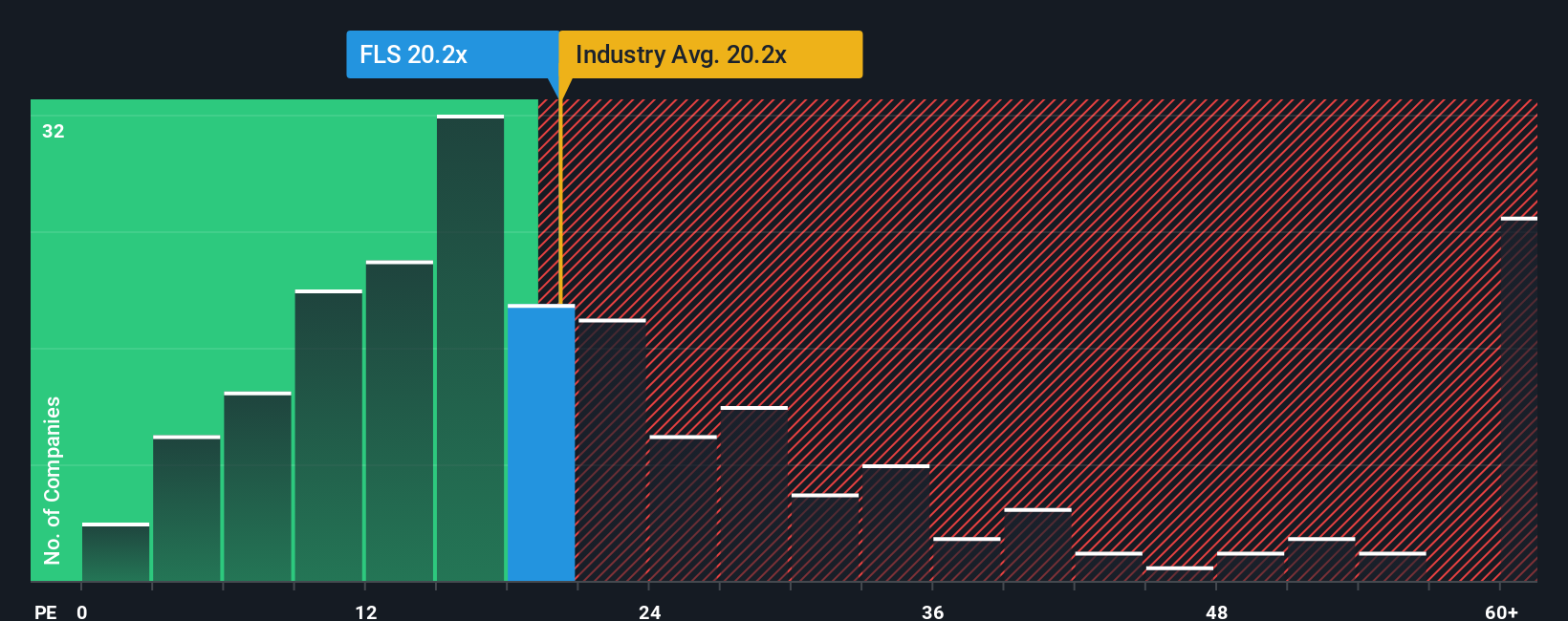

Approach 2: FLSmidth Price vs Earnings (PE) Ratio

The Price-to-Earnings (PE) ratio is a popular way to value established, profitable companies because it shows how much investors are willing to pay for each unit of earnings. A high PE ratio may indicate growth expectations, while a lower ratio can suggest undervaluation or higher risk.

Different levels of profitability, growth outlook, and risk profile influence what counts as a “normal” or “fair” PE for a stock. Fast-growing, low-risk companies often warrant higher multiples, whereas companies with more modest growth or greater risk may trade at lower PEs.

FLSmidth currently trades at a PE ratio of 20.5x. This sits above its peer average of 18.2x, but below the broader Machinery industry average of 24.7x. Compared to these benchmarks, FLSmidth appears reasonably valued on a relative basis.

To bring more nuance to these comparisons, Simply Wall St calculates a proprietary “Fair Ratio.” This figure is 17.2x for FLSmidth and considers additional factors like expected earnings growth, industry dynamics, profit margins, company size, and risk. This provides a more tailored benchmark than simply looking at the industry or peers alone.

Comparing FLSmidth’s current PE ratio of 20.5x to its Fair Ratio of 17.2x suggests the market is pricing the stock above what would be justified given its particular mix of growth, profitability, and risk.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1408 companies where insiders are betting big on explosive growth.

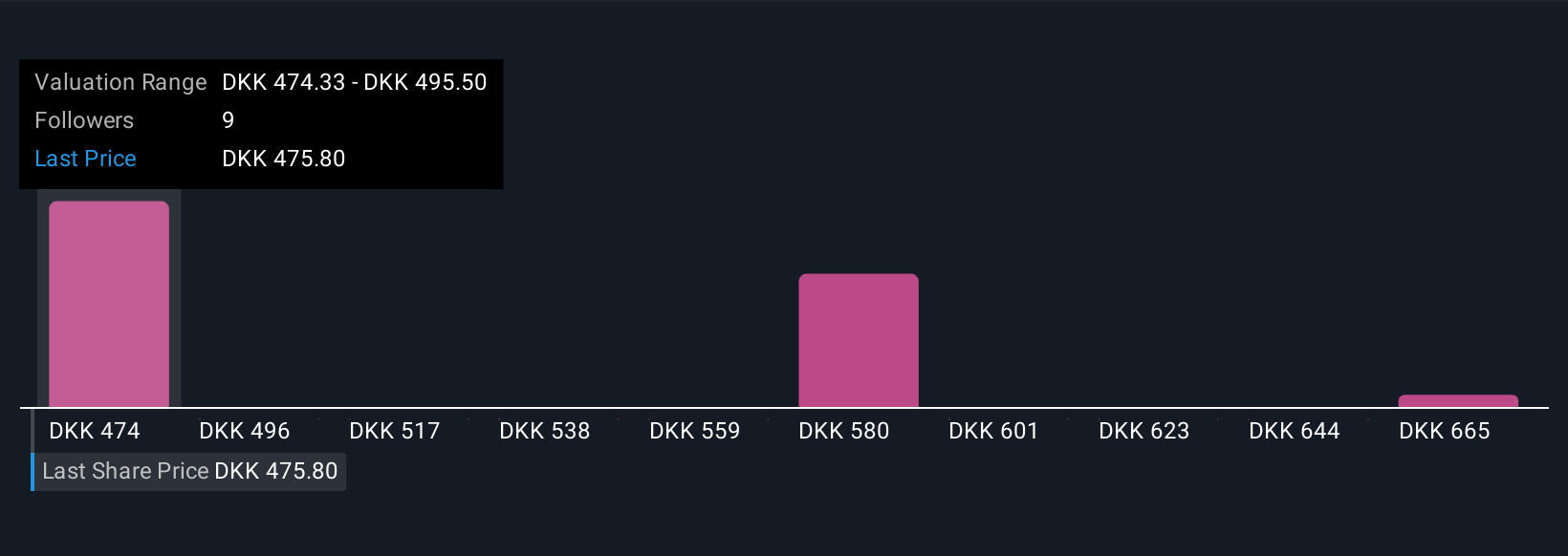

Upgrade Your Decision Making: Choose your FLSmidth Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply a story behind the numbers, where you combine your perspective about a company, such as FLSmidth’s future revenue, earnings, or profit margins, with financial forecasts and your own sense of fair value.

Instead of relying only on broad metrics, Narratives let you tie a company’s business developments or industry events directly to your investment outlook, translating your story into a tangible fair value for comparison with the current price. Narratives are easy to use and available right now within the Community page on Simply Wall St’s platform, used by millions of investors.

This powerful approach helps you clearly decide when to buy or sell, track how your view holds up as new information emerges, and even adjust your assumptions whenever news or earnings updates are released. Your Narrative updates dynamically. For FLSmidth, for example, you might find one investor’s Narrative aligns with a bullish analyst’s price target of DKK 500, based on strong margin expansion, while another investor leans toward a bearish target of DKK 344, prioritizing cautious revenue forecasts and structural risks.

No matter your perspective, Narratives help you make smart, story-driven decisions that go beyond the surface numbers.

Do you think there's more to the story for FLSmidth? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:FLS

FLSmidth

Provides flowsheet technology and service solutions for the mining and cement industries in Denmark, the United States of America, Canada, Chile, Brazil, Peru, Australia, North and South America, Europe, the Middle East, Africa, and Asia.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives