- Japan

- /

- Food and Staples Retail

- /

- TSE:8142

3 Dividend Stocks Yielding Between 3% And 4%

Reviewed by Simply Wall St

In a week marked by busy earnings reports and mixed economic signals, global markets have experienced fluctuations, with major indexes like the S&P 500 and Nasdaq Composite retreating after reaching record highs. Amidst this backdrop of volatility, investors seeking stability may find dividend stocks appealing due to their potential for consistent income generation. In the current market landscape, a good dividend stock is often characterized by its ability to maintain reliable payouts even in uncertain economic conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.12% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.83% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 5.03% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.48% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.93% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.00% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.97% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.83% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.10% | ★★★★★★ |

Click here to see the full list of 2032 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

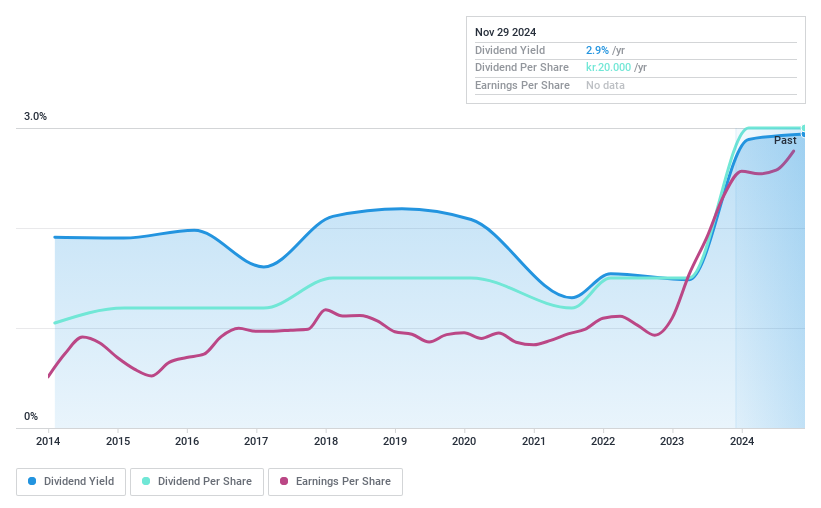

Lån & Spar Bank (CPSE:LASP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lån & Spar Bank A/S offers a range of banking products and services in Denmark with a market cap of DKK 2.28 billion.

Operations: Lån & Spar Bank A/S generates its revenue primarily from banking operations, amounting to DKK 1.55 billion.

Dividend Yield: 3%

Lån & Spar Bank has demonstrated stable and reliable dividend payments over the past decade, with dividends increasing during this period. Despite a relatively low yield of 3.03% compared to top Danish dividend payers, its low payout ratio of 14.5% suggests dividends are well-covered by earnings. Recent earnings results show growth in net interest income and net income, supporting its ability to maintain current dividend levels amidst trading below estimated fair value by 43.4%.

- Unlock comprehensive insights into our analysis of Lån & Spar Bank stock in this dividend report.

- Our valuation report unveils the possibility Lån & Spar Bank's shares may be trading at a discount.

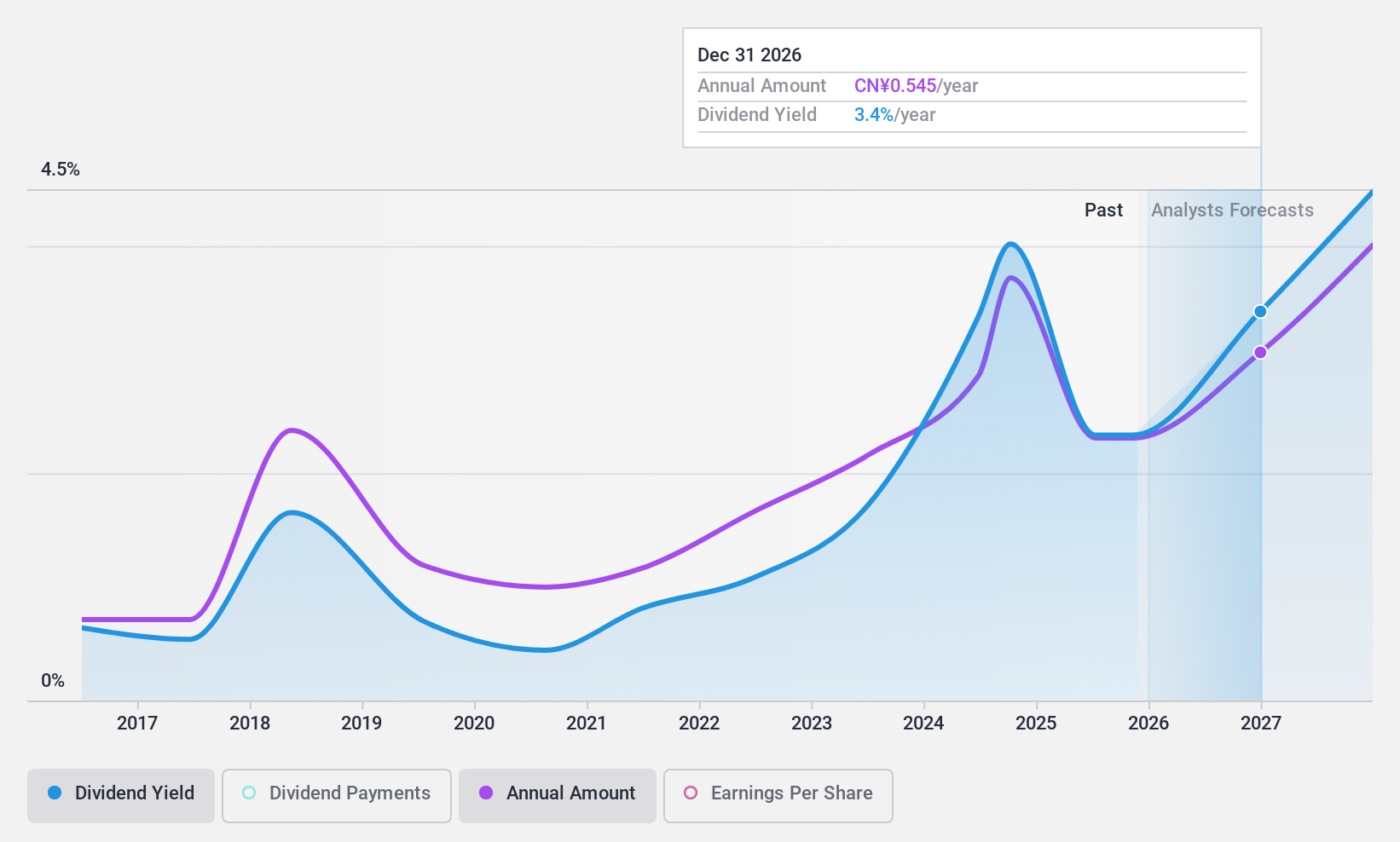

LBX Pharmacy Chain (SHSE:603883)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LBX Pharmacy Chain Joint Stock Company operates a pharmacy store chain in China with a market cap of CN¥13.44 billion.

Operations: LBX Pharmacy Chain Joint Stock Company generates its revenue primarily from operating a chain of pharmacy stores across China.

Dividend Yield: 3.7%

LBX Pharmacy Chain's dividend yield is among the top 25% in China, but its dividend history over the past eight years has been volatile. While dividends are well-covered by cash flows with a low cash payout ratio of 27.1%, earnings coverage is tighter at 75.3%. Recent earnings showed a decline in net income to CNY 630.15 million for the nine months ended September 2024, indicating potential challenges in sustaining dividends amidst share price volatility and trading below fair value estimates.

- Click here to discover the nuances of LBX Pharmacy Chain with our detailed analytical dividend report.

- Our expertly prepared valuation report LBX Pharmacy Chain implies its share price may be lower than expected.

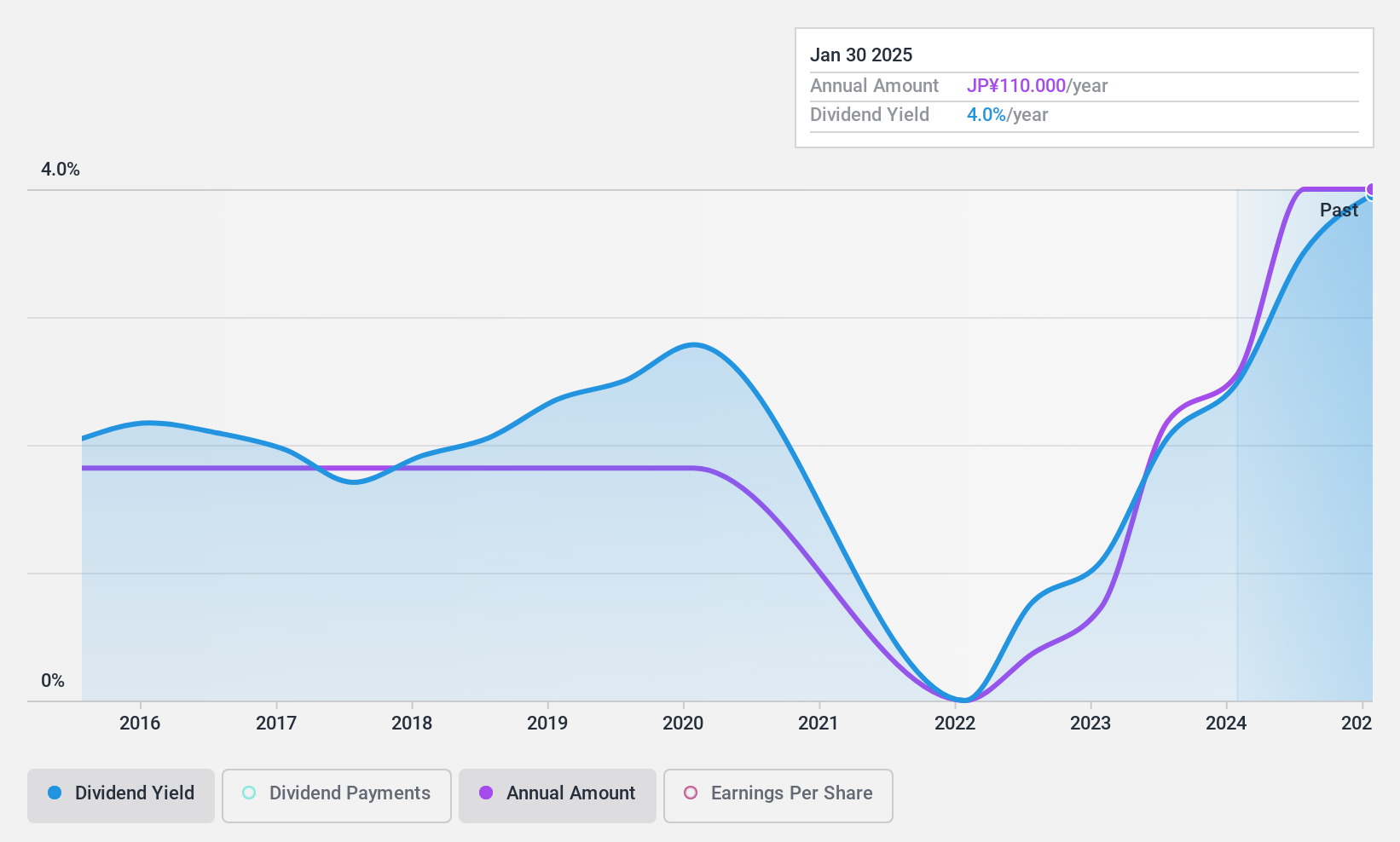

Toho (TSE:8142)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Toho Co., Ltd. operates in Japan through its subsidiaries, focusing on food wholesale, cash and carry, and supermarket businesses with a market cap of ¥29.10 billion.

Operations: Toho Co., Ltd. generates its revenue from several segments, including the Distributor Business with ¥210.83 billion, Food Solution Business contributing ¥17.50 billion, Cash and Carry Business at ¥44.59 billion, and the Food Supermarket Business accounting for ¥11.15 billion.

Dividend Yield: 4.1%

Toho's dividend yield is in the top 25% of Japan's market, with a payout ratio of 28.8%, indicating dividends are well-covered by earnings and cash flows (20% cash payout ratio). Despite recent earnings growth of 91.1%, Toho has an unstable dividend history with volatility over the past decade. The stock trades significantly below estimated fair value, but its share price has been highly volatile recently, adding risk to its dividend reliability.

- Delve into the full analysis dividend report here for a deeper understanding of Toho.

- Our comprehensive valuation report raises the possibility that Toho is priced lower than what may be justified by its financials.

Seize The Opportunity

- Embark on your investment journey to our 2032 Top Dividend Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toho might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8142

Toho

Through its subsidiaries, engages in the food wholesale, cash and carry, and supermarket businesses primarily in Japan.

Flawless balance sheet with solid track record and pays a dividend.