Kreditbanken (CPSE:KRE) Margin Miss Challenges Persistent Growth Narrative

Reviewed by Simply Wall St

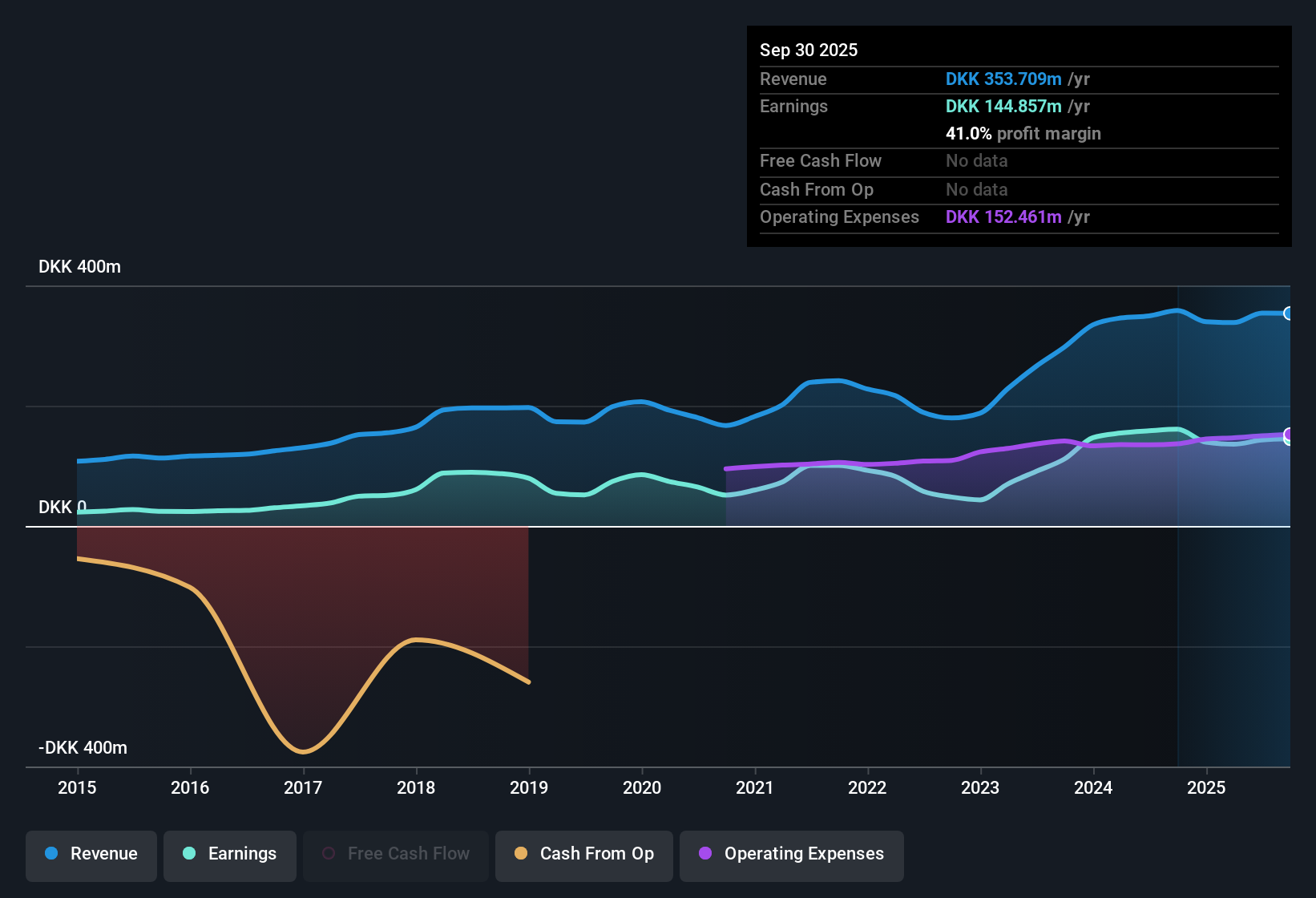

Kreditbanken (CPSE:KRE) reported net profit margins of 41%, down from 44.9% a year earlier. Profit growth has declined over the past year following a prior five-year average of 19.5% annual earnings expansion. Shares now trade at DKK7,400, notably below the estimated fair value of DKK15,565.49. The company's P/E ratio of 8.6x stands lower than both its peer average of 11.1x and the European Banks industry average of 9.7x. Despite recent margin compression, the bank continues to offer perceived value and an attractive dividend, presenting a mixed yet intriguing picture for investors.

See our full analysis for Kreditbanken.Next, we will see how these headline figures measure up against the most widely held narratives about Kreditbanken, and where perceptions and data might go in different directions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Growth Slows After Five-Year Run

- Kreditbanken delivered annual earnings growth averaging 19.5% per year over the last five years, but this trend has reversed with negative growth in the most recent period.

- What stands out from the prevailing market view is that, while a track record of consistent multi-year earnings expansion conjures optimism about business quality,

- the abrupt shift to negative growth now directly challenges assumptions that past momentum can be sustained without disruption.

- Recent performance does not suggest a stable base for continued high expansion, raising fresh questions for those expecting ongoing compounding gains.

P/E Lags Both Peers and Sector Average

- The current price-to-earnings ratio of 8.6x ranks below the peer average of 11.1x and the broader European Banks industry mean of 9.7x, signaling a relative valuation discount that is hard to ignore.

- According to the prevailing market view, investors often take this sizable gap as an opportunity, arguing:

- that a below-peer P/E paired with attractive, sustained dividends offers potential upside, especially if margin pressure proves to be temporary rather than structural.

- This valuation may also reflect heightened caution following the recent margin contraction, rather than a blanket case for undervaluation across the board.

Share Price Trades Well Below DCF Fair Value

- Kreditbanken's current share price of DKK7,400 sits noticeably below its DCF fair value estimate of DKK15,565.49, highlighting a sizable valuation gap that sets it apart from typical sector trading patterns.

- The prevailing market take highlights a tension: while the significant difference from DCF fair value seems to present a clear value argument,

- the recent decline in profit margins and negative earnings growth make it unclear whether the fair value will be realized without a strong shift in momentum.

- This gap may tempt value-oriented buyers, but the bank’s ability to close it depends on a return to more robust operational trends.

Curious how numbers become stories that shape markets? Curious how numbers become stories that shape markets? Explore Community Narratives

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Kreditbanken's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Kreditbanken’s abrupt swing from robust multi-year growth to negative earnings, along with recent margin compression, signals a break in consistency and stable expansion.

If you want steadier results and less volatility across market cycles, use stable growth stocks screener (2091 results) to target companies with reliable growth records and proven earnings momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kreditbanken might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:KRE

Kreditbanken

Provides various banking products and services to private and business customers in Southern Jutland, Denmark.

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives