Jyske Bank (CPSE:JYSK) Margin Miss Fuels Doubt on Profitability Narrative

Reviewed by Simply Wall St

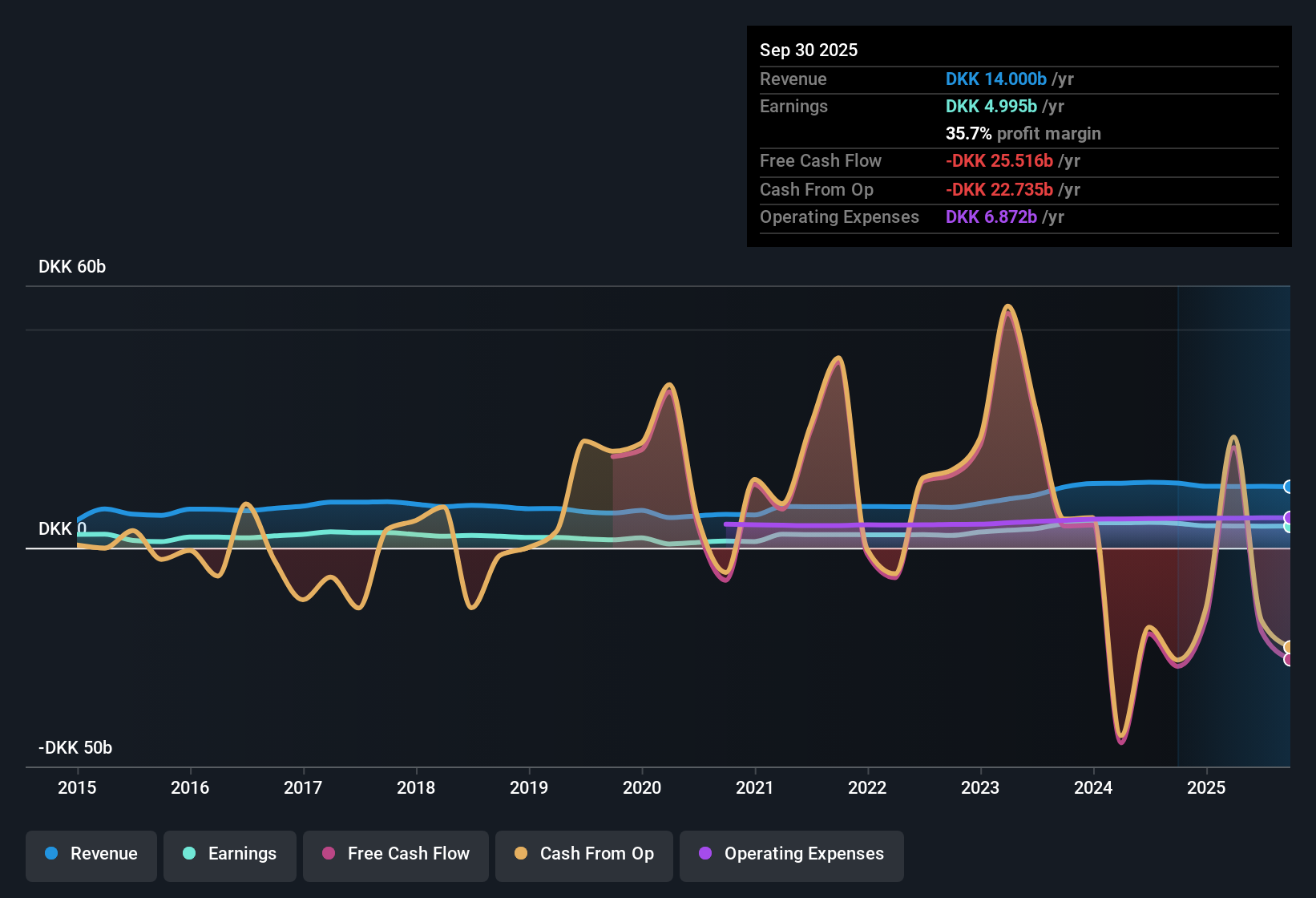

Jyske Bank (CPSE:JYSK) reported a net profit margin of 35.7%, down from last year’s 37.9%. Over the past five years, earnings have grown at an annual rate of 19.4%. However, recent signals are negative. Earnings growth turned negative in the most recent year, and forecasts point to annual declines of 2.7% for revenue and 6.1% for earnings over the next three years. Despite the challenging outlook, investors are looking closely at valuation, which appears attractive compared to peers and the sector, even as the bank’s growth prospects come under pressure.

See our full analysis for Jyske Bank.Up next, we'll see how these headline results compare to the prevailing narratives for Jyske Bank. Are the stories holding up, or is the outlook shifting?

See what the community is saying about Jyske Bank

Digital Gains Face Revenue Headwinds

- Analysts forecast Jyske Bank’s revenue to shrink by 4.4% annually over the next three years, creating pressure despite recent momentum from digital transformation and asset management initiatives.

- The consensus narrative highlights a tension:

- Investors are relying on growth from digital efficiencies and fee income, yet the projected revenue decline puts these expectations to the test, especially if market adoption of new services slows.

- Revenue growth is also closely tied to continued customer satisfaction and stable regulatory environments. Any missteps in these areas risk undermining the digital strategy’s payoff.

- Consensus expectations remain on the table, but the next quarters will reveal if fee and digital momentum are enough to offset falling top-line figures.

See where analysts land on Jyske Bank's evolving story with the full consensus narrative. 📊 Read the full Jyske Bank Consensus Narrative.

Profit Margins Resilient but Sliding

- Profit margins are expected to contract slightly, from 35.3% now to 34.9% over three years. This indicates Jyske Bank may maintain its efficiency edge, but with less cushion than before.

- According to the consensus narrative:

- Industry-leading cost efficiency (cost/income ratio below 50%) and diversified income are stabilizers, but margin erosion could accelerate if digital transformation loses momentum or credit costs rise.

- Any reversal in customer loyalty or increased competition in lending could cut further into margins, challenging the view that Jyske can consistently deliver above-industry profitability.

Valuation Discount Signals Market Skepticism

- Jyske Bank’s current Price-to-Earnings Ratio is 9x, lower than both the peer average (10.3x) and the European Banks industry (9.9x). The share price (DKK 760.00) trades at a steep discount to its DCF fair value (DKK 1,519.04).

- Per the consensus narrative:

- The analyst price target of DKK 793.5 implies only a modest 4.4% upside, suggesting the market views Jyske as fairly valued unless its digital and fee income bets materialize more strongly than expected.

- Investors are weighing margin challenges and subdued long-term growth forecasts against the attractive valuation, waiting to see if these discounts are justified or mark a buying opportunity.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Jyske Bank on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a unique take on these results? Put your outlook in perspective and craft your personal narrative in just a few minutes. Do it your way

A great starting point for your Jyske Bank research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Jyske Bank faces shrinking revenue forecasts and eroding margins. This suggests its growth agenda may not overcome mounting operational headwinds.

If you want stocks showing steadier expansion and fewer setbacks, focus on stable growth stocks screener (2119 results) and discover companies that consistently grow sales and profits across different markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:JYSK

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives