Why You Might Be Interested In GrønlandsBANKEN A/S (CPH:GRLA) For Its Upcoming Dividend

GrønlandsBANKEN A/S (CPH:GRLA) stock is about to trade ex-dividend in three days. Ex-dividend means that investors that purchase the stock on or after the 25th of March will not receive this dividend, which will be paid on the 29th of March.

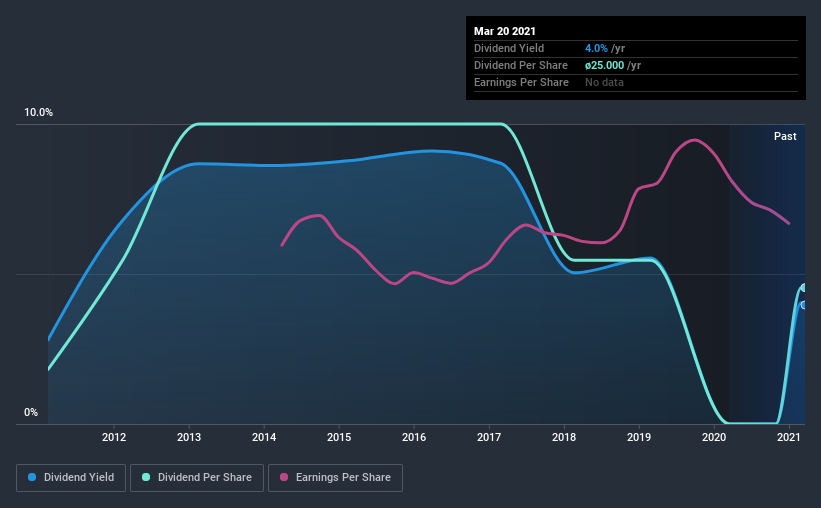

GrønlandsBANKEN's next dividend payment will be kr.25.00 per share, and in the last 12 months, the company paid a total of kr.25.00 per share. Based on the last year's worth of payments, GrønlandsBANKEN stock has a trailing yield of around 4.0% on the current share price of DKK630. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to check whether the dividend payments are covered, and if earnings are growing.

See our latest analysis for GrønlandsBANKEN

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Fortunately GrønlandsBANKEN's payout ratio is modest, at just 47% of profit.

Generally speaking, the lower a company's payout ratios, the more resilient its dividend usually is.

Click here to see how much of its profit GrønlandsBANKEN paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. This is why it's a relief to see GrønlandsBANKEN earnings per share are up 5.8% per annum over the last five years.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the past 10 years, GrønlandsBANKEN has increased its dividend at approximately 9.6% a year on average. It's encouraging to see the company lifting dividends while earnings are growing, suggesting at least some corporate interest in rewarding shareholders.

Final Takeaway

Has GrønlandsBANKEN got what it takes to maintain its dividend payments? It has been growing its earnings per share somewhat in recent years, although it reinvests more than half its earnings in the business, which could suggest there are some growth projects that have not yet reached fruition. GrønlandsBANKEN ticks a lot of boxes for us from a dividend perspective, and we think these characteristics should mark the company as deserving of further attention.

On that note, you'll want to research what risks GrønlandsBANKEN is facing. For example, we've found 2 warning signs for GrønlandsBANKEN (1 is a bit unpleasant!) that deserve your attention before investing in the shares.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade GrønlandsBANKEN, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CPSE:GRLA

GrønlandsBANKEN

Provides various financial services to private and business customers, and public institutions in Greenland.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026