Føroya Banki (CPSE:FOBANK) Profit Margin Declines, Challenging Bullish Community Valuation Narratives

Reviewed by Simply Wall St

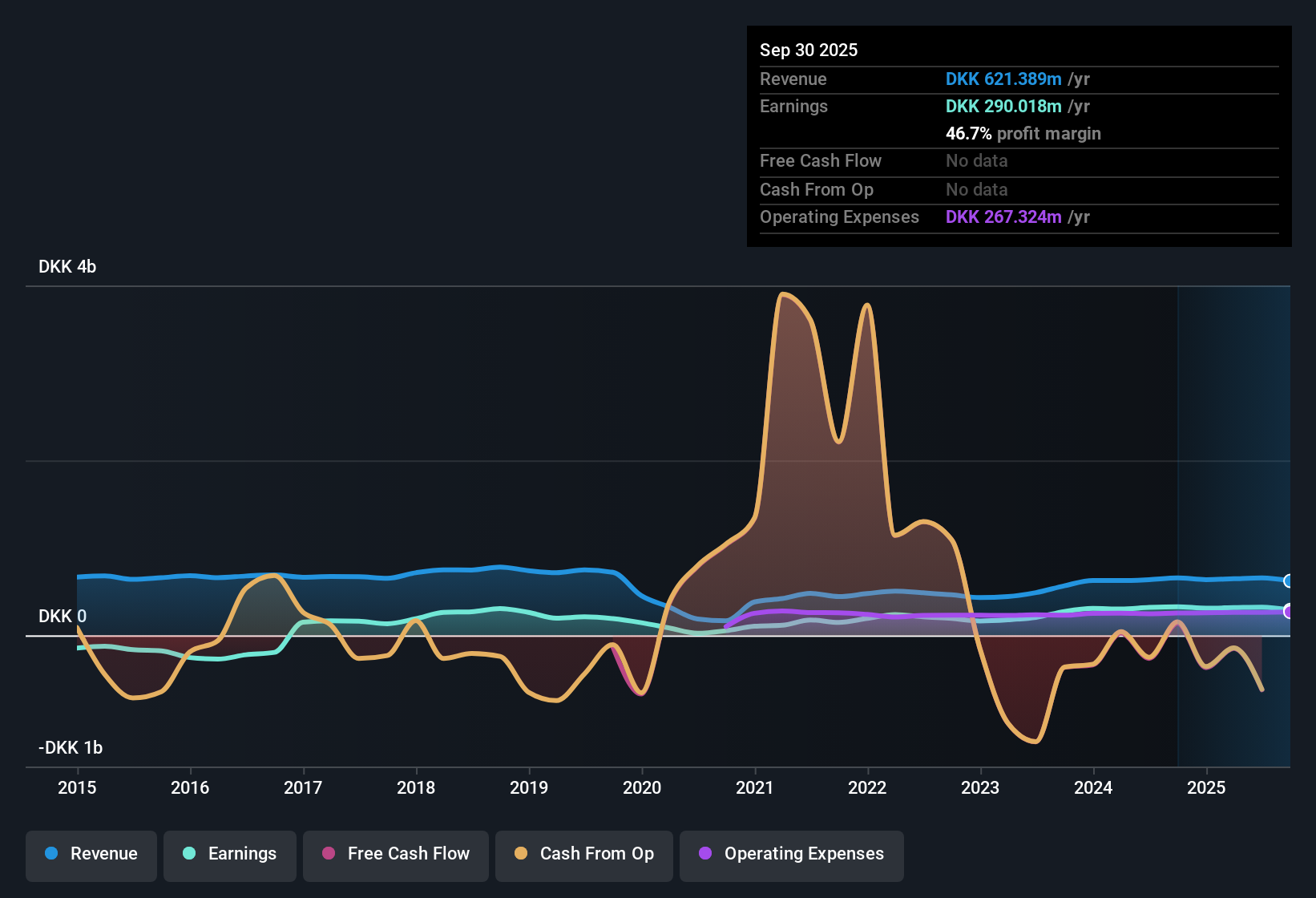

Føroya Banki (CPSE:FOBANK) booked a net profit margin of 46.7%, down from last year’s 49.8%, signaling slightly compressed profitability. Over the past year, earnings growth turned negative. However, the bank maintains a five-year annualized earnings growth rate of 21.5% and continues to deliver high quality results. Investors will be weighing these mixed signals carefully, as shares now trade at a significant discount to estimated fair value and the bank’s risk profile appears predominantly positive, with only minor risks identified.

See our full analysis for Føroya Banki.Next, we will see how these headline results compare with the prevailing narratives in the market. This is where the most important storylines may get reinforced or challenged.

Curious how numbers become stories that shape markets? Explore Community Narratives

P/E Ratio Signals Deep Discount

- Føroya Banki trades at a Price-To-Earnings ratio of just 7.8x, noticeably below both the European Banks industry average of 10x and the peer average of 10.1x. Shares are also well under the DCF fair value of DKK588.08 compared to the current price of DKK237.00.

- The prevailing market analysis highlights this valuation gap as a strong argument for positive sentiment:

- A P/E multiple significantly below sector peers supports the view that the market may be underappreciating the bank’s long-term earnings power, especially given the five-year annualized earnings growth rate of 21.5%, which outpaces most regional competitors.

- However, negative earnings growth in the most recent year challenges this optimism, creating a contrast between the discounted valuation and near-term profitability pressures.

Profit Margins Narrow, Quality Holds

- Net profit margin has declined year-over-year from 49.8% to 46.7%, but the company is still recognized for high quality earnings.

- Analysis of market positioning indicates that while margin compression raises questions about future profitability, it does not undermine the strength of the underlying earnings:

- Although shrinking margins can trigger caution, the durability of "high quality" profit measures, called out explicitly by the filing, remains reassuring and may help offset negative perception from the headline decline.

- The five-year annualized growth rate of 21.5% further suggests that historical profitability strength may help the bank manage short-term pressures.

Risk Profile Stays Favourable

- No major risks are flagged for the bank, and only minor issues have been observed. None are present at this time according to the filings.

- Market commentary notes that the absence of significant flagged risks gives investors confidence:

- Consistent identification of only minor risk factors positions Føroya Banki as relatively robust compared to the sector, supporting positive market sentiment even as recent growth moderates.

- The combination of low risk and a discounted valuation may make the shares appealing to patient, long-term investors focused on risk-adjusted returns.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Føroya Banki's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite high-quality long-term growth, Føroya Banki is wrestling with margin compression and a recent dip in earnings. This has raised near-term profitability questions.

If you want steadier performers, try stable growth stocks screener (2083 results) to find companies delivering consistent earnings and revenue expansion through changing cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:FOBANK

Føroya Banki

Provides personal and corporate banking services in the Faroe Islands and Greenland.

Good value with adequate balance sheet.

Market Insights

Community Narratives