Danske Bank (CPSE:DANSKE): Evaluating Current Valuation Following Recent Share Performance

Reviewed by Simply Wall St

Danske Bank (CPSE:DANSKE) shares have seen modest movement recently, prompting investors to weigh the bank’s recent return data in light of broader market trends. The conversation now revolves around whether current valuations offer meaningful opportunity.

See our latest analysis for Danske Bank.

Steadily climbing through the year, Danske Bank’s share price has benefited as confidence grows around its comeback story and steadier financial footing. While short-term share price returns have been positive, it is the bank’s standout one-year total shareholder return of 54.36% and five-year total return of 287.04% that really underscore the resurgence in momentum.

If Danske Bank’s revival has you thinking bigger, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares near their recent highs and strong returns already logged, the question becomes whether Danske Bank’s current price reflects further growth potential or if any upside has already been fully accounted for by the market.

Most Popular Narrative: 3.8% Undervalued

Danske Bank's widely followed narrative puts fair value just above the last close, suggesting a slight undervaluation that hinges on contested forward-looking assumptions. Market momentum has elevated expectations, and valuation rests on whether the bank can fulfill these forecasts amid sector shifts.

Despite recent investments and digital enhancements, Danske Bank faces intensifying competition from both non-bank fintechs and Big Tech entrants. This competition is likely to erode fee and commission income and threaten future revenue growth, especially as digital disruption accelerates.

Profit margins are on trial. Revenue projections are in the spotlight. Can Danske Bank buck the trend that is pressuring its peers? The real narrative centers on shrinking profits, decelerating revenue growth and a future valuation multiple that could outpace the industry. Ready to uncover the bold moves and subtle risks powering this forecast?

Result: Fair Value of $288.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, renewed competition from fintechs or a reversal in cost controls could quickly undermine earnings momentum and test Danske Bank’s ability to sustain its gains.

Find out about the key risks to this Danske Bank narrative.

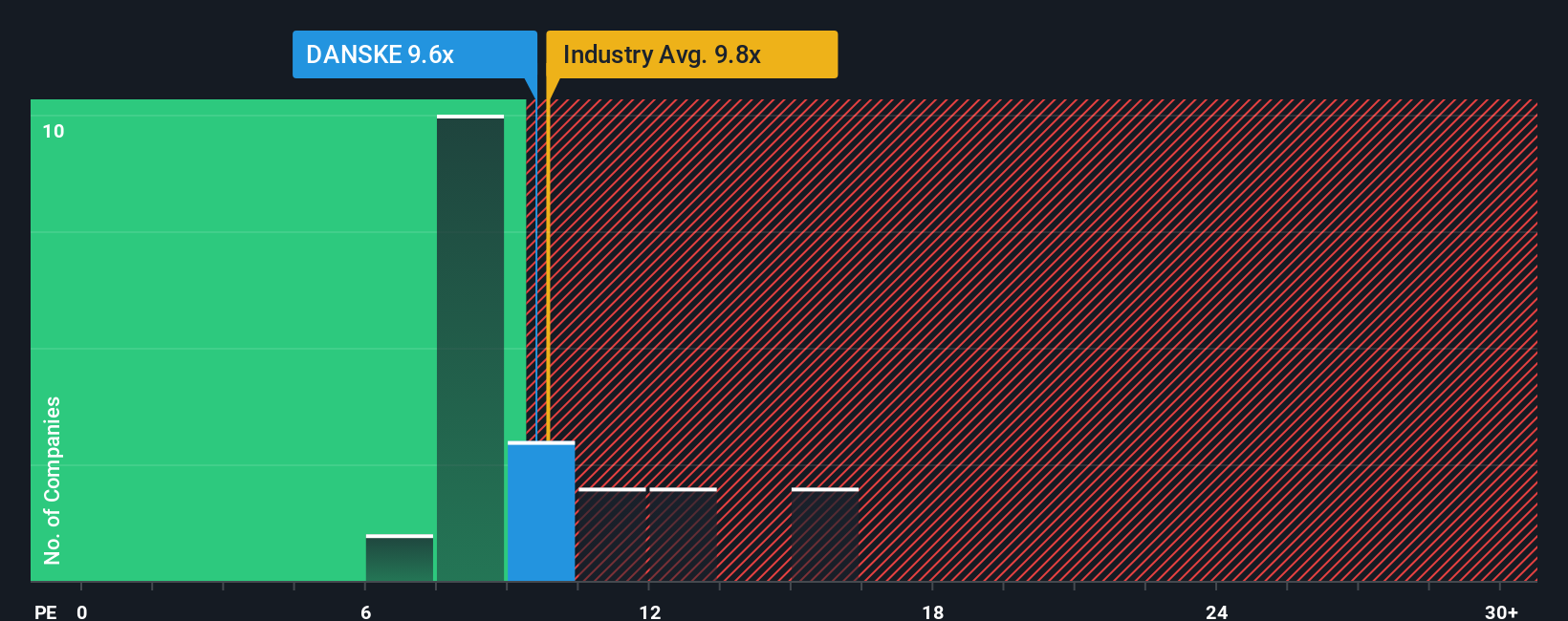

Another View: Sizing Up Value Using Earnings Ratios

Looking through the lens of the price-to-earnings ratio, Danske Bank trades at 9.8x, which nearly matches the European Banks industry average and is slightly above its direct peer average. This is below its fair ratio of 12.1x, suggesting some upside is possible if the market re-rates the stock. But does this reflect genuine opportunity or simply market optimism at work?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Danske Bank Narrative

If this perspective does not resonate with you, or if you would rather draw your own conclusions from the data, you can piece together your own narrative in just a few minutes and Do it your way

A great starting point for your Danske Bank research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t settle for just one opportunity when your next winning stock could be just a click away. Get ahead of the crowd and grow your portfolio with these powerful themes:

- Tap fresh growth potential by reviewing these 26 AI penny stocks. These companies are riding the AI wave and reshaping entire industries with breakthrough innovation.

- Secure consistent income by targeting these 21 dividend stocks with yields > 3% that deliver reliable yields and have proven track records of long-term payout strength.

- Capitalize on emerging tech by searching these 28 quantum computing stocks that are poised to revolutionize computing, security, and data with state-of-the-art advances.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:DANSKE

Danske Bank

Provides various banking products and services to corporate, institutional, and international clients.

Fair value with questionable track record.

Similar Companies

Market Insights

Community Narratives