- Germany

- /

- Renewable Energy

- /

- XTRA:UN0

Uniper (XTRA:UN0): Evaluating Valuation as Utilities Sector Faces Cautious Market Sentiment

Reviewed by Simply Wall St

See our latest analysis for Uniper.

Uniper’s 1-year total shareholder return of -33.17% highlights how sentiment around the stock has soured as the year has unfolded, a trend reflected in its steady share price declines since January. While there have been brief rallies, momentum remains subdued compared to earlier periods. This could indicate that investors are still assessing the shifting risk profile and overall valuation as the utility sector faces ongoing challenges.

If you’re keeping an eye on how other industries are weathering changing market conditions, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

After a stretch of disappointing returns and ongoing sector pressures, is Uniper now trading at a discount that presents value? Or are investors right in assuming its future growth is already accounted for in the share price?

Price-to-Sales of 0.2x: Is it justified?

Uniper’s last close at €30.65 puts its stock at a price-to-sales ratio of 0.2x, noticeably below both industry and peer averages. This may make it appear undervalued on this basis.

The price-to-sales metric indicates how much investors are willing to pay per euro of revenue. It is especially relevant for companies like Uniper, which are currently unprofitable, as it bypasses the need for positive earnings and instead focuses on topline sales.

This ratio highlights that Uniper’s valuation is lower than the European Renewable Energy industry average of 2.4x, and also below the peer group’s average of 0.8x. Compared to its own estimated fair price-to-sales ratio of 0.3x, the market appears to be discounting Uniper. This could reflect skepticism about its turnaround or broader sector risks, but the level remains below where it could revert in a more optimistic scenario.

Explore the SWS fair ratio for Uniper

Result: Price-to-Sales of 0.2x (UNDERVALUED)

However, concerns over Uniper’s declining revenues and persistent sector headwinds could limit any potential recovery in the near term.

Find out about the key risks to this Uniper narrative.

Another View: SWS DCF Model Sends a Different Signal

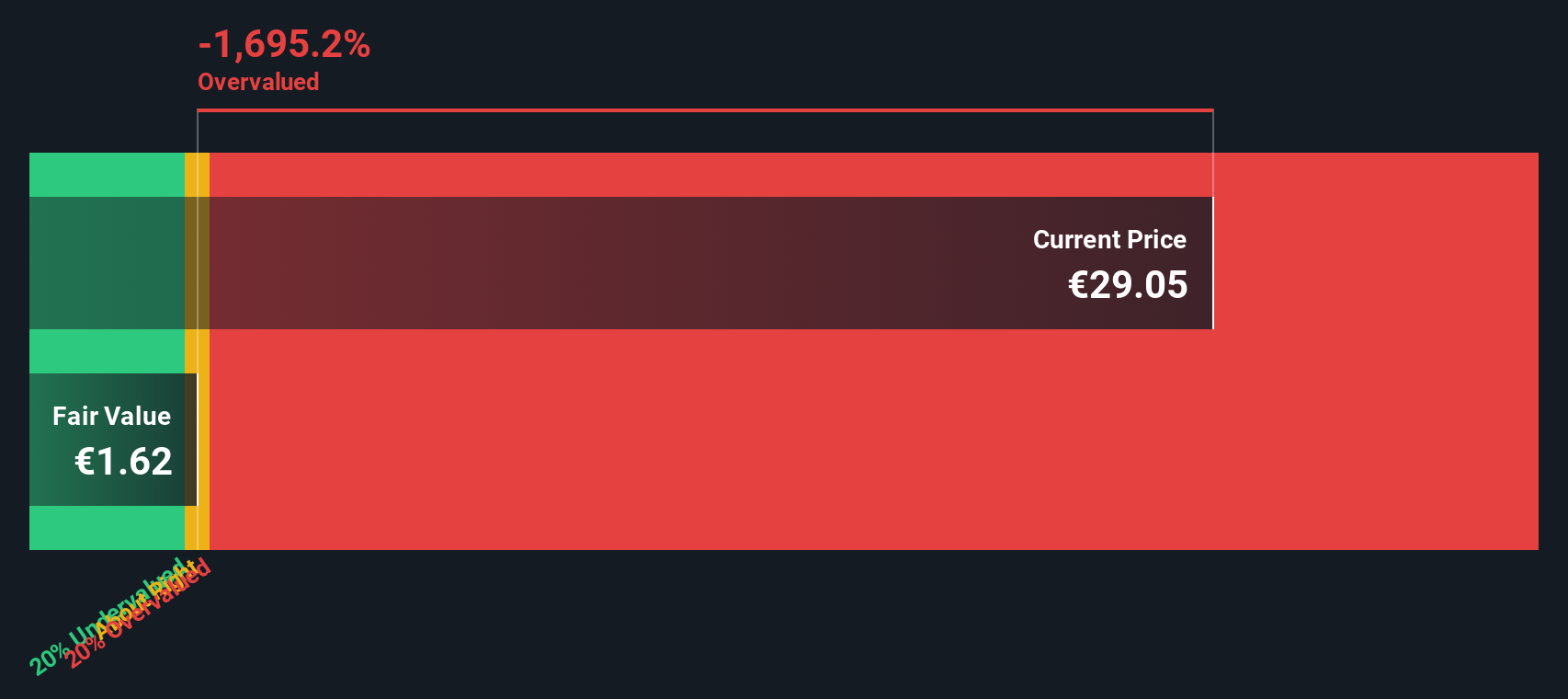

While Uniper’s price-to-sales ratio suggests the stock is undervalued, our SWS DCF model estimates its fair value at just €1.37 per share. This means the current price is significantly above what the DCF model considers reasonable, pointing toward possible overvaluation.

Look into how the SWS DCF model arrives at its fair value.

When valuation results pull in opposite directions like this, investors have to decide which perspective fits their outlook. Which approach do you trust more when it comes to Uniper’s future?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Uniper for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 853 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Uniper Narrative

If you see things differently or want to get hands-on with the data, you can shape your own Uniper story in just a few minutes. So why not Do it your way?

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Uniper.

Looking for more investment ideas?

Great investors are always one step ahead. Gain an edge by using the Simply Wall Street Screener to spot unique opportunities across multiple growth sectors, value picks, and future trends.

- Capture market momentum and potential breakout gains by checking out these 3579 penny stocks with strong financials thriving in today's fast-evolving landscape.

- Tap into the booming field of artificial intelligence by assessing these 26 AI penny stocks that are positioned to lead in tomorrow's economy.

- Boost your search for untapped value and strong fundamentals by evaluating these 853 undervalued stocks based on cash flows with the greatest reward potential right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:UN0

Uniper

Operates as an energy company in Germany, the United Kingdom, Sweden, the rest of Europe, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives