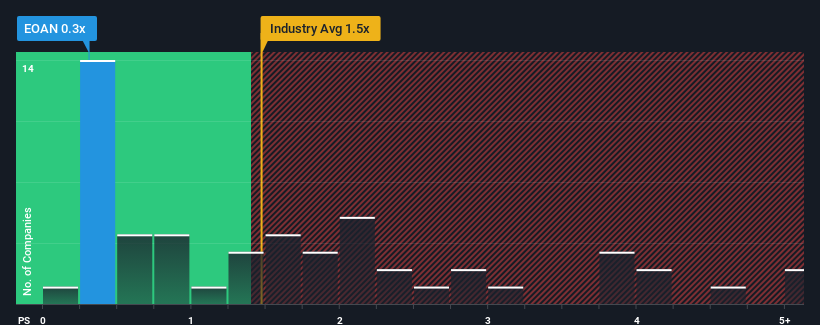

It's not a stretch to say that E.ON SE's (ETR:EOAN) price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" for companies in the Integrated Utilities industry in Germany, where the median P/S ratio is around 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for E.ON

What Does E.ON's Recent Performance Look Like?

E.ON hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think E.ON's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, E.ON would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 6.4% decrease to the company's top line. Still, the latest three year period has seen an excellent 69% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue growth will show minor resilience over the next three years growing only by 0.4% per annum. Meanwhile, the broader industry is forecast to contract by 0.06% per annum, which would indicate the company is doing better than the majority of its peers.

Even though the growth is only slight, it's peculiar that E.ON's P/S sits in line with the majority of other companies given the industry is set for a decline. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that E.ON currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. One such risk is that the company may not live up to analysts' revenue trajectories in tough industry conditions. It appears some are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with E.ON, and understanding them should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if E.ON might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:EOAN

E.ON

Operates as an energy company in Germany, the United Kingdom, Sweden, the Netherlands, rest of Europe, and internationally.

Good value low.