- Germany

- /

- Transportation

- /

- XTRA:SIX2

Top 3 German Dividend Stocks To Watch

Reviewed by Simply Wall St

As the German economy shows signs of resilience with industrial output and orders exceeding expectations, investors are increasingly looking for stable income sources amid mixed signals from global markets. In this environment, dividend stocks can offer a reliable stream of income while potentially benefiting from Germany's economic strengths.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.33% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 5.07% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.81% | ★★★★★☆ |

| INDUS Holding (XTRA:INH) | 5.69% | ★★★★★☆ |

| MLP (XTRA:MLP) | 5.21% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 9.10% | ★★★★★☆ |

| Südzucker (XTRA:SZU) | 7.56% | ★★★★★☆ |

| Brenntag (XTRA:BNR) | 3.32% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.42% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.29% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top German Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

PWO (XTRA:PWO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PWO AG manufactures and sells lightweight construction aluminum sheet components made of steel for the mobility industry across Germany, Czechia, Canada, Mexico, Serbia, and China with a market cap of €91.25 million.

Operations: PWO AG generates its revenue from the manufacture and sale of lightweight aluminum sheet components made of steel for the mobility industry in various countries including Germany, Czechia, Canada, Mexico, Serbia, and China.

Dividend Yield: 6%

PWO AG's recent earnings report shows mixed results, with second-quarter sales at €141.87 million and net income at €3.4 million, down from €5.4 million a year ago. Despite this, PWO's dividend yield of 5.99% is among the top 25% in Germany and well-covered by both earnings (33.3% payout ratio) and free cash flow (19.5%). However, its dividend history has been volatile over the past decade, raising concerns about reliability for long-term investors.

- Take a closer look at PWO's potential here in our dividend report.

- Upon reviewing our latest valuation report, PWO's share price might be too pessimistic.

Sixt (XTRA:SIX2)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sixt SE, with a market cap of €2.73 billion, offers global mobility services for private and business customers through its corporate and franchise station network.

Operations: Sixt SE generates revenue through its global network of corporate and franchise stations, catering to both private and business customers.

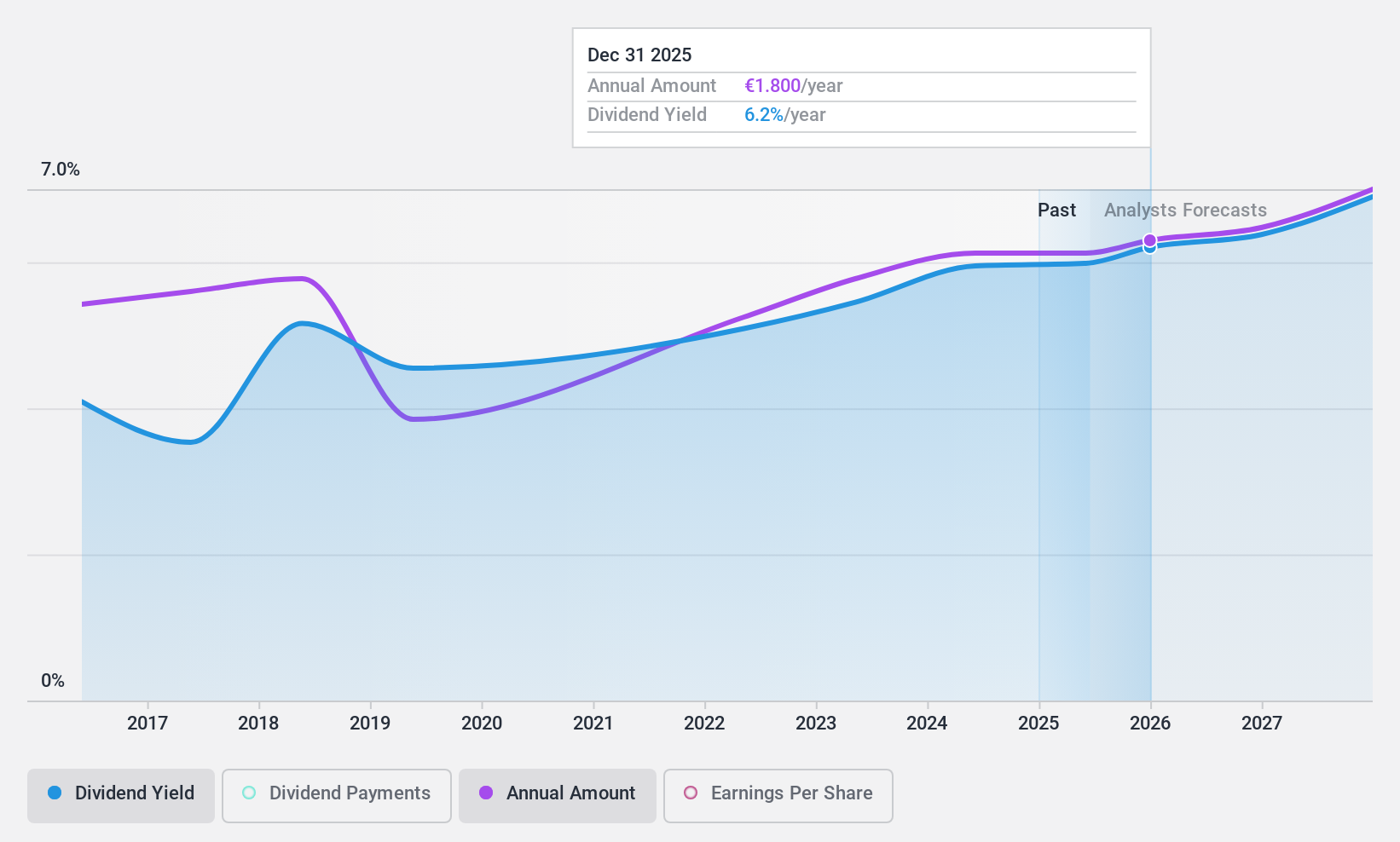

Dividend Yield: 6.3%

Sixt SE offers a high dividend yield of 6.33%, placing it in the top 25% of German dividend payers, but its payments are not covered by free cash flows, raising sustainability concerns. Recent earnings guidance indicates revenue growth, with Q2 revenue at €1.01 billion compared to €925.1 million last year, though net income decreased significantly from €96.57 million to €48.29 million, reflecting potential volatility in financial performance and dividend reliability.

- Unlock comprehensive insights into our analysis of Sixt stock in this dividend report.

- Our valuation report here indicates Sixt may be undervalued.

WashTec (XTRA:WSU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: WashTec AG offers car wash solutions across Germany, Europe, North America, and the Asia Pacific with a market cap of €473.73 million.

Operations: WashTec AG generates revenue from its operations in North America (€91.10 million) and segment adjustments (€393.04 million).

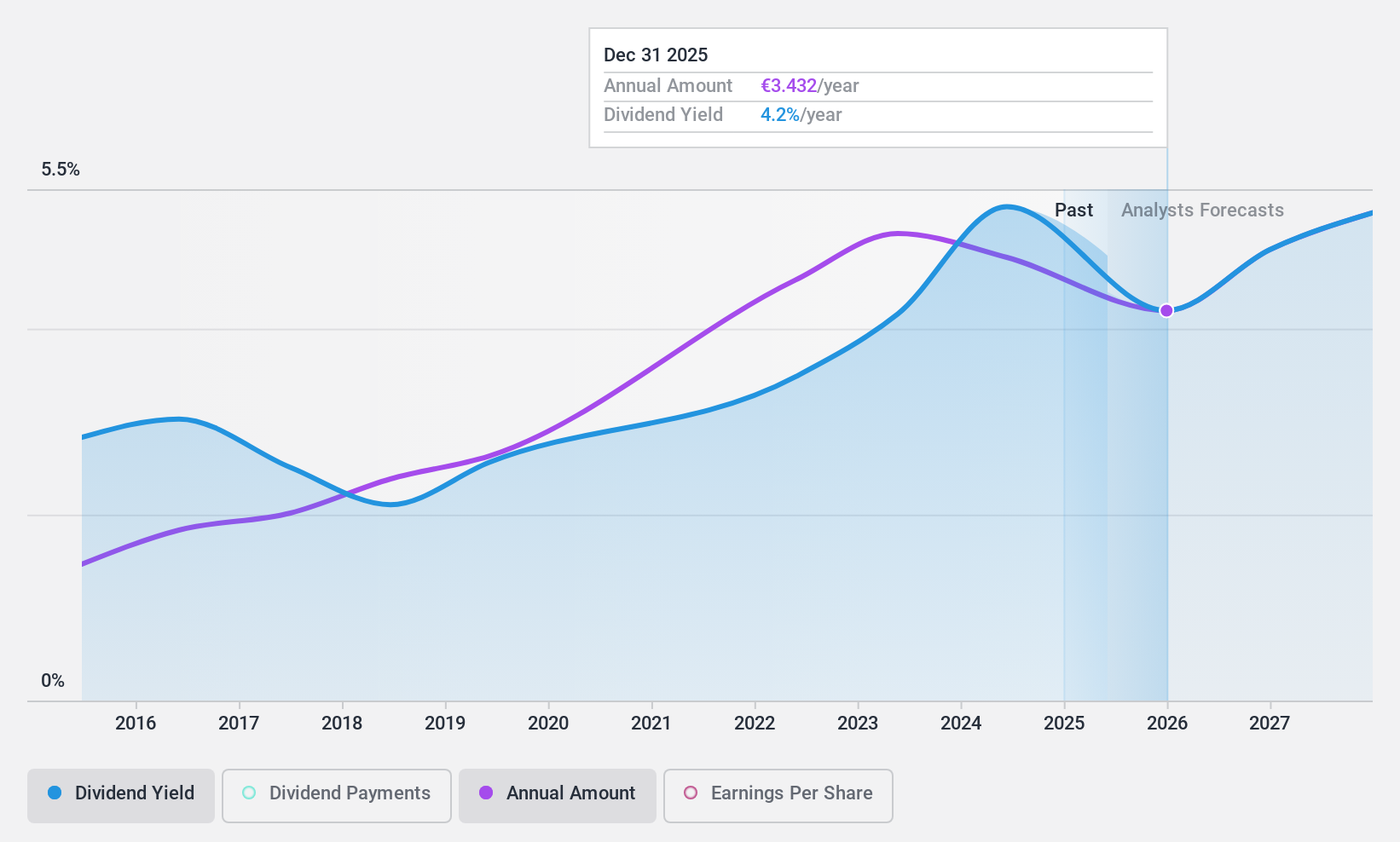

Dividend Yield: 6.2%

WashTec AG's dividend yield of 6.21% is among the top 25% in Germany, yet its sustainability is questionable due to a high payout ratio of 101.5%, indicating dividends are not covered by earnings. Recent Q2 results show a decline in sales to €119.41 million from €127.08 million year-over-year, but net income rose to €7.55 million from €6.17 million, suggesting some stability in profitability despite revenue challenges and debt levels remaining high.

- Click here and access our complete dividend analysis report to understand the dynamics of WashTec.

- In light of our recent valuation report, it seems possible that WashTec is trading behind its estimated value.

Where To Now?

- Navigate through the entire inventory of 30 Top German Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SIX2

Sixt

Through its subsidiaries, provides mobility services through corporate and franchise station network for private and business customers worldwide.

Good value with adequate balance sheet and pays a dividend.