- Germany

- /

- Transportation

- /

- XTRA:SIX2

Sixt (XTRA:SIX2): Assessing Valuation After Expansion Push and Strong Earnings Growth

Reviewed by Simply Wall St

Sixt (XTRA:SIX2) is making headlines after announcing accelerated franchise expansions in Latin America and the Caribbean, as well as launching new airport branches across the U.S. These moves come in addition to newly secured credit facilities and positive earnings momentum.

See our latest analysis for Sixt.

Despite Sixt’s international expansions and solid earnings growth, momentum has not quite translated into share price strength, with a year-to-date share price return of -12.1% and a 1-year total shareholder return of just 1.8%. Weakness over recent months suggests investors remain cautious, even as fundamentals improve. However, steady long-term sales and profit gains could help change sentiment ahead.

If you are scanning for new opportunities in the mobility space, now is an ideal time to broaden your investing radar and discover See the full list for free.

With the share price lagging even as Sixt posts impressive earnings growth and expands aggressively, the central question is whether the stock’s current valuation reflects upside from this momentum, or if the market has already factored future gains into the price. Could this be a genuine buying opportunity, or is growth fully priced in?

Price-to-Earnings of 11.4x: Is it justified?

Sixt’s stock is currently trading at a price-to-earnings (P/E) ratio of 11.4x, well below peer and industry benchmarks. This suggests investors are attaching a discount to its earnings relative to other transportation companies. With the last close price at €69.45, the P/E ratio points to the market underestimating future growth or risks compared to Sixt’s peers.

The price-to-earnings multiple indicates how much investors are willing to pay for each euro of the company's net earnings. It is particularly relevant for companies like Sixt that have a track record of strong, consistent profit growth in a mature sector, as it helps benchmark Sixt against industry trends and investor expectations.

Sixt's P/E of 11.4x is significantly lower than both direct peer averages (23.6x) and the broader European Transportation industry (15.6x). This implies the stock may be undervalued for its robust earnings momentum. The fair P/E ratio for Sixt, based on quantitative analysis, would be closer to 12.2x, highlighting potential room for market re-rating if confidence returns.

Explore the SWS fair ratio for Sixt

Result: Price-to-Earnings of 11.4x (UNDERVALUED)

However, persistent share price declines and lagging three to five year returns could reinforce market skepticism if earnings momentum slows or global growth headwinds worsen.

Find out about the key risks to this Sixt narrative.

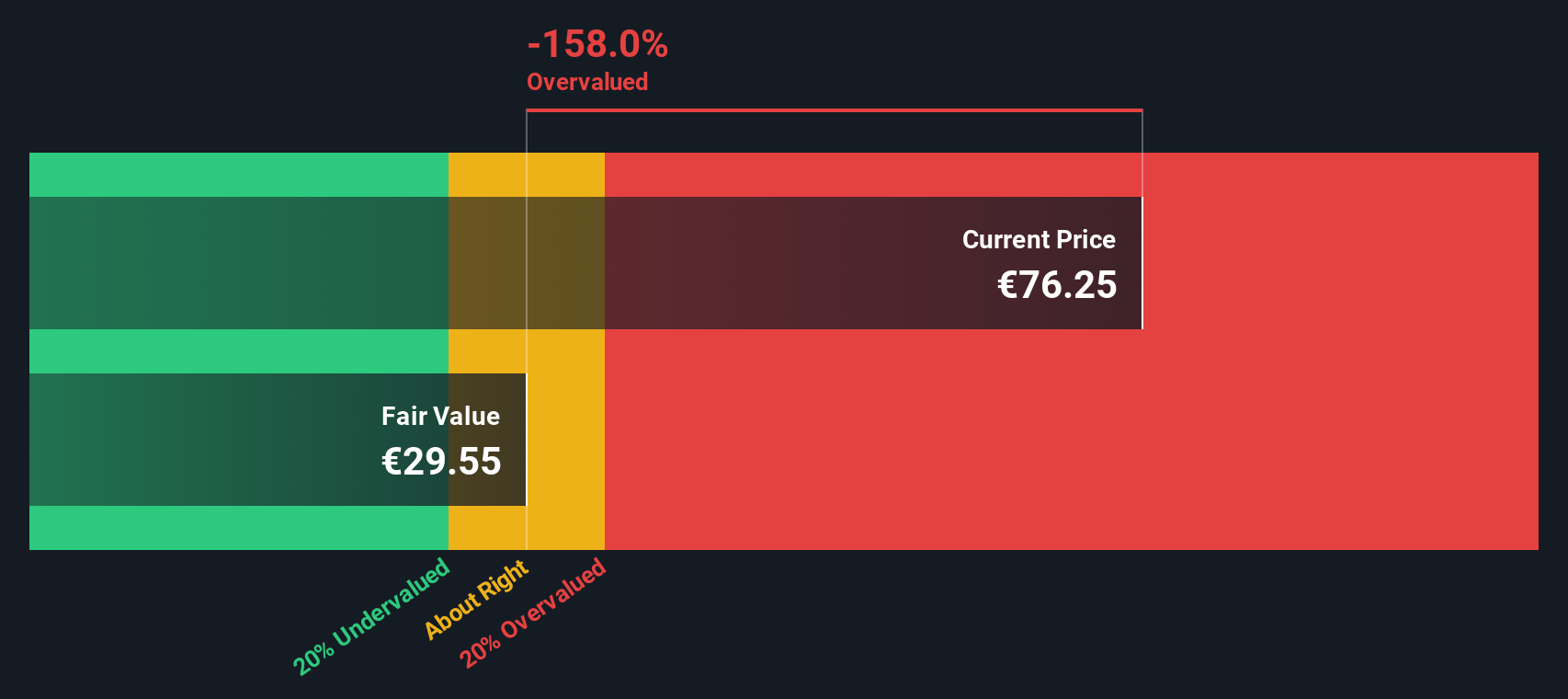

Another View: Discounted Cash Flow Perspective

Taking a different approach, our DCF model values Sixt at €81.93 per share, about 15.2% above its current market price. This suggests there could be meaningful upside potential if the company meets future cash flow expectations. However, it is worth considering whether these projections might be overly optimistic, or if the discount offers an opportunity for attentive investors.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sixt for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 897 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sixt Narrative

If you would like to look deeper, you can easily review the numbers, reach your own conclusions, or shape your own Sixt story in just a few minutes. Do it your way.

A great starting point for your Sixt research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the curve by using the Simply Wall Street Screener to find stocks that fit your strategy. Don’t miss your chance to access the next wave of standout investments before everyone else.

- Capture high yields by checking out these 15 dividend stocks with yields > 3%, which offers attractive payouts and strong financial health.

- Tap into the future of medicine with these 30 healthcare AI stocks, driving healthcare breakthroughs through artificial intelligence.

- Seize tomorrow’s technology opportunities through these 26 quantum computing stocks, accelerating innovation in the quantum computing sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SIX2

Sixt

Through its subsidiaries, provides mobility services through corporate and franchise branch network for private and business customers.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives