Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Müller - Die lila Logistik SE (ETR:MLL) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Müller - Die lila Logistik

What Is Müller - Die lila Logistik's Debt?

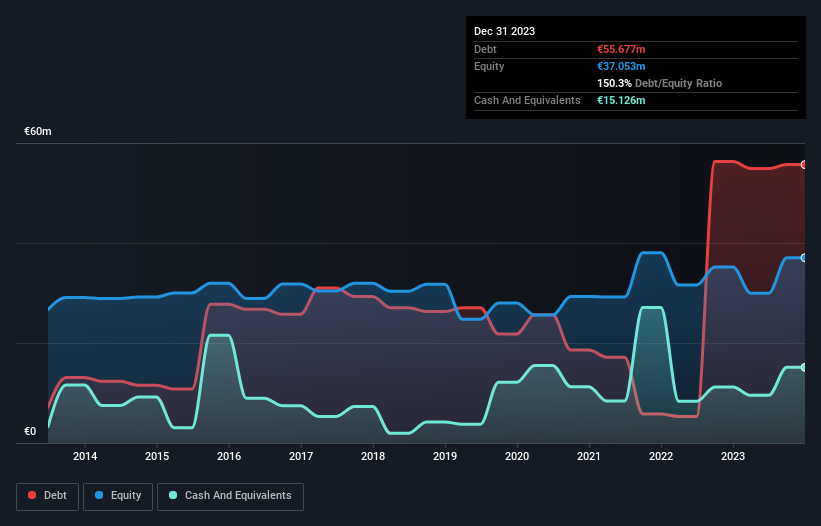

As you can see below, Müller - Die lila Logistik had €55.7m of debt, at December 2023, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of €15.1m, its net debt is less, at about €40.6m.

A Look At Müller - Die lila Logistik's Liabilities

The latest balance sheet data shows that Müller - Die lila Logistik had liabilities of €60.7m due within a year, and liabilities of €109.9m falling due after that. Offsetting this, it had €15.1m in cash and €31.9m in receivables that were due within 12 months. So it has liabilities totalling €123.6m more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the €51.3m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, Müller - Die lila Logistik would likely require a major re-capitalisation if it had to pay its creditors today. There's no doubt that we learn most about debt from the balance sheet. But it is Müller - Die lila Logistik's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Müller - Die lila Logistik wasn't profitable at an EBIT level, but managed to grow its revenue by 60%, to €260m. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

Even though Müller - Die lila Logistik managed to grow its top line quite deftly, the cold hard truth is that it is losing money on the EBIT line. To be specific the EBIT loss came in at €609k. Considering that alongside the liabilities mentioned above make us nervous about the company. It would need to improve its operations quickly for us to be interested in it. On the bright side, we note that trailing twelve month EBIT is worse than the free cash flow of €26m and the profit of €1.8m. So one might argue that there's still a chance it can get things on the right track. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 5 warning signs for Müller - Die lila Logistik you should be aware of, and 1 of them makes us a bit uncomfortable.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:MLL

Müller - Die lila Logistik

Provides logistics services in Germany and internationally.

Moderate risk and fair value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026