Does Deutsche Post’s 15.4% 2025 Rally Mean There Is More Room to Run?

Reviewed by Bailey Pemberton

Thinking about what to do with your Deutsche Post shares, or maybe you’re just considering buying into one of Europe’s most recognized logistics players? You’re not alone. The stock’s price has seen a healthy climb so far this year, up 15.4% year-to-date, and 4.0% over the past month. This pacing is hard to ignore for value-minded investors. Looking further back, Deutsche Post has managed to put up a 26.5% gain across five years, even after some recent sideways movements in the past week.

So what’s been driving sentiment lately? In the last year, optimism was powered by the company’s success in managing shifting volumes and strong demand for cross-border e-commerce. Market watchers have also noted Deutsche Post’s ongoing digital transformation initiatives, helping them adapt quickly to global logistics challenges and evolving consumer behavior. Although there haven’t been any headline-grabbing announcements in the past few weeks, the long-term momentum hints that investors still see room for growth as global trade keeps rebounding.

If you’re interested in valuation, here’s an eye-opener: Deutsche Post scores a 5 out of 6 on our undervaluation checks, putting it solidly in the “potential bargain” category. But how do we actually break down that score, and which valuation methods matter most for a company like this? Let’s walk through the approaches and stick around, because we’ll wrap up with a smarter, less conventional take on what these numbers really mean for investors.

Approach 1: Deutsche Post Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) valuation method estimates a company’s worth by projecting its future cash flows and then discounting them back to today’s value. This gives investors an idea of what the business may truly be worth, based on its fundamental ability to generate cash long term.

In the case of Deutsche Post, the latest trailing twelve months Free Cash Flow was an impressive €5.71 billion. Analyst forecasts provide annual estimates for the next five years, with projections ranging from €3.01 billion in 2026 to €4.51 billion by 2029. Beyond that period, projections are extrapolated to give a view ten years out, showing continued growth but at a more modest pace. These figures help build a long-range picture of how much cash Deutsche Post is likely to produce.

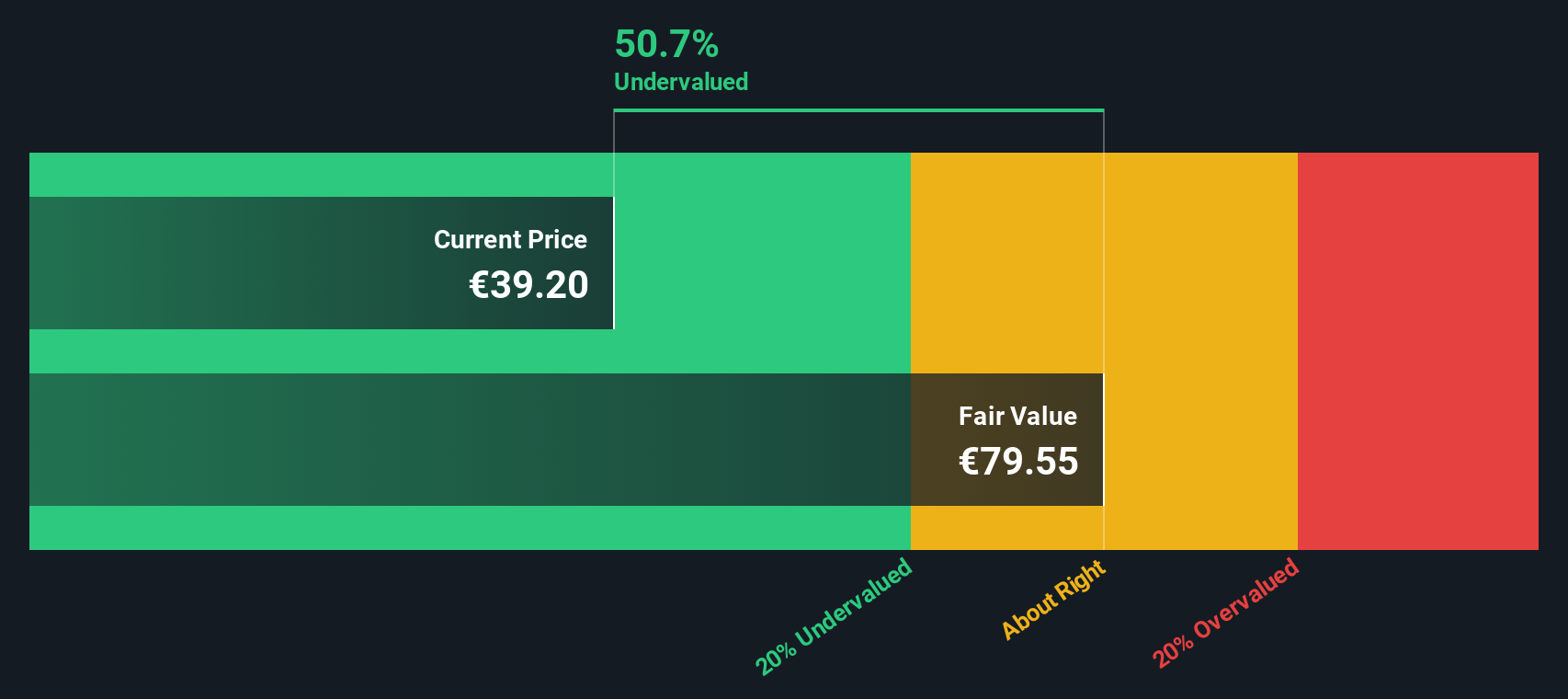

The model arrives at an intrinsic value of €79.50 per share using this approach. Notably, this suggests the stock is trading at a 50.7% discount to its fair value, meaning the market price is significantly lower than what the company’s future cash flows may justify.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Deutsche Post is undervalued by 50.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Deutsche Post Price vs Earnings

For profitable companies like Deutsche Post, the Price-to-Earnings (PE) ratio is one of the most widely used valuation tools. It allows investors to quickly compare what they are paying for each euro of the company’s profit. This makes it a useful shorthand for assessing whether a stock looks expensive or cheap relative to its actual earnings.

What qualifies as a “fair” PE ratio is shaped by a company’s expected earnings growth, how risky or stable its business model is, and market sentiment. Higher growth prospects and lower risk tend to justify a higher PE, while the reverse calls for a discount.

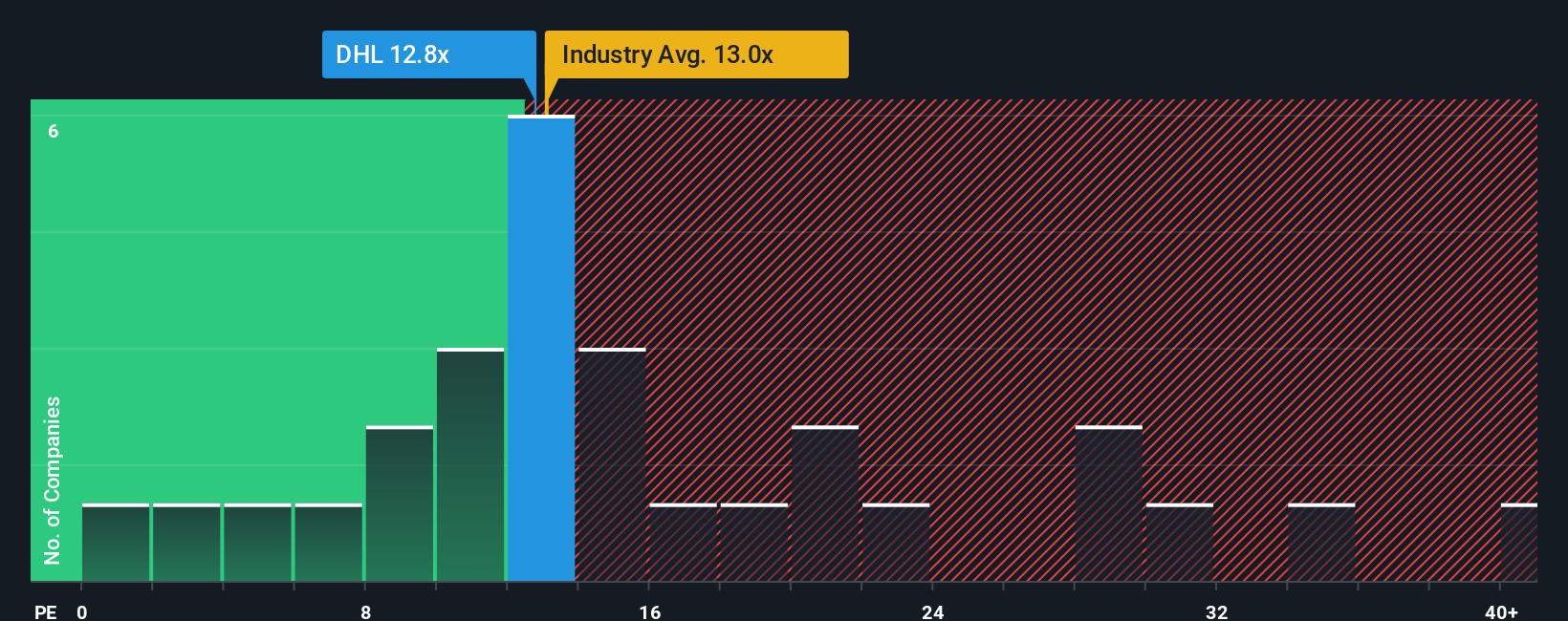

Deutsche Post shares currently trade at a PE of 12.74x. That puts them well below the logistics industry average of 15.87x and also lower than the peer group average of 16.73x. On the surface, this suggests the market is pricing Deutsche Post at a discount compared to similar companies.

There is more nuance to consider. Simply Wall St’s proprietary “Fair Ratio” goes beyond simple industry averages by blending expectations about Deutsche Post’s earnings growth, its risks, profit margins, size, and industry characteristics. The result is a custom PE benchmark just for this stock: 15.50x.

By comparing the Fair Ratio to the company's actual PE, a much fuller picture emerges. With Deutsche Post’s PE sitting significantly below its Fair Ratio, it suggests the shares could be undervalued, especially when considering the company’s fundamentals and not just broad sector trends.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Deutsche Post Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, accessible tool that lets you create your own story about Deutsche Post, weaving together your expectations for its future growth, margins, and fair value based on what you believe will shape its business.

Rather than just relying on numbers, Narratives allow you to link the company’s story to your financial forecasts and then see what that means for fair value. You can access and create Narratives easily on the Simply Wall St Community page, where millions of investors compare views and share their reasoning.

Narratives dynamically update whenever news or fresh results are published, letting you instantly see how shifts in the business or global environment affect your investment case and the estimated fair value compared to the current stock price. This helps you decide whether to buy, sell, or hold.

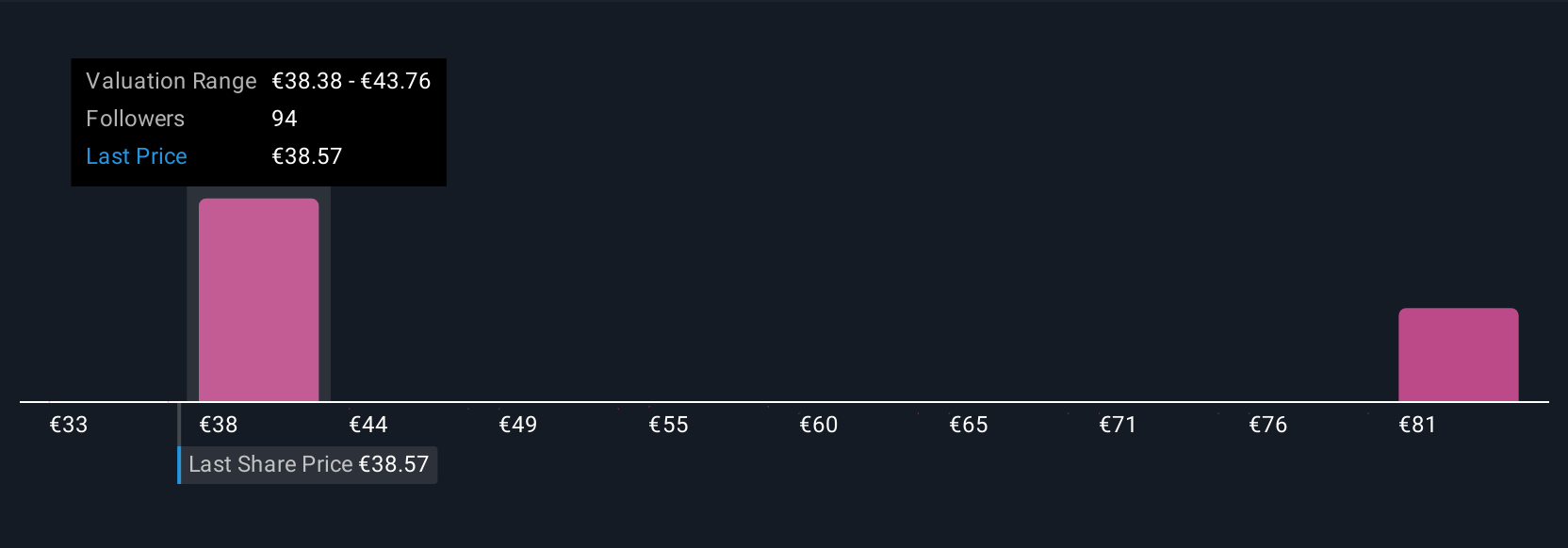

For example, among Deutsche Post investors, the highest Narrative values expect a price target of €60.0 based on strong e-commerce growth and global trade expansion, while bear cases see just €34.0, focused on uncertain volumes and regulatory risks.

Do you think there's more to the story for Deutsche Post? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:DHL

Deutsche Post

Operates as a mail and logistics company in Germany, rest of Europe, the Americas, the Asia Pacific, the Middle East, and Africa.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives