- Germany

- /

- Telecom Services and Carriers

- /

- HMSE:O2D

O2 Telefónica (HMSE:O2D): A Fresh Look at Valuation as Share Price Trends Lower

Reviewed by Simply Wall St

Telefónica Deutschland Holding (HMSE:O2D) has caught the attention of investors lately, even without a headline-grabbing event making waves in the market. When a stock moves without an obvious catalyst, it’s natural to wonder whether the market is picking up on subtle signals or simply reassessing the company’s future outlook in light of prevailing trends. For shareholders and potential buyers alike, these quieter moments can actually be just as telling as big announcements. They often prompt a closer look at whether current prices reflect the real value of the business.

Over the past year, Telefónica Deutschland Holding’s share price has drifted lower, with a total return of -6% during that period, and momentum has softened further in recent months. The stock has slid by nearly 10% over the past 3 months and is also in the red year-to-date. Despite a lack of jaw-dropping news, this downward move stands out against some of the chatter around telecom sector resilience and raises questions about changing risk perception and growth expectations for O2D.

With that backdrop, is Telefónica Deutschland Holding now an overlooked bargain or is the market already factoring in stalling growth and future risks? Let’s dig into the valuation case.

Price-to-Earnings of 18x: Is it justified?

Telefónica Deutschland Holding is currently trading at a Price-to-Earnings ratio of 18, which is slightly lower than both the European Telecom industry average of 19 and the peer group average of 18.5. This suggests that the market may be assigning a modest discount to O2D's earnings compared to its competitors.

The Price-to-Earnings (P/E) ratio is a widely used metric that compares a company’s share price to its earnings per share. This provides investors with a quick reference to how richly or modestly the market is valuing each unit of earnings. In the telecom sector, where stable cash flows and moderate growth are the norm, the P/E ratio can highlight investor confidence in a company’s near-term profit potential.

With O2D's P/E standing just below industry and peer benchmarks, the share price appears to reflect a cautious but not pessimistic outlook for future profitability. This may indicate that despite muted recent returns, investors still recognize the company’s steady earnings history.

Result: Fair Value of €2.03 (ABOUT RIGHT)

See our latest analysis for Telefónica Deutschland Holding.However, operational setbacks or further delays in delivering growth could quickly shift sentiment and threaten the cautiously fair valuation currently assigned to O2D.

Find out about the key risks to this Telefónica Deutschland Holding narrative.Another View: What Does the SWS DCF Model Say?

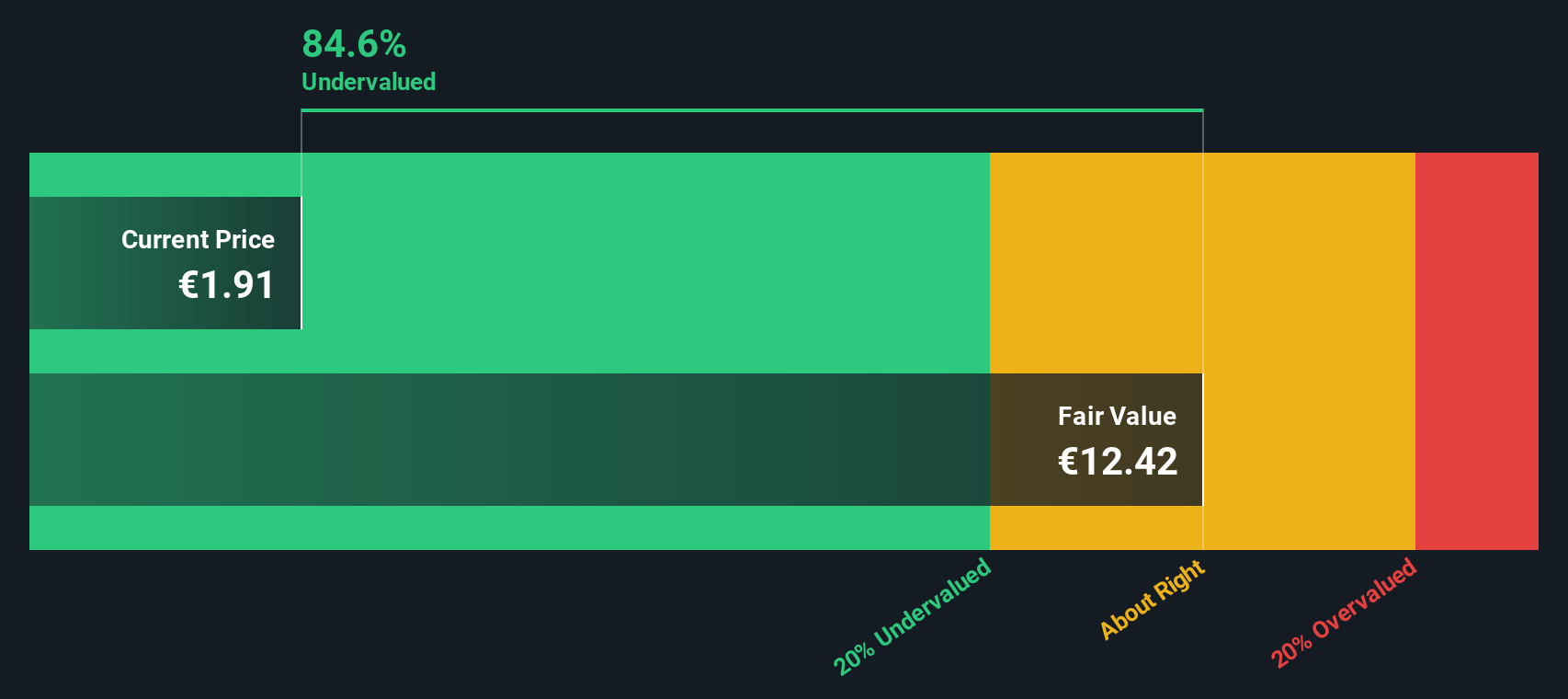

Looking at Telefónica Deutschland Holding through the lens of our DCF model, the picture appears quite different. This method suggests the shares are trading well below their estimated fair value, raising an entirely new set of questions. Could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Telefónica Deutschland Holding Narrative

If you have a different perspective or want to dive deeper into the numbers, you can piece together your own story in just minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Telefónica Deutschland Holding.

Looking for more investment ideas?

Don’t let opportunities pass you by. Take charge of your investment journey with strategies that set you ahead of the crowd. These screens highlight where smart money might be moving next.

- Boost your income by scanning for high-yield payers through handpicked dividend stocks with yields > 3% that offer strong and consistent returns above 3%.

- Find tomorrow’s tech winners by tapping into a world of potential with AI penny stocks, focusing on companies innovating in artificial intelligence and automation.

- Seize value opportunities by uncovering stocks priced attractively with robust fundamentals, all with our dedicated screen for undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Telefónica Deutschland Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About HMSE:O2D

Telefónica Deutschland Holding

Provides integrated telecommunication services to private and business customers in Germany.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion