It's Unlikely That q.beyond AG's (ETR:QBY) CEO Will See A Huge Pay Rise This Year

Despite q.beyond AG's (ETR:QBY) share price growing positively in the past few years, the per-share earnings growth has not grown to investors' expectations, suggesting that there could be other factors at play driving the share price. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 12 May 2021. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

See our latest analysis for q.beyond

Comparing q.beyond AG's CEO Compensation With the industry

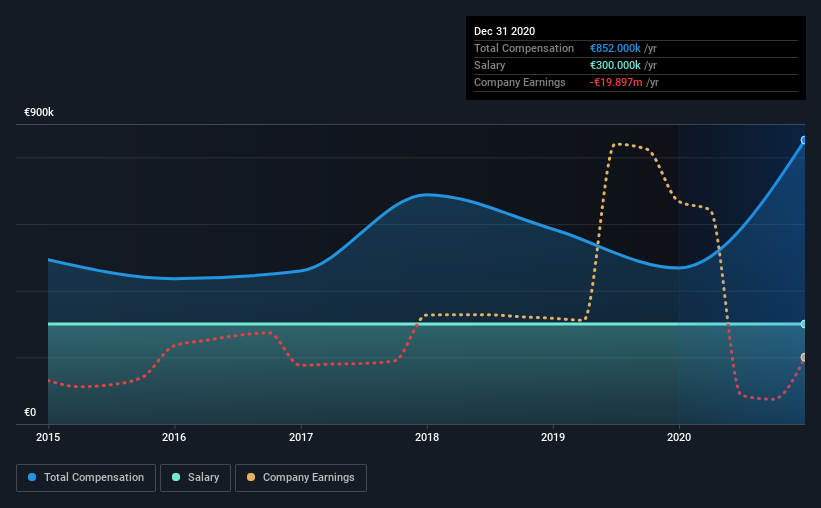

At the time of writing, our data shows that q.beyond AG has a market capitalization of €231m, and reported total annual CEO compensation of €852k for the year to December 2020. That's a notable increase of 82% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at €300k.

For comparison, other companies in the same industry with market capitalizations ranging between €83m and €333m had a median total CEO compensation of €409k. Hence, we can conclude that Jürgen Hermann is remunerated higher than the industry median. Furthermore, Jürgen Hermann directly owns €1.9m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €300k | €300k | 35% |

| Other | €552k | €168k | 65% |

| Total Compensation | €852k | €468k | 100% |

Talking in terms of the industry, salary represented approximately 35% of total compensation out of all the companies we analyzed, while other remuneration made up 65% of the pie. Although there is a difference in how total compensation is set, q.beyond more or less reflects the market in terms of setting the salary. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at q.beyond AG's Growth Numbers

q.beyond AG has reduced its earnings per share by 5.1% a year over the last three years. It saw its revenue drop 40% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has q.beyond AG Been A Good Investment?

q.beyond AG has generated a total shareholder return of 28% over three years, so most shareholders would be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

In Summary...

Despite the positive returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about whether these returns will continue. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

Shareholders may want to check for free if q.beyond insiders are buying or selling shares.

Switching gears from q.beyond, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade q.beyond, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:QBY

q.beyond

Engages in the cloud, applications, artificial intelligence (AI), and security business in Germany and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026