- Germany

- /

- Wireless Telecom

- /

- XTRA:FNTN

Freenet (XTRA:FNTN) Margins Decline to 10.3%; Recent Profit Drop Undercuts Bullish Narratives

Reviewed by Simply Wall St

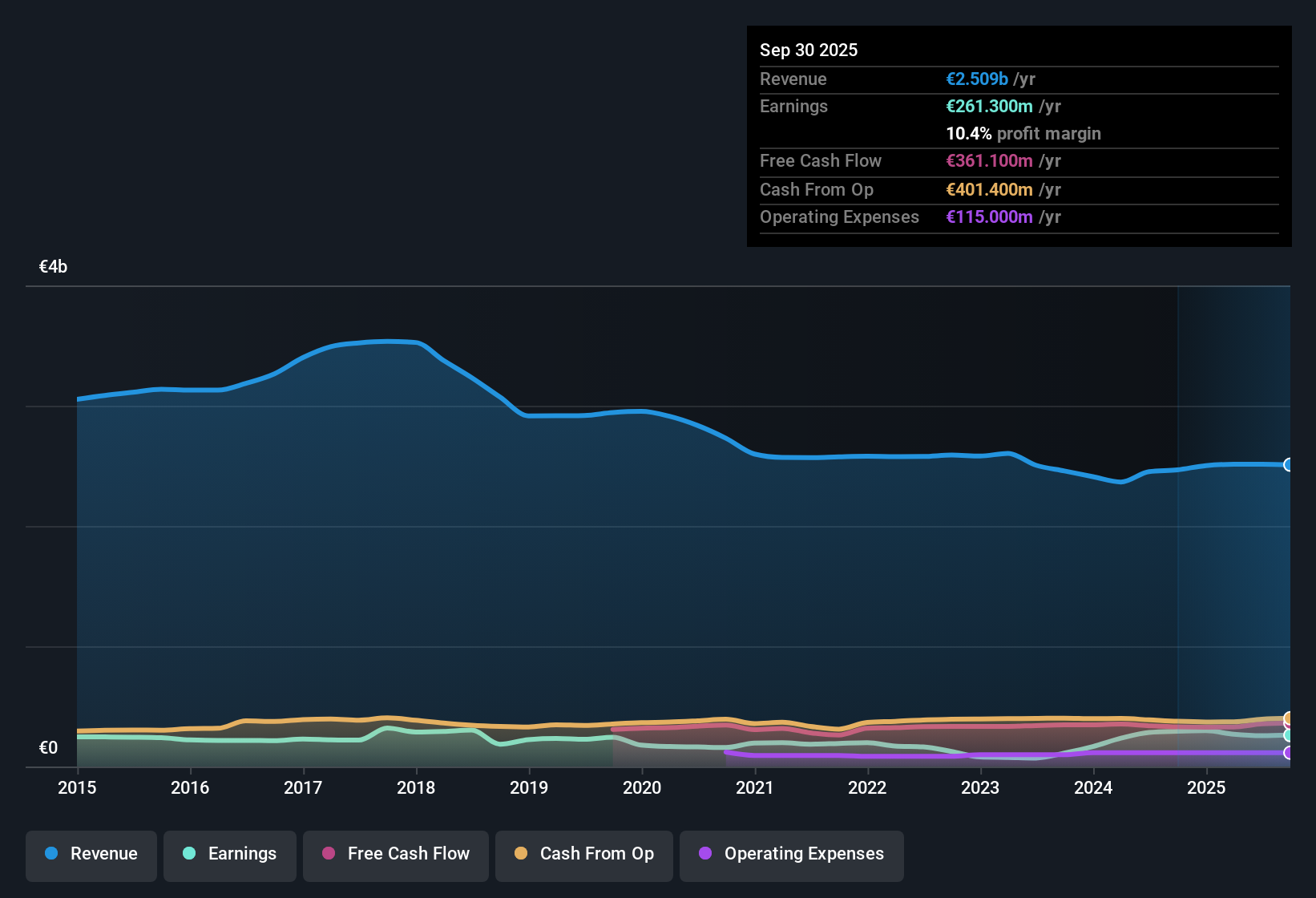

Freenet (XTRA:FNTN) posted five-year annualized earnings growth of 11.5%, but its net profit margin fell to 10.3% from 11.8% last year. Recent results undershot the company’s track record, with earnings moving into negative territory year-on-year and forecast growth now slowing to 4.21% annually, trailing both the company’s past performance and the broader German market’s projected 6.1% revenue growth. With top-line sales expected to edge up just 1.9% a year, investors are weighing the company’s softer margins and sluggish outlook against a notably low Price-to-Earnings ratio of 12.1x and a market valuation well below sector averages. This sets the stage for a results-driven discussion this earnings season.

See our full analysis for freenet.Up next, we’ll see how the latest financials stack up against the most-followed narratives around Freenet and whether expectations hold up to scrutiny.

See what the community is saying about freenet

DCF Fair Value Nearly Triples Share Price

- Freenet’s shares closed at €27.32, sitting dramatically below the DCF fair value of €92.96. This represents an implied gap of more than 240% from intrinsic value, and is also well under its 12.1x PE peer average of 22.6x.

- According to the analysts' consensus view, this steep valuation discount stands out because, while future earnings growth is projected to slow to 4.21% per year and revenue growth lags the German market at just 1.9% per year,

- The gap is partially explained by concerns around dividend sustainability and the risk that long-term operating partnerships may not offset competitive pricing pressures. Both factors could constrain the ability to deliver on mid-term profit margin targets.

- However, despite the slower growth outlook, the deeply discounted price relative to fair value and sector multiples supports the argument for upside if management’s cost optimization and subscriber growth strategies deliver even modestly above expectations.

See what the community thinks about whether Freenet’s value gap presents an opportunity or a value trap. 📊 Read the full freenet Consensus Narrative.

Subscription TV Drives Margin Optimism

- waipu.tv, Freenet’s digital TV streaming business, has delivered around 25% revenue growth. It has become a key contributor to group EBITDA and is driving management’s push towards more predictable, higher-margin, recurring revenue streams.

- Analysts' consensus view points to operational efficiency efforts such as AI integration and online channel optimization as backing margin expansion,

- with the consensus expecting profit margins to rise from 10.2% now to 11.7% in three years, even as top-line growth slows.

- However, this margin optimism leans heavily on strategic partnerships and cost-cutting measures. Consensus also acknowledges that if the pace of digital adoption or new partner agreements falters, margin gains may disappoint.

Mixed Analyst Targets Signal Divided Expectations

- While the analyst price target stands at €32.03 (roughly 14.6% above the current share price of €27.32), estimates diverge significantly, with bullish forecasts at €39.4 and bearish predictions at €26.5. This indicates meaningful uncertainty about Freenet’s future performance.

- Consensus narrative highlights this split, noting that even though expected earnings per share could reach €2.96 by 2028 and margins are forecast to climb, share count reductions and sustained ARPU pressure inject risk.

- The company will need to outperform muted revenue trends and deliver visible operating leverage for shares to rerate meaningfully higher.

- This division among analysts reflects caution over the company’s ability to fully capitalize on recurring revenues amidst competitive headwinds and shifting partner dynamics.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for freenet on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Shape your own narrative in just a few minutes and share your unique perspective: Do it your way.

A great starting point for your freenet research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Freenet’s muted revenue progress, slowing earnings growth, and profit margin pressures highlight the challenges of relying on a less consistent expansion story.

If you want steadier growth, use stable growth stocks screener (2082 results) to find companies with a proven track record of reliable earnings and revenue momentum worth your attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if freenet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:FNTN

freenet

Provides telecommunications, broadcasting, and multimedia services for mobile communications/mobile internet, and digital lifestyle sectors in Germany.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion