- Germany

- /

- Telecom Services and Carriers

- /

- XTRA:DTE

Is There an Opportunity for Deutsche Telekom After Its 153% Five Year Return?

Reviewed by Bailey Pemberton

If you are trying to figure out what to do with Deutsche Telekom stock, you are far from alone. With a share price that just closed at 29.01, it is easy to see why the stock is at the center of investment conversations. Over the last five years, Deutsche Telekom has delivered a jaw-dropping 153.3% return, and even though the last week saw a dip of -3.2%, longer-term holders are still sitting on impressive gains.

Recent news around the company's continued investment in 5G infrastructure and strategic moves in both European and US telecom markets have reinforced optimism about its growth potential. The muted -0.5% year-to-date return, combined with a respectable 5.4% gain over the past year, suggests the market is still digesting recent headlines. Investors are keeping a close watch, weighing whether this is a momentary pause in a longer growth story or a shift in risk sentiment.

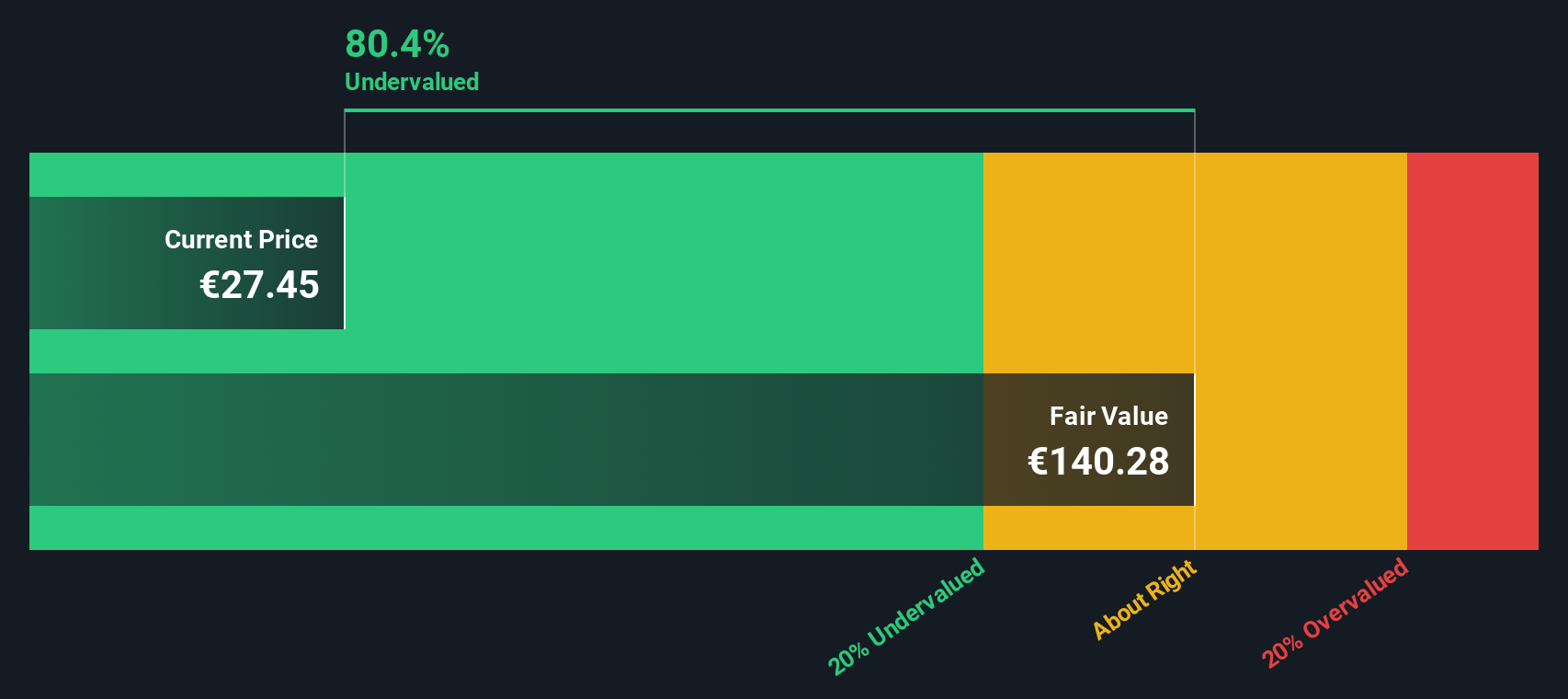

The real story, though, is valuation. By the numbers, Deutsche Telekom passes every major undervaluation check you can throw at it, earning a perfect value score of 6. Of course, figuring out whether a stock is truly undervalued takes more than just running through a checklist. Let's dive into the valuation methods that really matter and, at the end, explore an even more revealing way to judge if Deutsche Telekom is a buy right now.

Approach 1: Deutsche Telekom Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's value. This approach essentially asks, "How much are all the cash Deutsche Telekom will generate in the years ahead worth in today's euros?"

For Deutsche Telekom, analysts estimate its latest twelve months Free Cash Flow at a substantial €21.8 billion, with projections showing steady annual growth. Looking ahead, cash flow is forecasted to reach €23.6 billion by 2029. Further long-term estimates, extrapolated using moderate growth rates, bring Free Cash Flow up to just under €28 billion by 2035.

Based on these projections, the DCF calculation yields an intrinsic value of €117.86 per share, far above the current share price of €29.01. This points to a 75.4% implied undervaluation by the market according to this approach.

If you believe in the reliability of these future cash flow forecasts, the case for Deutsche Telekom stock being undervalued is clear.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Deutsche Telekom is undervalued by 75.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

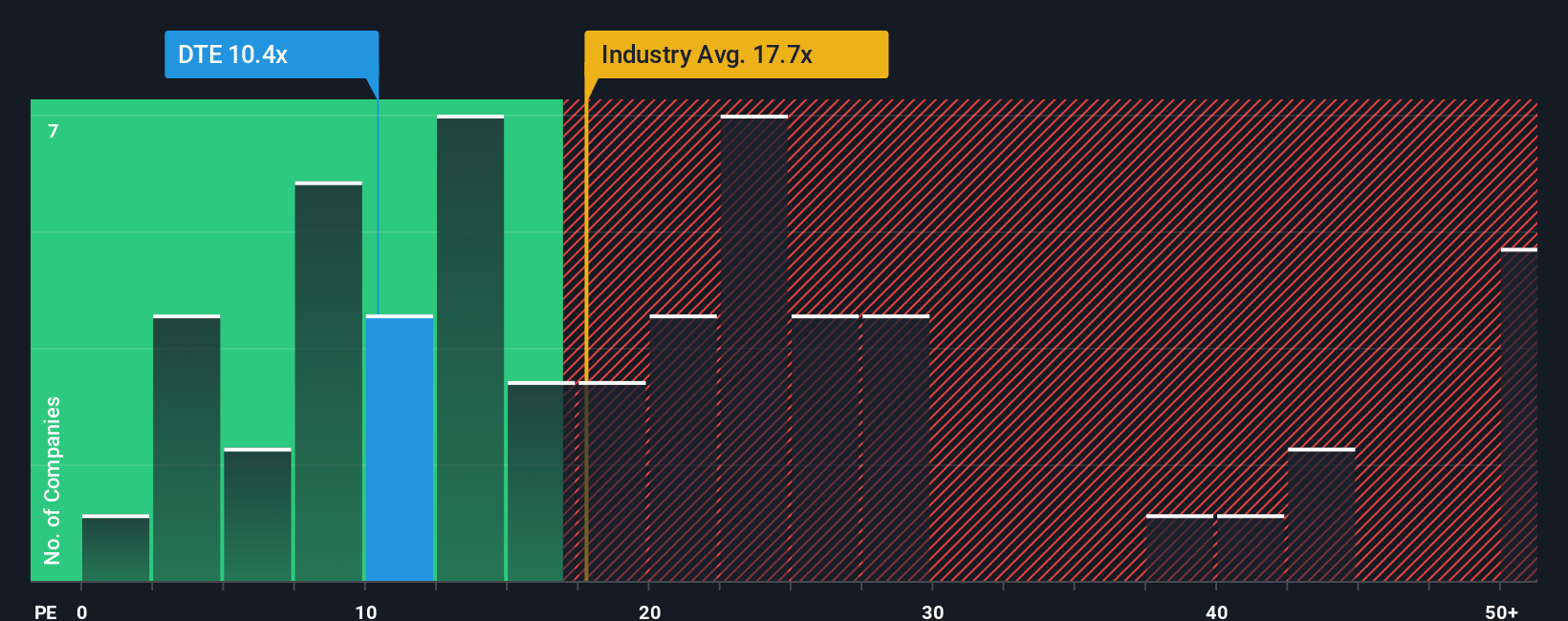

Approach 2: Deutsche Telekom Price vs Earnings

The Price-to-Earnings (PE) ratio is a preferred valuation metric for profitable companies because it directly relates a company's market price to its underlying earnings. Essentially, it shows how much investors are willing to pay today for a euro of current earnings, making it especially relevant for steady earners such as Deutsche Telekom.

The range of what counts as a "normal" or "fair" PE ratio depends a lot on expectations for a company's future growth and the risks attached. Higher growth and lower risks tend to justify a higher PE ratio, while slower prospects or more uncertainty push that number down. Benchmarking Deutsche Telekom, the company is currently trading at a PE of 11x. In contrast, the broader telecom industry averages 16.8x, and similar peers in the sector have an even higher average PE of 19.7x.

Simply Wall St's proprietary "Fair Ratio" takes this a step further by analyzing not just industry trends but also Deutsche Telekom's own growth outlook, profit margins, market cap, and risk factors. The platform assigns the company a Fair PE Ratio of 21.4x, a figure higher than both the industry average and its peers. This approach is more insightful than broad benchmarks because it personalizes the fair value based on all the factors that matter for Deutsche Telekom specifically.

With Deutsche Telekom trading at just 11x earnings while its Fair Ratio stands at 21.4x, the evidence points clearly to the stock being undervalued by this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

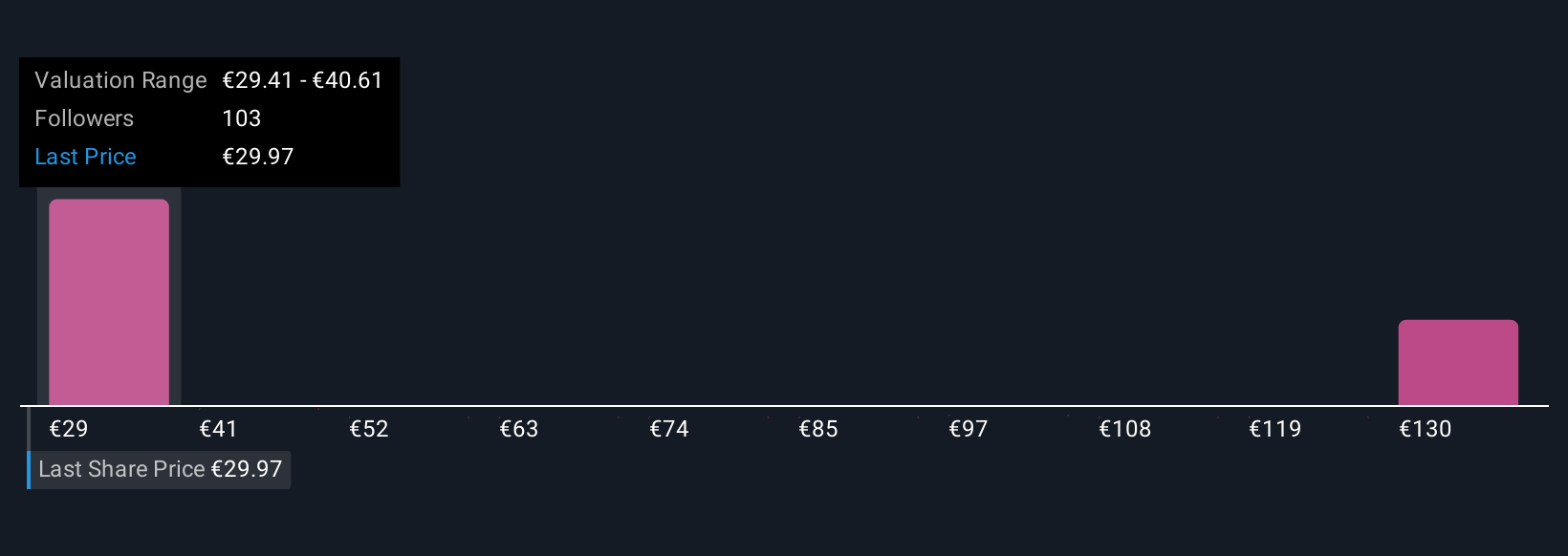

Upgrade Your Decision Making: Choose your Deutsche Telekom Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story and set of assumptions about a company, how you see Deutsche Telekom's future unfolding, and it connects your forecasts for revenue, earnings, and margins directly to a calculated fair value.

Narratives are simple yet powerful tools that let you bridge the gap between just looking at numbers and truly understanding what is driving value. Unlike static models, a Narrative ties together what is happening in Deutsche Telekom's business, your financial forecasts, and the price at which you would consider buying or selling, all in a single, evolving view.

On Simply Wall St’s Community page, used by millions of investors, anyone can easily create and update Narratives, helping you interpret breaking news, earnings results, or strategic shifts as they happen. By comparing the Fair Value from your Narrative to the current market Price, you can quickly see whether your story suggests it's time to buy, hold, or sell, and adapt as new information emerges.

For example, some investors expect Deutsche Telekom’s earnings to fall as low as €8.8 billion and set a price target of €31, while others see stronger growth and a price target as high as €43.50. Which story feels right to you?

Do you think there's more to the story for Deutsche Telekom? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:DTE

Deutsche Telekom

Provides integrated telecommunication services worldwide.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives