- Germany

- /

- Telecom Services and Carriers

- /

- XTRA:DTE

Evaluating Deutsche Telekom’s Value After Bold European Network Expansion in 2025

Reviewed by Bailey Pemberton

- Wondering if Deutsche Telekom might be a hidden gem or an overrated stock? Let’s dig into whether its current share price makes sense given what’s under the hood.

- After recent volatility, the stock is currently trading at €27.27, with a 3.5% bump over the last week but down 6.5% year to date. This shows both short-term momentum and lingering uncertainty.

- In the past few weeks, Deutsche Telekom has attracted headlines with bold moves in European network expansion as well as strategic partnerships aimed at strengthening its digital footprint. These developments have sparked debate among analysts about the sustainability of its recent gains and the company’s positioning for future growth.

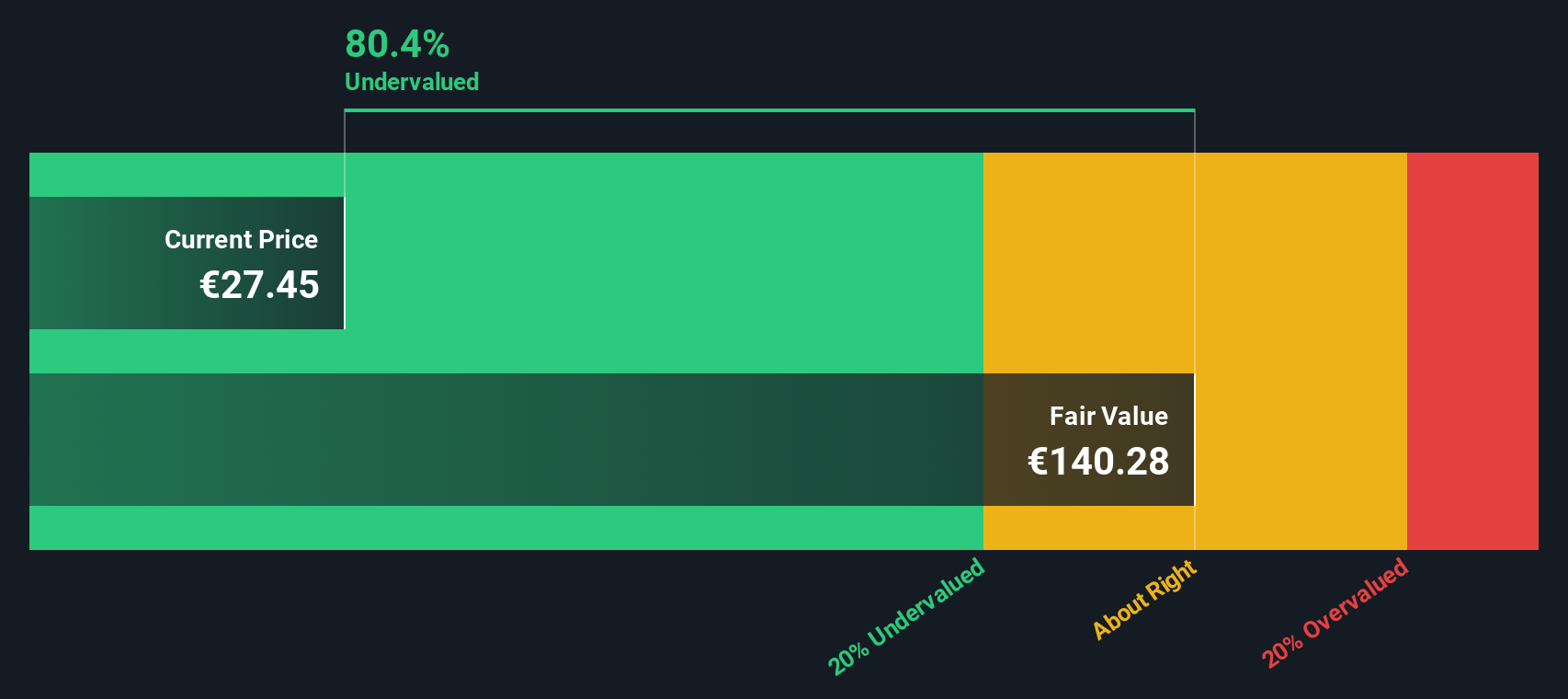

- On our valuation checks, Deutsche Telekom scores 6 out of 6, meaning it appears undervalued in every area we look at. Up next, we will break down which valuation methods get you closest to the truth, so make sure to stick around for a smarter way to make sense of what valuation really means.

Find out why Deutsche Telekom's -2.4% return over the last year is lagging behind its peers.

Approach 1: Deutsche Telekom Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation tool that estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to their value today. This approach helps investors gauge what a stock should be worth based on the company’s predicted ability to generate cash into the future.

For Deutsche Telekom, the DCF model projects Free Cash Flow (FCF) from €21.76 billion over the last twelve months, rising gradually according to analyst and in-house estimates. Analysts forecast cash flows up to 2029, with projections showing FCF could reach €23.07 billion by the end of that year. Beyond the analyst window, models extrapolate growth in cash generation further into the future, but with increasing uncertainty. All cash flows are measured in euro, in billions, providing clarity when comparing to the stock’s current market valuation.

Based on this 2 Stage Free Cash Flow to Equity DCF, Deutsche Telekom’s intrinsic value is calculated at €113.22 per share. With the stock currently trading at €27.27, this represents a 75.9% discount to fair value. According to this analysis, the market may be significantly underestimating the company’s future cash-earning potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Deutsche Telekom is undervalued by 75.9%. Track this in your watchlist or portfolio, or discover 873 more undervalued stocks based on cash flows.

Approach 2: Deutsche Telekom Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Deutsche Telekom. It directly relates the company’s share price to its earnings, giving investors a quick way to assess value relative to profitability. A “normal” or fair PE ratio for any business is not a fixed number; it depends on factors such as expected earnings growth, company risk, and the company's position within its industry cycle.

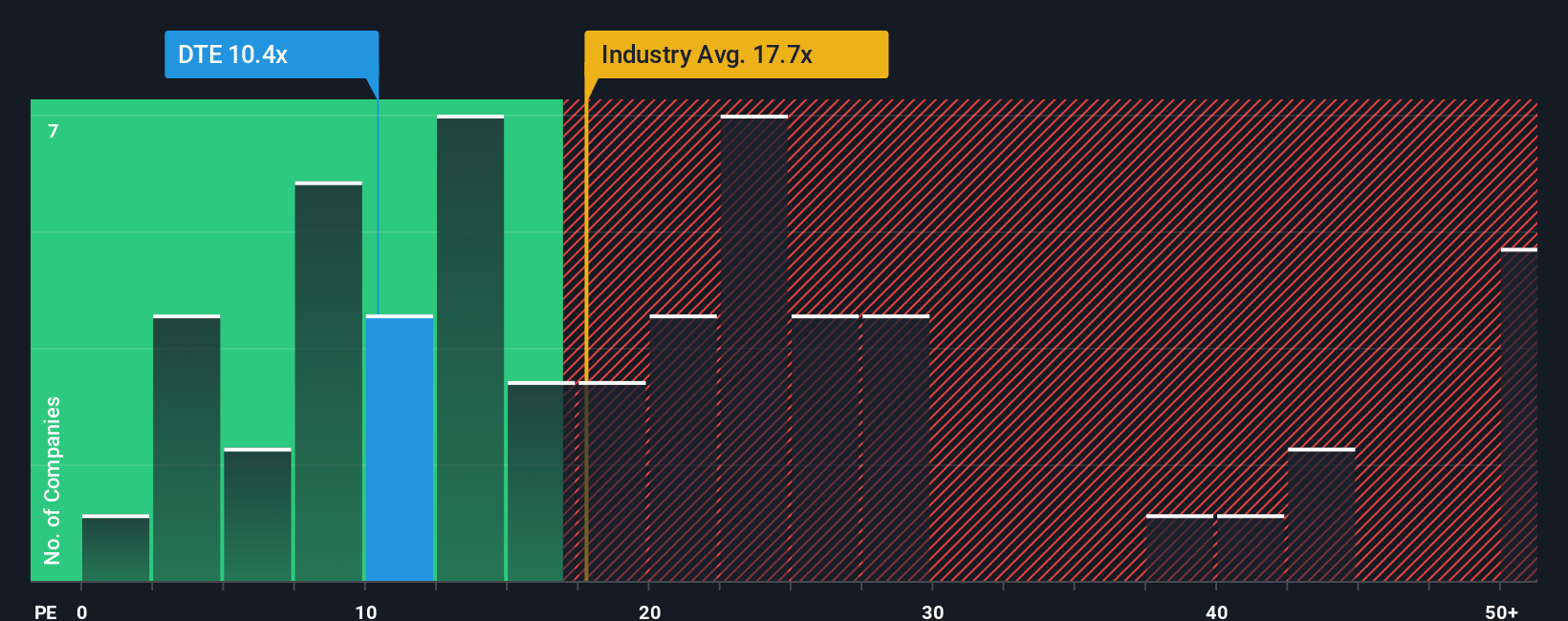

Deutsche Telekom currently trades at a PE ratio of 10.3x. This is noticeably lower than both the average Telecom industry PE of 16.1x and the peer average of 17.8x. This suggests that the stock could be comparatively cheap based on reported profits alone. However, such comparisons do not account for nuances such as growth outlook or risk profile.

Simply Wall St’s “Fair Ratio” provides a more refined valuation benchmark. The Fair Ratio for Deutsche Telekom is calculated at 20.7x, factoring in variables such as the company’s earnings growth prospects, profit margins, scale, industry performance, and specific business risks. Unlike basic industry or peer averages, the Fair Ratio offers a tailored context for what reflects fair value for this particular company.

Looking at the numbers, Deutsche Telekom’s current PE ratio of 10.3x is considerably below its Fair Ratio of 20.7x. This suggests the market may be overlooking the company’s strengths and growth potential.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1401 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Deutsche Telekom Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. This dynamic, user-friendly tool goes beyond the numbers to connect a company’s story with its financial forecast and a fair value that is meaningful to you.

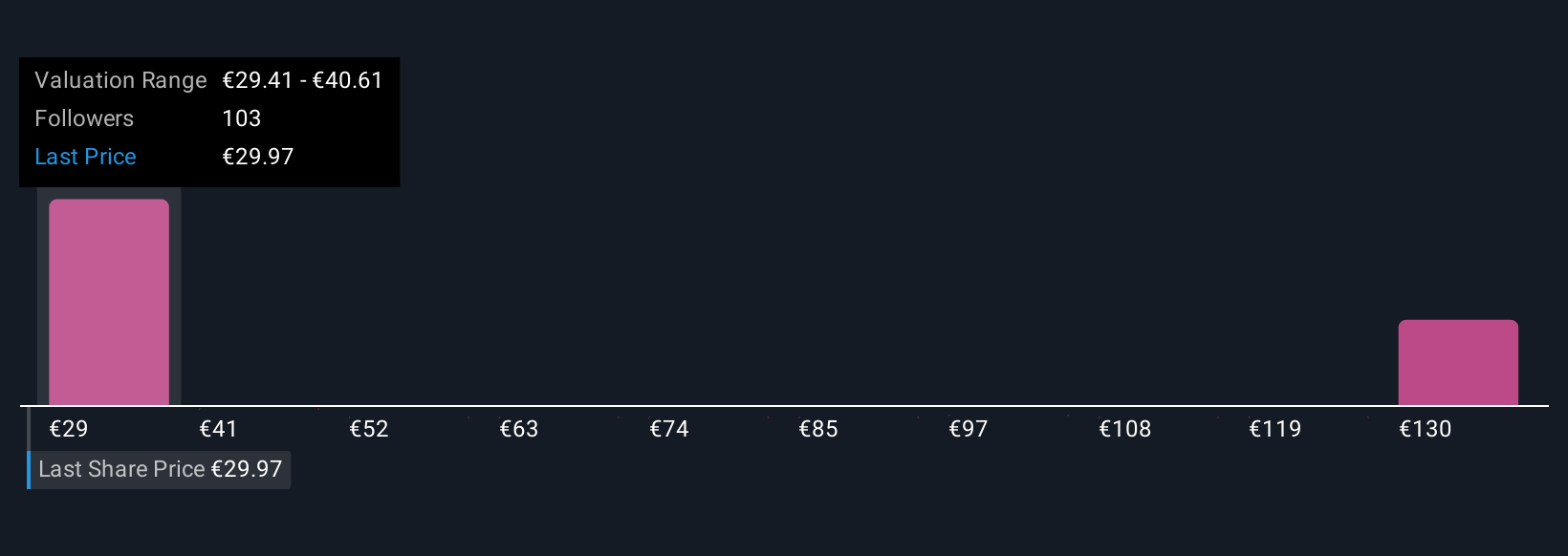

A Narrative is your way of telling the story behind a stock. You combine your view of Deutsche Telekom’s strengths, risks, and future prospects with specific forecasts for revenue, earnings, and profit margins, which all link directly to a fair value estimate for the shares.

This approach is available to millions on Simply Wall St’s Community page. It helps you quickly see whether the current price is above or below your own fair value, making smarter buy or sell decisions much more clear-cut.

Narratives are updated automatically whenever fresh news or earnings releases emerge, so your investment view stays relevant and up to date without any extra effort on your part.

For example, some investors building their Deutsche Telekom Narrative expect continued digital transformation and strong US expansion to drive sustained long-term growth, supporting a fair value of €43.5 per share. Others are more cautious, focusing on competitive threats and seeing fair value at just €31.0 per share.

Do you think there's more to the story for Deutsche Telekom? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:DTE

Deutsche Telekom

Provides integrated telecommunication services worldwide.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives