- Germany

- /

- Wireless Telecom

- /

- XTRA:1U1

Can 1&1 (XTRA:1U1) Sustain Profitability With Flat Revenues in a Tough Telecom Market?

Reviewed by Sasha Jovanovic

- On November 11, 2025, 1&1 AG confirmed its full-year 2025 earnings guidance, projecting stable contract base and service revenue at the previous year’s level of €3,303.1 million, while reporting nine-month sales of €3,016.26 million and a net income decline to €110.71 million compared to the prior year.

- Despite reaffirming guidance, the company’s drop in net income and near-identical sales year-on-year highlight ongoing operational pressures in a competitive German telecom market.

- We'll examine how the combination of stable service revenues and a sharp decline in net income updates 1&1's investment narrative.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

1&1 Investment Narrative Recap

To be a shareholder in 1&1 right now, you need to believe in the company’s ability to execute on its network rollout and ultimately capture margin improvement as it transitions from costly roaming agreements to its own infrastructure. The latest confirmation of full-year guidance, despite net income dropping and flat sales, does not materially move the needle for the near-term catalyst, network independence, or the biggest risk, which remains execution delays and operational bottlenecks.

Among the most relevant announcements, the repeated confirmation of stable revenue guidance highlights the company’s effort to set expectations for predictable top-line results. Yet, given the limited revenue growth and earnings decline reported in the most recent quarterly update, the pressure remains on delivering improved operational efficiency and advancing its mobile network migration to drive profitability.

By contrast, hidden beneath stable revenues, the persistent pressure on margins is a detail investors should be aware of, especially when it comes to...

Read the full narrative on 1&1 (it's free!)

1&1's narrative projects €4.2 billion revenue and €265.6 million earnings by 2028. This requires 1.3% yearly revenue growth and a €114.6 million earnings increase from the current €151.0 million.

Uncover how 1&1's forecasts yield a €21.12 fair value, in line with its current price.

Exploring Other Perspectives

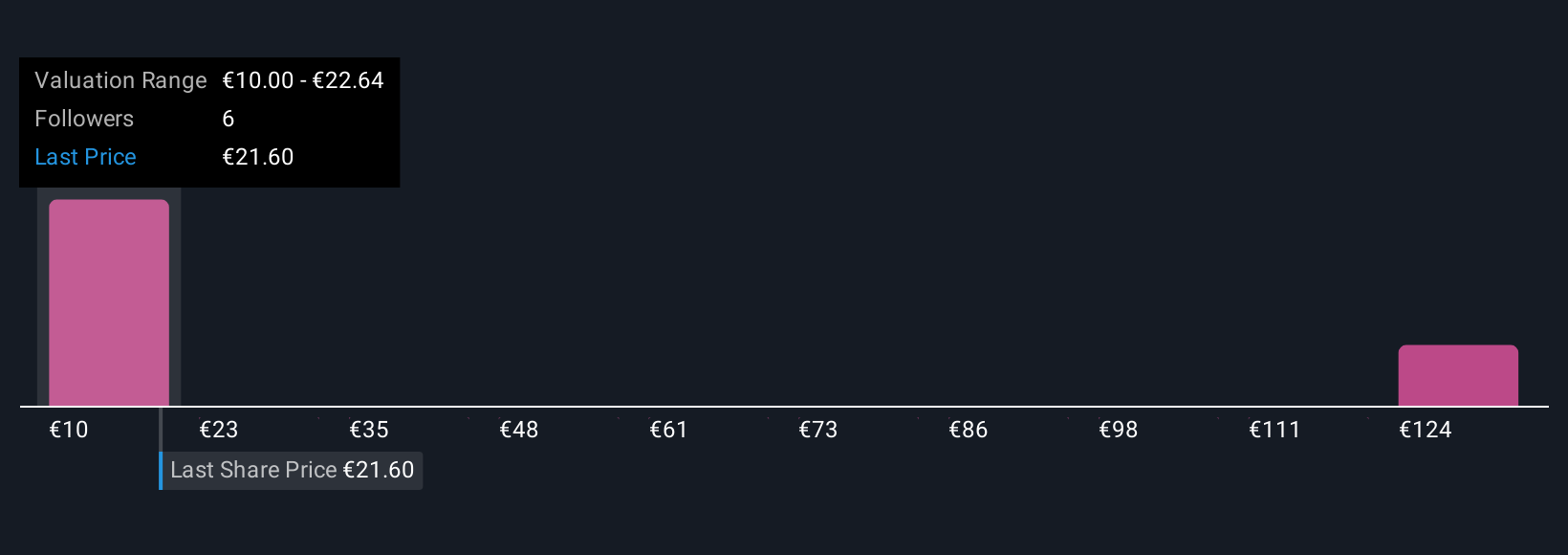

Simply Wall St Community fair value estimates for 1&1 AG range widely from €10 to €136.37, with four different perspectives included. As you weigh these market opinions, remember that execution risk linked to the mobile network rollout can have significant implications for future margins and earnings performance.

Explore 4 other fair value estimates on 1&1 - why the stock might be worth less than half the current price!

Build Your Own 1&1 Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your 1&1 research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free 1&1 research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate 1&1's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:1U1

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives