Schweizer Electronic's(ETR:SCE) Share Price Is Down 48% Over The Past Five Years.

Schweizer Electronic AG (ETR:SCE) shareholders should be happy to see the share price up 25% in the last month. But that doesn't change the fact that the returns over the last five years have been less than pleasing. You would have done a lot better buying an index fund, since the stock has dropped 48% in that half decade.

See our latest analysis for Schweizer Electronic

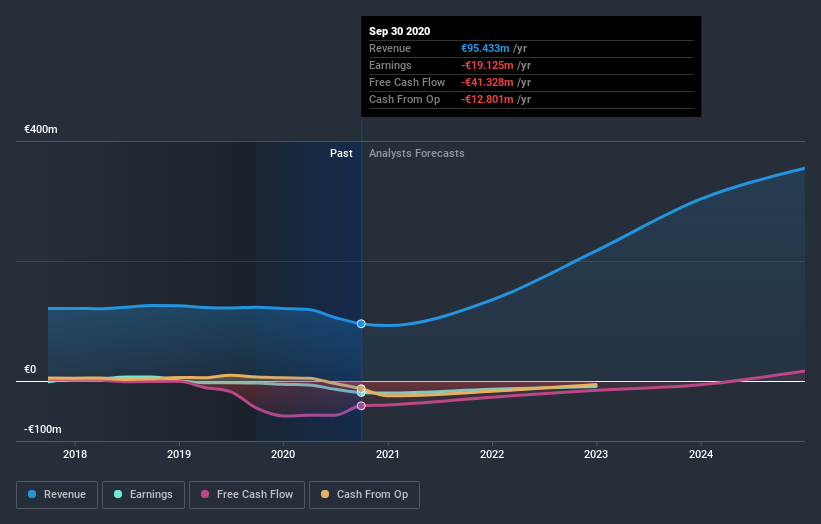

Because Schweizer Electronic made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last five years Schweizer Electronic saw its revenue shrink by 0.3% per year. That's not what investors generally want to see. The share price decline at a rate of 8% per year is disappointing. But it doesn't surprise given the falling revenue. It might be worth watching for signs of a turnaround - buyers are probably expecting one.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Schweizer Electronic stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Schweizer Electronic's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Schweizer Electronic's TSR, which was a 44% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

Schweizer Electronic shareholders are down 14% for the year, but the market itself is up 4.2%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Schweizer Electronic better, we need to consider many other factors. For example, we've discovered 3 warning signs for Schweizer Electronic (1 is potentially serious!) that you should be aware of before investing here.

But note: Schweizer Electronic may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

If you decide to trade Schweizer Electronic, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About XTRA:SCE

Schweizer Electronic

Engages in the development, production, and distribution of printed circuit boards (PCBs) and embedding solutions worldwide.

Excellent balance sheet and fair value.

Market Insights

Community Narratives