As global markets navigate a busy earnings season and economic uncertainties, growth stocks have generally lagged behind value shares, with cautious earnings reports impacting major indices. Despite this backdrop, insider ownership in companies can signal confidence in their long-term potential and resilience amid market volatility. In the current environment, a good stock often combines robust growth prospects with substantial insider ownership, suggesting alignment between management's interests and those of shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's explore several standout options from the results in the screener.

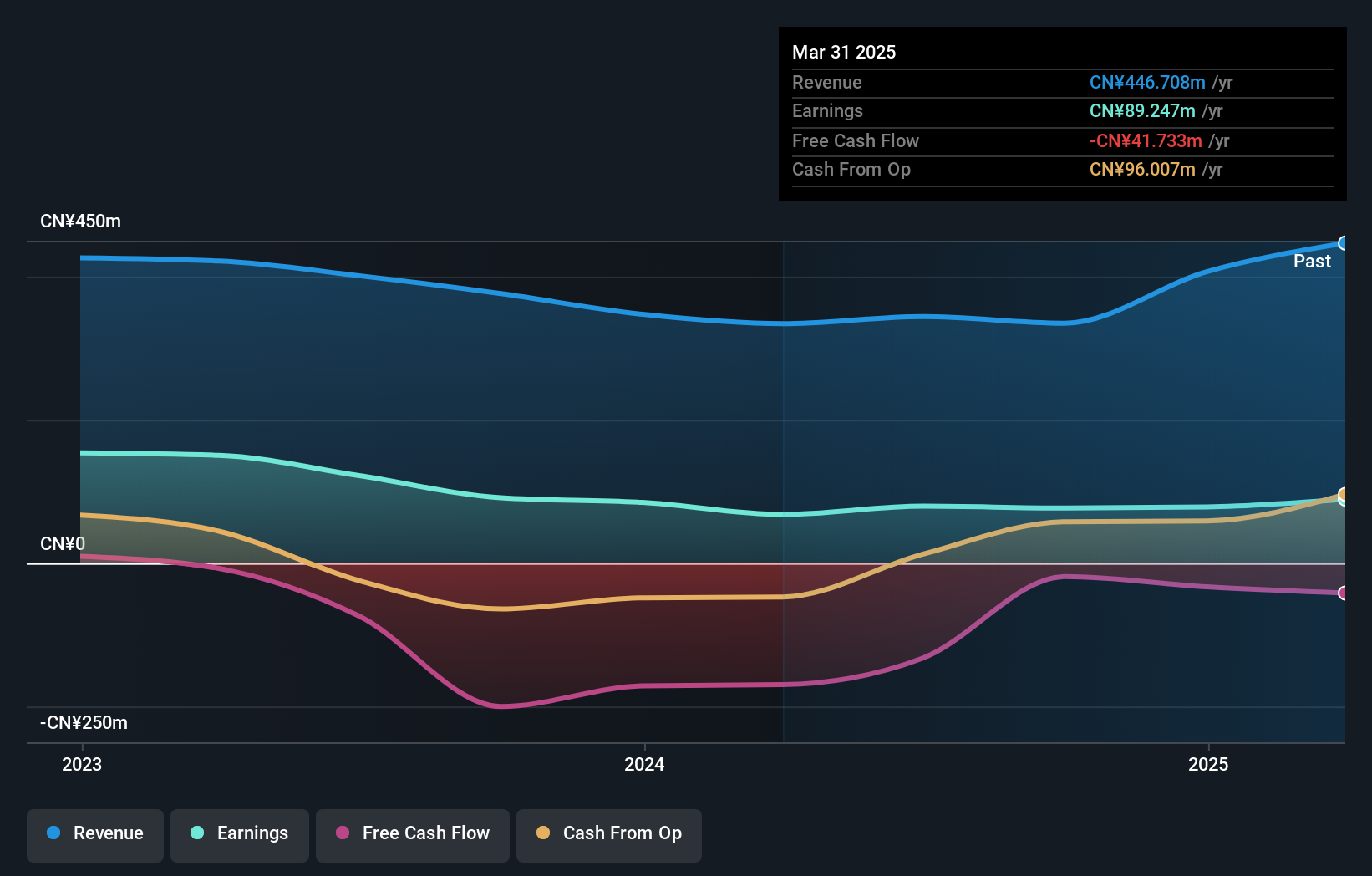

Asian Star Anchor Chain Jiangsu (SHSE:601890)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Asian Star Anchor Chain Jiangsu, with a market cap of CN¥7.60 billion, manufactures and sells anchor chains, marine mooring chains, and related accessories globally through its subsidiaries.

Operations: The company's revenue segments include the manufacture and sale of anchor chains, marine mooring chains, and related accessories on a global scale.

Insider Ownership: 37.9%

Revenue Growth Forecast: 23.8% p.a.

Asian Star Anchor Chain Jiangsu demonstrates promising growth potential with earnings forecasted to increase significantly over the next three years. Despite a slight decline in sales, net income improved to CNY 193.17 million for the nine months ending September 2024. The company's revenue growth is expected to outpace the Chinese market at 23.8% annually, although its earnings growth lags behind market expectations. With a Price-To-Earnings ratio of 31.2x, it remains attractively valued compared to peers.

- Get an in-depth perspective on Asian Star Anchor Chain Jiangsu's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Asian Star Anchor Chain Jiangsu's current price could be inflated.

JHT DesignLtd (SHSE:603061)

Simply Wall St Growth Rating: ★★★★★☆

Overview: JHT Design Co., Ltd. focuses on the research, development, production, and sale of semiconductor chip testing equipment in China and has a market cap of CN¥4.74 billion.

Operations: The company generates revenue primarily from the research, development, production, and sale of semiconductor chip testing equipment in China.

Insider Ownership: 23.1%

Revenue Growth Forecast: 29.3% p.a.

JHT Design Ltd. shows potential as a growth company with high insider ownership, despite recent declines in sales and net income for the nine months ending September 2024. The company reported CNY 256.33 million in sales and CNY 44.93 million in net income, both lower than the previous year. However, its earnings are forecasted to grow significantly at 33.9% annually, outpacing both revenue growth of 29.3% and market expectations in China.

- Delve into the full analysis future growth report here for a deeper understanding of JHT DesignLtd.

- Our valuation report here indicates JHT DesignLtd may be overvalued.

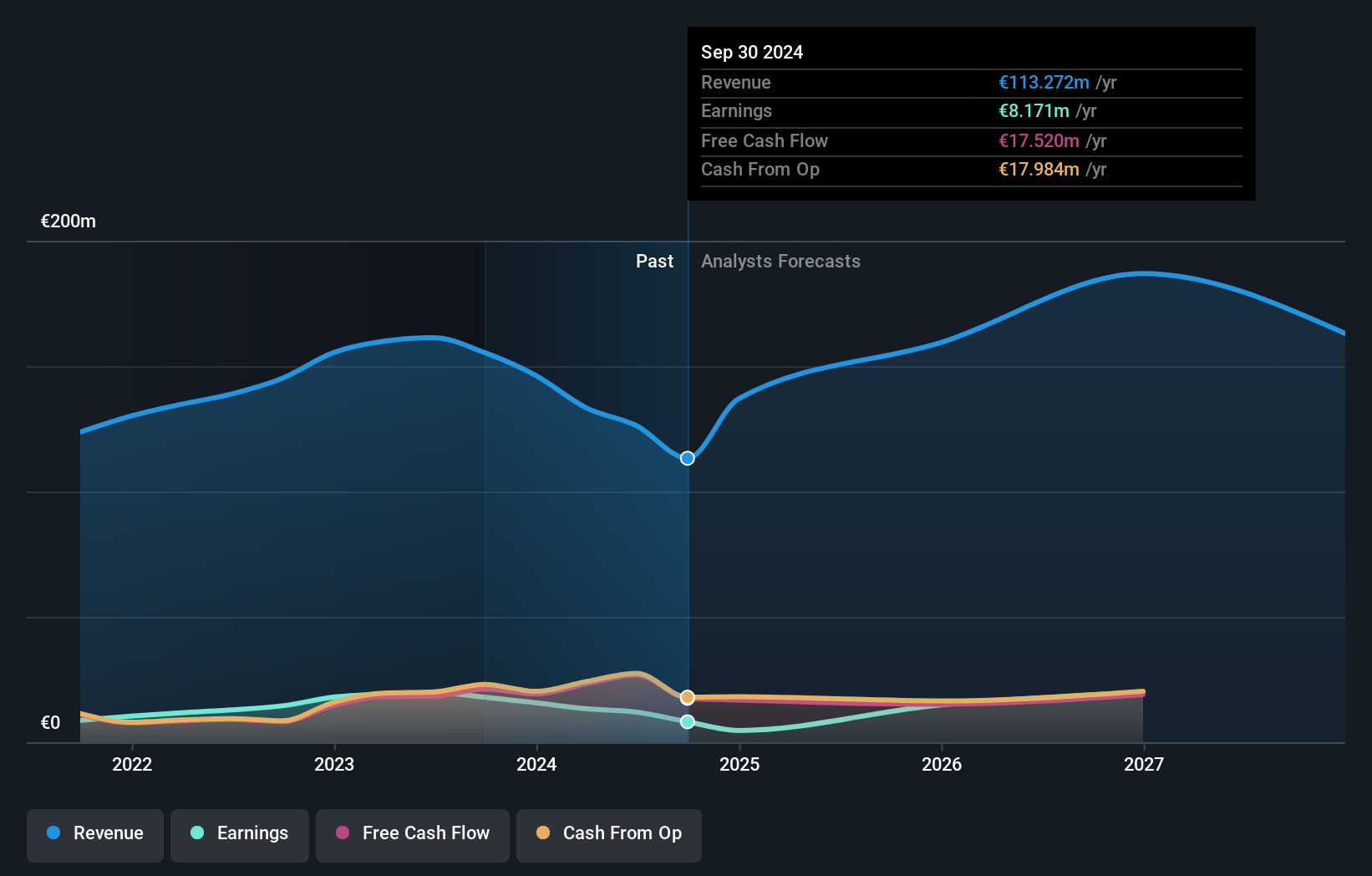

Stemmer Imaging (XTRA:S9I)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Stemmer Imaging AG offers machine vision technology for industrial and non-industrial applications globally, with a market cap of €324.35 million.

Operations: The company's revenue segment consists of €126.23 million from machine vision technology for various applications worldwide.

Insider Ownership: 27.7%

Revenue Growth Forecast: 13.3% p.a.

Stemmer Imaging is poised for substantial growth, with earnings projected to increase significantly at 23.2% annually, outpacing the German market. Despite a recent decline in sales and net income, it trades below its estimated fair value. The company is undergoing a takeover by MiddleGround Management, which has secured an 83.54% stake with plans to delist Stemmer Imaging, offering shareholders €48 per share—a premium over recent trading prices.

- Click here to discover the nuances of Stemmer Imaging with our detailed analytical future growth report.

- Our expertly prepared valuation report Stemmer Imaging implies its share price may be too high.

Turning Ideas Into Actions

- Click here to access our complete index of 1534 Fast Growing Companies With High Insider Ownership.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601890

Asian Star Anchor Chain Jiangsu

Engages in the manufacture and sale of anchor chains, marine mooring chains, and related accessories worldwide.

High growth potential with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion