Nynomic AG (ETR:M7U) Stock Rockets 26% As Investors Are Less Pessimistic Than Expected

Nynomic AG (ETR:M7U) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 44% in the last twelve months.

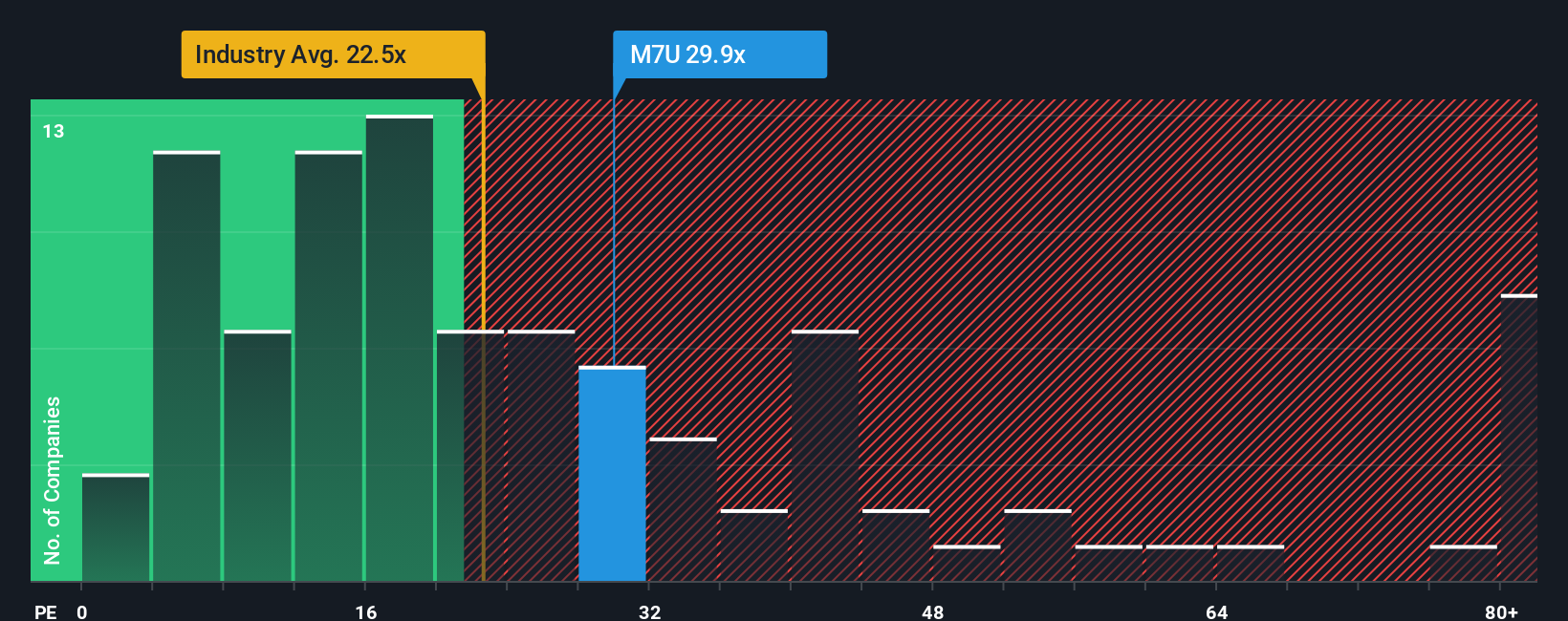

Since its price has surged higher, given close to half the companies in Germany have price-to-earnings ratios (or "P/E's") below 18x, you may consider Nynomic as a stock to avoid entirely with its 29.9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Nynomic hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for Nynomic

Is There Enough Growth For Nynomic?

In order to justify its P/E ratio, Nynomic would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 65% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 63% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 22% over the next year. Meanwhile, the rest of the market is forecast to expand by 22%, which is not materially different.

With this information, we find it interesting that Nynomic is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Nynomic's P/E?

Nynomic's P/E is flying high just like its stock has during the last month. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Nynomic currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Nynomic, and understanding should be part of your investment process.

Of course, you might also be able to find a better stock than Nynomic. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Nynomic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:M7U

Nynomic

Manufactures and sells products for the spectroscopy, sensor technology, laboratory automation and medical technology, agriculture and environmental technology, and industrial markets worldwide.

Excellent balance sheet and good value.

Market Insights

Community Narratives