- Sweden

- /

- Professional Services

- /

- OM:HIFA B

Discover 3 European Penny Stocks With At Least €70M Market Cap

Reviewed by Simply Wall St

As European markets navigate the complexities of global economic shifts, including concerns about Middle Eastern tensions and cautious central bank policies, investors are exploring diverse opportunities. Penny stocks, though an older term, remain a viable investment area for those looking to tap into smaller or newer companies with potential growth prospects. By focusing on penny stocks with strong financial health and resilience, investors can uncover opportunities that balance stability with the possibility of significant returns.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| KebNi (OM:KEBNI B) | SEK1.976 | SEK535.8M | ✅ 3 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.77 | SEK282.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.91 | €61.38M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.41 | €16.49M | ✅ 2 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €1.83 | €39M | ✅ 3 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.37 | SEK2.27B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.74 | SEK227.54M | ✅ 2 ⚠️ 2 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €3.28 | €10.41M | ✅ 2 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.065 | €285.1M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.976 | €32.91M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 456 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

NEXT Biometrics Group (OB:NEXT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NEXT Biometrics Group ASA, with a market cap of NOK550.44 million, offers fingerprint sensor technology across Asia, Europe, Africa, and North America.

Operations: The company generates revenue of NOK65.66 million from its fingerprint sensor technology segment.

Market Cap: NOK550.44M

NEXT Biometrics Group ASA, with a market cap of NOK550.44 million and revenue of NOK65.66 million, is navigating the penny stock landscape by leveraging its fingerprint sensor technology across multiple regions. Despite being unprofitable, it has reduced losses over five years while maintaining a debt-free status and covering liabilities with short-term assets of NOK120.6 million. Recent strategic partnerships in India and other countries aim to expand its market share through advanced biometric solutions like the FAP 20 Basalt L1 Slim sensor, potentially increasing annual orders by up to NOK25 million and enhancing integration into national ID programs globally.

- Dive into the specifics of NEXT Biometrics Group here with our thorough balance sheet health report.

- Evaluate NEXT Biometrics Group's historical performance by accessing our past performance report.

Hifab Group (OM:HIFA B)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hifab Group AB (publ) offers project management and consulting services across Sweden, Europe, Asia, and Africa with a market capitalization of SEK227.54 million.

Operations: The company generates revenue from its Project Management segment, totaling SEK323.09 million.

Market Cap: SEK227.54M

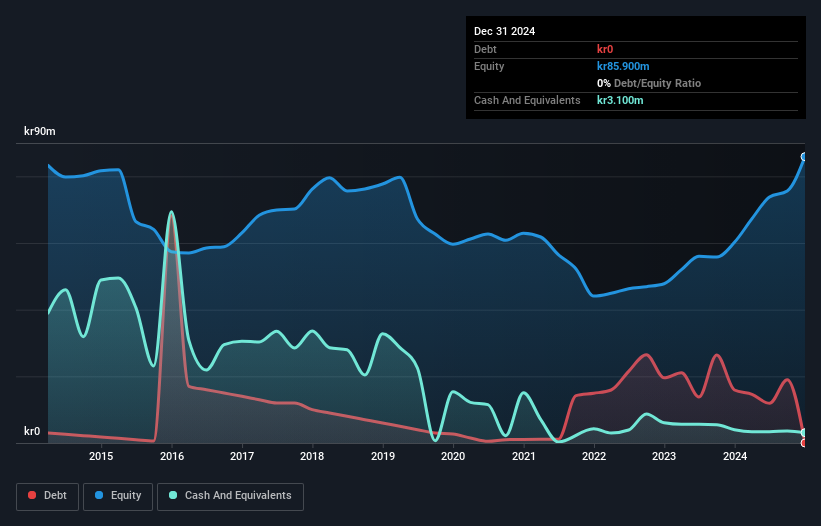

Hifab Group AB, with a market cap of SEK227.54 million, stands out in the penny stock arena by maintaining robust financial health and consistent earnings growth. Its project management segment generated revenue of SEK323.09 million, showcasing resilience despite recent sales and net income declines compared to last year. The company's strong cash position covers its debt effectively, with operating cash flow far exceeding debt levels. Hifab's profitability has improved significantly, evidenced by a high return on equity of 27% and enhanced profit margins from 4.6% to 7.6%. However, an inexperienced board may pose governance challenges moving forward.

- Click here to discover the nuances of Hifab Group with our detailed analytical financial health report.

- Gain insights into Hifab Group's historical outcomes by reviewing our past performance report.

H2APEX Group (XTRA:H2A)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: H2APEX Group SCA focuses on developing, manufacturing, and operating green hydrogen plants to support the de-carbonization of industry and infrastructure in Germany and Luxembourg, with a market cap of €71.26 million.

Operations: H2APEX Group SCA has not reported any specific revenue segments.

Market Cap: €71.26M

H2APEX Group SCA, with a market cap of €71.26 million, is navigating financial challenges typical of many penny stocks. The company recently reported a significant decline in first-quarter sales to €2.06 million from €10.12 million the previous year and expects full-year revenue between €6 million and €8 million as it refocuses on internal projects. Despite raising nearly €50 million through private placements, H2APEX faces liquidity constraints with only a few months of cash runway based on free cash flow estimates and high net debt to equity ratio at 118.7%. Its board's inexperience further complicates its strategic direction amidst volatile share prices.

- Get an in-depth perspective on H2APEX Group's performance by reading our balance sheet health report here.

- Evaluate H2APEX Group's prospects by accessing our earnings growth report.

Key Takeaways

- Reveal the 456 hidden gems among our European Penny Stocks screener with a single click here.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hifab Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HIFA B

Hifab Group

Provides project management and consulting services in Sweden, rest of Europe, Asia, and Africa.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives