- Germany

- /

- Industrials

- /

- XTRA:MBB

Basler Leads Trio Of German Exchange Stocks Estimated As Market Undervalues

Reviewed by Simply Wall St

Amidst a backdrop of global economic uncertainties and fluctuating markets, Germany's DAX index has notably retreated, reflecting broader European market tensions exacerbated by geopolitical strains and trade disputes. In such an environment, identifying stocks that potentially stand undervalued becomes crucial for investors looking for opportunities in sectors less affected by current volatilities.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Kontron (XTRA:SANT) | €19.61 | €30.65 | 36% |

| Stabilus (XTRA:STM) | €43.85 | €79.72 | 45% |

| technotrans (XTRA:TTR1) | €17.10 | €29.26 | 41.5% |

| Stratec (XTRA:SBS) | €41.90 | €81.48 | 48.6% |

| SBF (DB:CY1K) | €2.90 | €5.73 | 49.4% |

| CHAPTERS Group (XTRA:CHG) | €24.20 | €46.46 | 47.9% |

| MTU Aero Engines (XTRA:MTX) | €247.80 | €420.53 | 41.1% |

| R. STAHL (XTRA:RSL2) | €18.40 | €29.14 | 36.8% |

| Your Family Entertainment (DB:RTV) | €2.52 | €4.54 | 44.5% |

| Dr. Hönle (XTRA:HNL) | €17.40 | €34.59 | 49.7% |

Let's review some notable picks from our screened stocks.

Basler (XTRA:BSL)

Overview: Basler Aktiengesellschaft specializes in developing, manufacturing, and selling digital cameras for professional users globally, with a market capitalization of approximately €323.35 million.

Operations: The company generates €190.30 million in revenue from its digital camera segment.

Estimated Discount To Fair Value: 28.5%

Basler's financial outlook shows mixed signals. While the company's revenue is expected to grow at 13.2% annually, outpacing the German market average of 5.2%, its recent performance has been weaker, with a significant drop in sales and an increased net loss in Q1 2024. Despite these challenges, Basler is trading at €10.52, which is significantly below the estimated fair value of €14.71, indicating potential undervaluation based on discounted cash flows. Moreover, earnings are projected to surge by 84.03% annually over the next few years as it moves towards profitability.

- According our earnings growth report, there's an indication that Basler might be ready to expand.

- Dive into the specifics of Basler here with our thorough financial health report.

CHAPTERS Group (XTRA:CHG)

Overview: CHAPTERS Group AG operates in the DACH region, offering software solutions with a market capitalization of approximately €439.21 million.

Operations: The company generates revenue primarily through its data processing segment, amounting to €70.77 million.

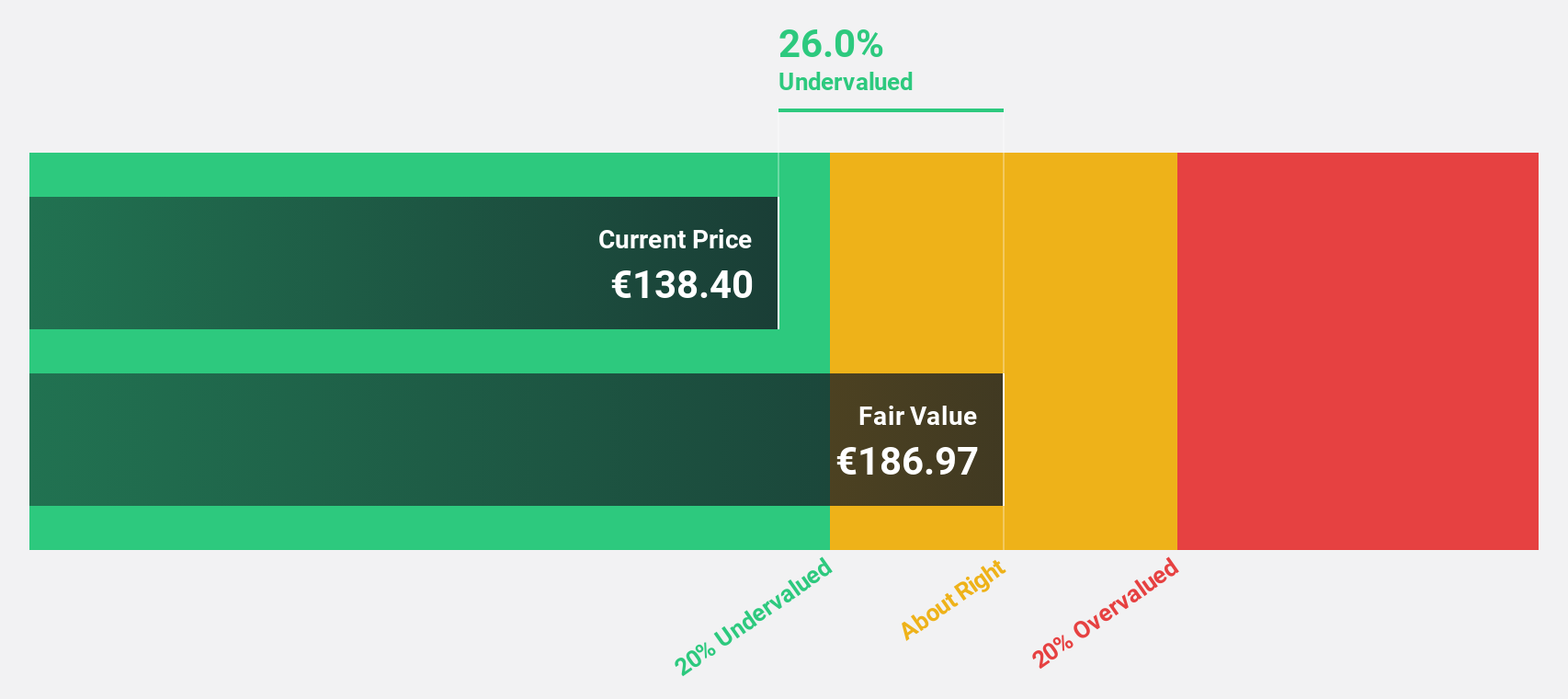

Estimated Discount To Fair Value: 47.9%

CHAPTERS Group AG is currently priced at €24.2, reflecting a significant undervaluation against the estimated fair value of €46.46, suggesting potential based on discounted cash flow analysis. Despite a past year's shareholder dilution and a low forecasted return on equity of 13% in three years, the company is expected to become profitable within this period with an anticipated revenue growth rate of 20.8% per year—substantially higher than the German market average. Recent financials show an improvement with sales increasing to €70.77 million from €42.07 million and reduced net losses year-over-year, alongside strategic funding moves like the recent private placement raising approximately €52 million.

- The growth report we've compiled suggests that CHAPTERS Group's future prospects could be on the up.

- Navigate through the intricacies of CHAPTERS Group with our comprehensive financial health report here.

MBB (XTRA:MBB)

Overview: MBB SE operates primarily in Germany and internationally, focusing on acquiring and managing medium-sized companies in the technology and engineering sectors, with a market capitalization of approximately €0.60 billion.

Operations: MBB SE generates revenue through three main segments: Consumer Goods (€94.23 million), Technical Applications (€378.50 million), and Service & Infrastructure (€487.10 million).

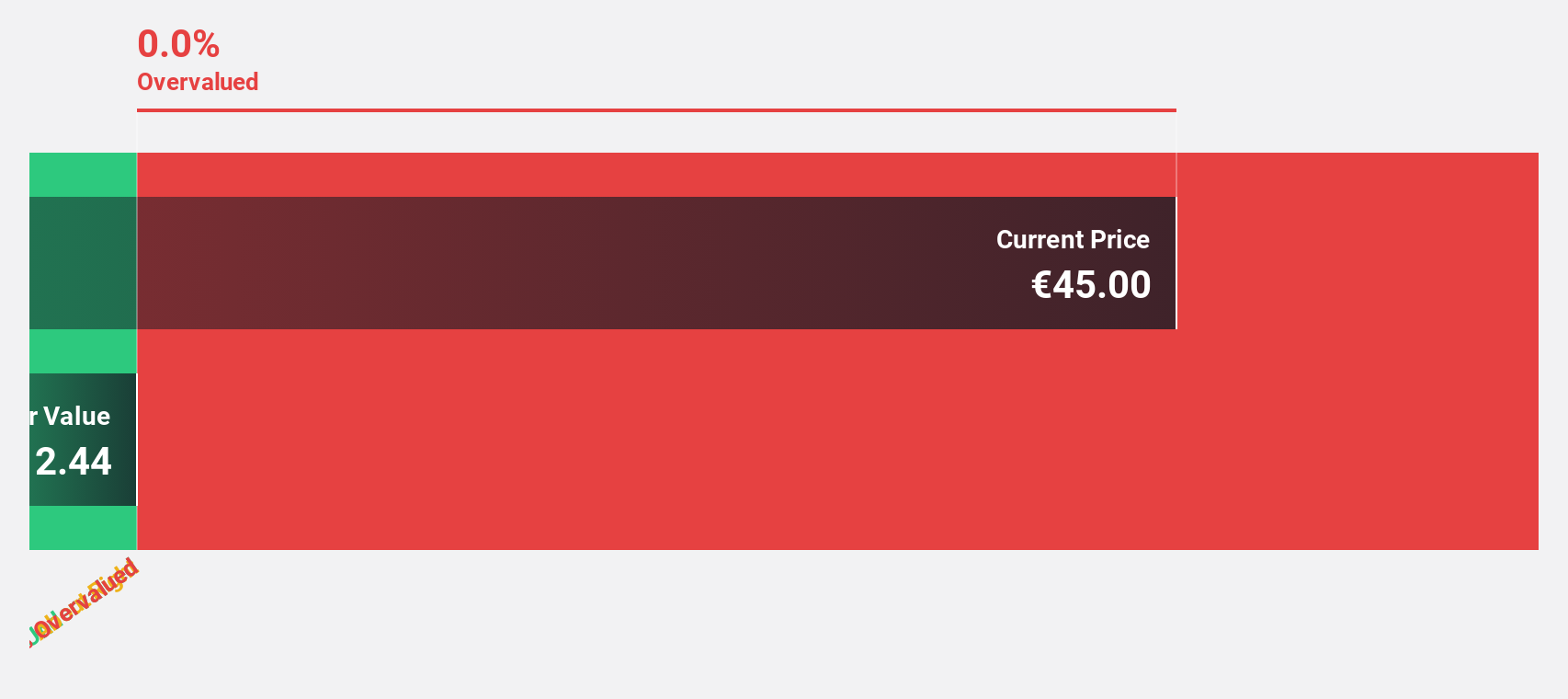

Estimated Discount To Fair Value: 15.6%

MBB, priced at €104.2, is trading 15.6% below its calculated fair value of €123.46, marking it as modestly undervalued based on cash flow analysis. Although its revenue growth forecast at 7.3% per year surpasses the German market's 5.2%, this pace is considered moderate rather than rapid. Earnings have surged by 63.9% over the past year with continued robust growth expected at an annual rate of 33.45%. However, a projected return on equity of only 9.6% in three years suggests potential challenges in sustaining profitability levels.

- Insights from our recent growth report point to a promising forecast for MBB's business outlook.

- Delve into the full analysis health report here for a deeper understanding of MBB.

Next Steps

- Get an in-depth perspective on all 27 Undervalued German Stocks Based On Cash Flows by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MBB

MBB

Engages in the acquisition and management of medium-sized companies primarily in the technology and engineering sectors in Germany and internationally.

Flawless balance sheet with reasonable growth potential.