- Germany

- /

- Communications

- /

- XTRA:ADV

Announcing: ADVA Optical Networking (ETR:ADV) Stock Increased An Energizing 128% In The Last Five Years

ADVA Optical Networking SE (ETR:ADV) shareholders might be concerned after seeing the share price drop 12% in the last quarter. But in stark contrast, the returns over the last half decade have impressed. In fact, the share price is 128% higher today. To some, the recent pullback wouldn't be surprising after such a fast rise. The more important question is whether the stock is too cheap or too expensive today.

View our latest analysis for ADVA Optical Networking

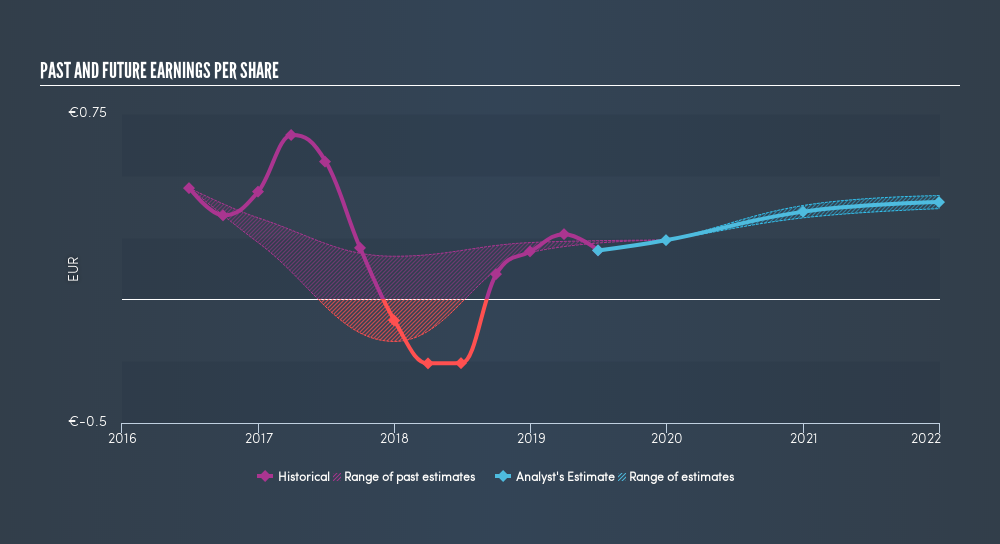

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last half decade, ADVA Optical Networking became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

We know that ADVA Optical Networking has improved its bottom line lately, but is it going to grow revenue? Check if analysts think ADVA Optical Networking will grow revenue in the future.

A Different Perspective

While it's never nice to take a loss, ADVA Optical Networking shareholders can take comfort that their trailing twelve month loss of 8.2% wasn't as bad as the market loss of around 9.1%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 18% for each year. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. Before forming an opinion on ADVA Optical Networking you might want to consider these 3 valuation metrics.

Of course ADVA Optical Networking may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About XTRA:ADV

Adtran Networks

Engages in the development, manufacture, and sale of optical and Ethernet-based networking solutions for telecommunications carriers and enterprises to deliver data, storage, voice, and video services.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion