Shareholders appeared unconcerned with Nagarro SE's (FRA:NA9) lackluster earnings report last week. We did some digging, and we believe the earnings are stronger than they seem.

Check out our latest analysis for Nagarro

A Closer Look At Nagarro's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

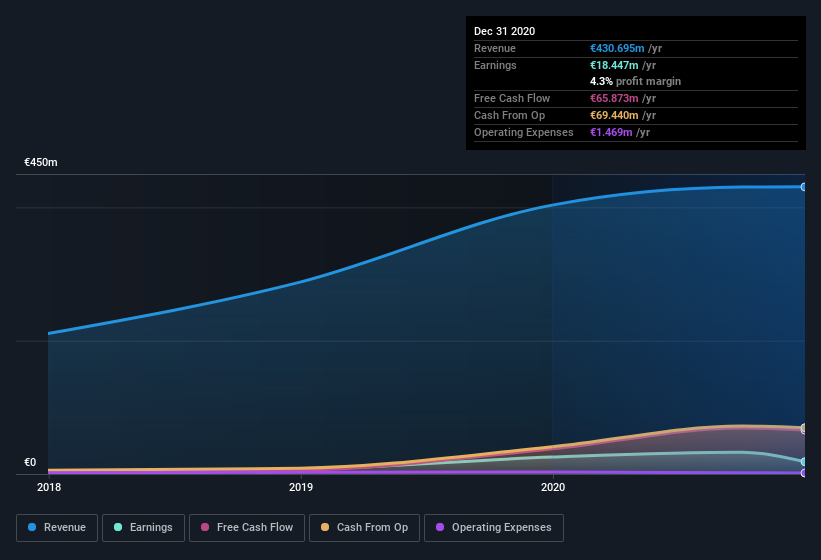

Nagarro has an accrual ratio of -0.36 for the year to December 2020. That indicates that its free cash flow quite significantly exceeded its statutory profit. Indeed, in the last twelve months it reported free cash flow of €66m, well over the €18.4m it reported in profit. Nagarro's free cash flow improved over the last year, which is generally good to see. However, that's not all there is to consider. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

How Do Unusual Items Influence Profit?

Nagarro's profit was reduced by unusual items worth €10m in the last twelve months, and this helped it produce high cash conversion, as reflected by its unusual items. In a scenario where those unusual items included non-cash charges, we'd expect to see a strong accrual ratio, which is exactly what has happened in this case. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual expenses don't come up again, we'd therefore expect Nagarro to produce a higher profit next year, all else being equal.

Our Take On Nagarro's Profit Performance

Considering both Nagarro's accrual ratio and its unusual items, we think its statutory earnings are unlikely to exaggerate the company's underlying earnings power. Based on these factors, we think Nagarro's underlying earnings potential is as good as, or probably even better, than the statutory profit makes it seem! If you want to do dive deeper into Nagarro, you'd also look into what risks it is currently facing. While conducting our analysis, we found that Nagarro has 3 warning signs and it would be unwise to ignore these.

After our examination into the nature of Nagarro's profit, we've come away optimistic for the company. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Nagarro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About DB:NA9

Nagarro

Provides digital product engineering and technology solutions in Germany, the United States of America, and internationally.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives