If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. That's why when we briefly looked at Beta Systems Software's (FRA:BSS) ROCE trend, we were pretty happy with what we saw.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Beta Systems Software:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.11 = €9.5m ÷ (€116m - €33m) (Based on the trailing twelve months to March 2021).

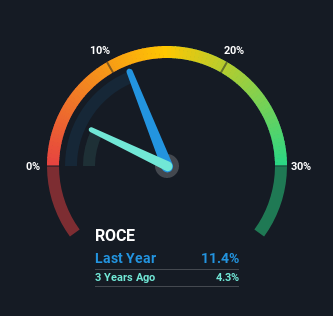

Thus, Beta Systems Software has an ROCE of 11%. In absolute terms, that's a pretty normal return, and it's somewhat close to the Software industry average of 12%.

Check out our latest analysis for Beta Systems Software

Historical performance is a great place to start when researching a stock so above you can see the gauge for Beta Systems Software's ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of Beta Systems Software, check out these free graphs here.

The Trend Of ROCE

While the returns on capital are good, they haven't moved much. The company has consistently earned 11% for the last five years, and the capital employed within the business has risen 73% in that time. 11% is a pretty standard return, and it provides some comfort knowing that Beta Systems Software has consistently earned this amount. Stable returns in this ballpark can be unexciting, but if they can be maintained over the long run, they often provide nice rewards to shareholders.

Our Take On Beta Systems Software's ROCE

In the end, Beta Systems Software has proven its ability to adequately reinvest capital at good rates of return. On top of that, the stock has rewarded shareholders with a remarkable 166% return to those who've held over the last five years. So while the positive underlying trends may be accounted for by investors, we still think this stock is worth looking into further.

On a final note, we've found 1 warning sign for Beta Systems Software that we think you should be aware of.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if Beta Systems Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:BSS

Beta Systems Software

Develops software products and solutions in Germany and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Santos: Undervalued After Takeover Fallout

Realty Income - A Fundamental and Historical Valuation

A Structured Counter‑Analysis of "The Leaking Dreadnought"

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks