Loss-Making SNP Schneider-Neureither & Partner SE (ETR:SHF) Set To Breakeven

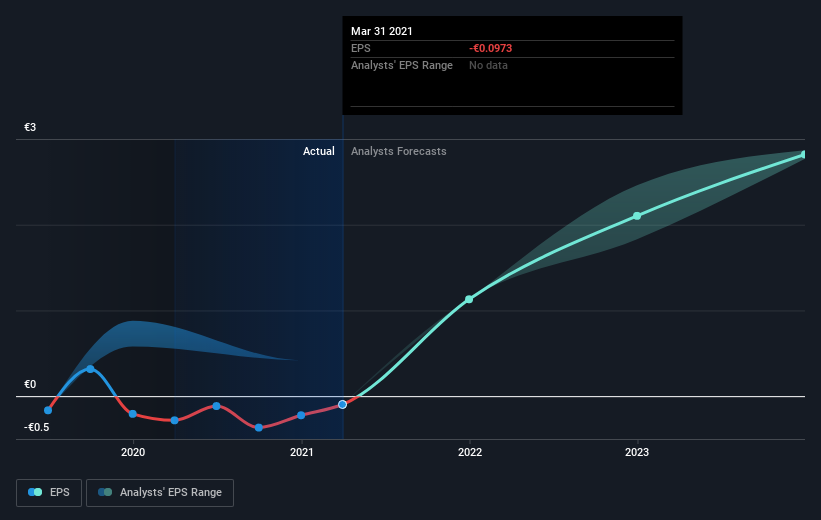

SNP Schneider-Neureither & Partner SE (ETR:SHF) is possibly approaching a major achievement in its business, so we would like to shine some light on the company. SNP Schneider-Neureither & Partner SE provides software products and software-related consulting services worldwide. The €415m market-cap company posted a loss in its most recent financial year of €1.5m and a latest trailing-twelve-month loss of €677k shrinking the gap between loss and breakeven. The most pressing concern for investors is SNP Schneider-Neureither & Partner's path to profitability – when will it breakeven? We've put together a brief outline of industry analyst expectations for the company, its year of breakeven and its implied growth rate.

See our latest analysis for SNP Schneider-Neureither & Partner

According to the 3 industry analysts covering SNP Schneider-Neureither & Partner, the consensus is that breakeven is near. They expect the company to post a final loss in 2020, before turning a profit of €8.0m in 2021. The company is therefore projected to breakeven around a year from now or less! At what rate will the company have to grow in order to realise the consensus estimates forecasting breakeven in under 12 months? Using a line of best fit, we calculated an average annual growth rate of 61%, which is rather optimistic! If this rate turns out to be too aggressive, the company may become profitable much later than analysts predict.

Underlying developments driving SNP Schneider-Neureither & Partner's growth isn’t the focus of this broad overview, though, keep in mind that generally a high forecast growth rate is not unusual for a company that is currently undergoing an investment period.

One thing we would like to bring into light with SNP Schneider-Neureither & Partner is its relatively high level of debt. Typically, debt shouldn’t exceed 40% of your equity, which in SNP Schneider-Neureither & Partner's case is 96%. A higher level of debt requires more stringent capital management which increases the risk in investing in the loss-making company.

Next Steps:

There are too many aspects of SNP Schneider-Neureither & Partner to cover in one brief article, but the key fundamentals for the company can all be found in one place – SNP Schneider-Neureither & Partner's company page on Simply Wall St. We've also compiled a list of key factors you should look at:

- Valuation: What is SNP Schneider-Neureither & Partner worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether SNP Schneider-Neureither & Partner is currently mispriced by the market.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on SNP Schneider-Neureither & Partner’s board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

If you’re looking to trade SNP Schneider-Neureither & Partner, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:SHF

SNP Schneider-Neureither & Partner

Provides software for management of digital transformation processes in Germany.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives