SAP (XTRA:SAP) Completes €3,100 Million Share Buyback of 1.63%

Reviewed by Simply Wall St

SAP (XTRA:SAP) experienced a 7% rise in share price last week, coinciding with significant company developments that likely bolstered investor confidence. The most impactful event was the recent buyback tranche, indicating robust shareholder value return intentions, as the company repurchased 555,655 shares for €106 million. Moreover, SAP's Q1 2025 earnings announcement revealed its impressive revenue growth to €9,013 million and a reversal from a net loss to €1,780 million net income. While broader market trends also showed gains, SAP's strong financial performance and ongoing buyback program likely contributed positively to its share price movement.

Buy, Hold or Sell SAP? View our complete analysis and fair value estimate and you decide.

SAP's recent share price increase, driven by the buyback initiative and improved Q1 earnings, reflects positively on the company's commitment to enhancing shareholder value. This boost aligns with SAP's long-term strategy of leveraging cloud and AI tools, potentially solidifying revenue and margin expansion. These advancements not only fortify SAP's position but also serve as catalyzers for potential sustained earnings growth, particularly given global uncertainties. Over the past three years, SAP has delivered a formidable total shareholder return of 163.74%, indicating robust performance against broader market dynamics. However, its 122.6% earnings growth in the past year substantially exceeded the German software industry's 40% return, demonstrating significant recent outperformance.

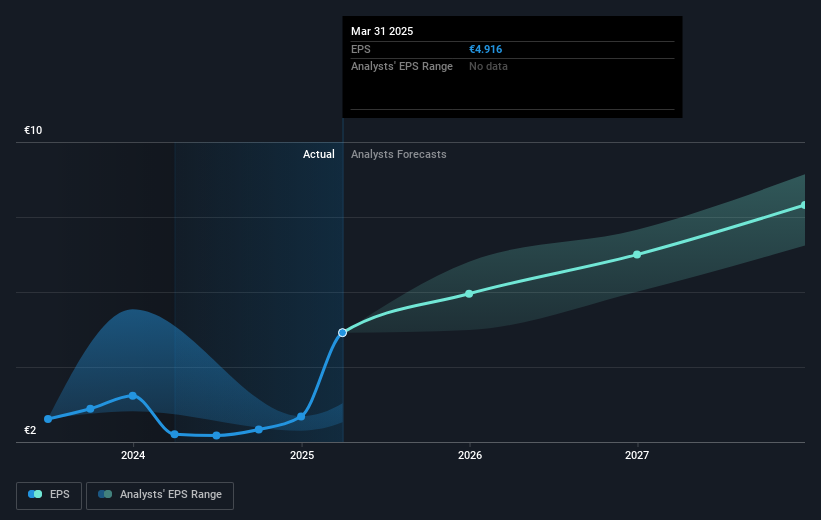

The impact of SAP's recent developments on future revenue forecasts cannot be understated; analysts expect annual revenue growth of 12.3% over the next three years, with earnings projected to reach €10.2 billion by April 2028. These projections suggest continued momentum, albeit with potential risks such as trade disputes and cloud revenue deceleration. The consensus analyst price target of €275.43 indicates a possible 12.2% increase from the current share price of €241.7. While SAP's price movement signals investor confidence, the current valuation at a Price-To-Earnings Ratio of 49.1x suggests consideration of the fair value and broader industry comparisons remains prudent. Investors are encouraged to assess how these shifts align with their expectations and risk tolerance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SAP

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion